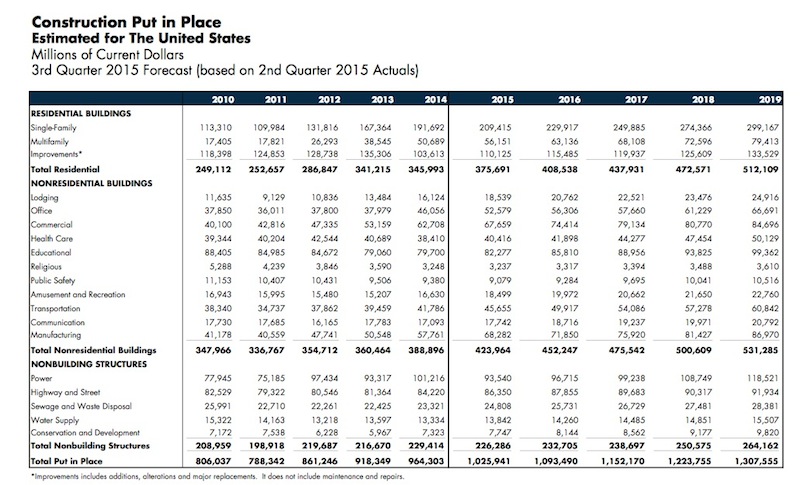

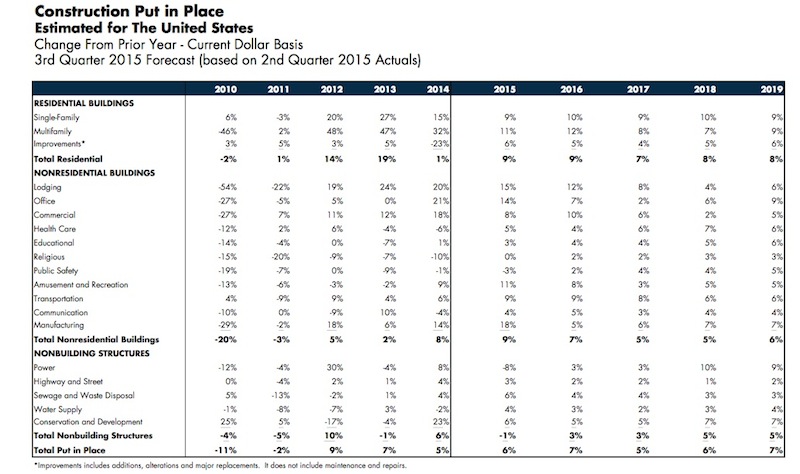

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

| Apr 11, 2012

C.W. Driver completes Rec Center on CSUN campus

The state-of-the-art fitness center supports university’s goal to encourage student recruitment and retention.

| Apr 10, 2012

JE Dunn completes two medical office buildings at St. Anthony’s Lakewood, Colo. campus

Designed by Davis Partnership Architects, P.C., Medical Plaza 1 and 2 are four-story structures totaling 96,804-sf and 101,581-sf respectively.

| Apr 10, 2012

THINK [about architecture] Scholarship enters 15th year

Students are invited to submit two-minute creative videos that illustrate how they interact with their school's design and what the space makes possible.

| Apr 10, 2012

Structured Development & Bucksbaum close on new retail site in Chicago

The site is the location of New City, a mixed-use development that will feature 370,000-sf of retail space and 280 residential rental units.

| Apr 10, 2012

Moriarty & Associates selected as GC for Miami’s BrickellHouse Condo

Construction of the 46-story development is schedule to get underway this summer and be completed in 2014.

| Apr 6, 2012

Flat tower green building concept the un-skycraper

A team of French designers unveil the “Flat Tower” design, a second place winner in the 2011 eVolo skyscraper competition.

| Apr 6, 2012

National Association of Women in Construction forum to be hosted in Philadelphia

The April Forum, titled “Declare your Independence!” will feature educational sessions on topics ranging from Managing the Generation Gap and Dealing with Contract language across state borders to Strategic and Succession Planning.

| Apr 6, 2012

Rooftop solar energy program wins critical approval from L.A. city council

Los Angeles Business Council applauds decision allowing LADWP to create new national model for rooftop solar energy