Get ready for a surge in prefabrication activity by contractors.

FMI, the consulting and investment banking firm, recently polled contractors about how much time they were spending, in craft labor hours, on prefabrication for construction projects. More than 250 contractors participated in the survey, and the average response to that question was 18%. More revealing, however, was the participants’ anticipation that craft hours dedicated to prefab would essentially double, to 34%, within the next five years.

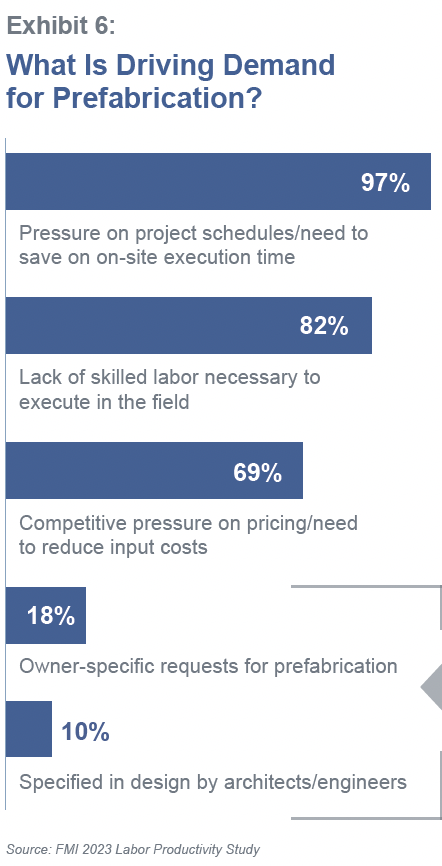

The study—a sequel to FMI’s 2023 Labor Productivity Study—reiterates how the industry’s receptivity to prefab solutions corresponds with its ongoing labor shortages and compressed project schedules. (Contractors experienced approximately $30 billion to $40 billion in lost profits due to labor inefficiencies in 2022.) In its latest study, contractors told FMI that “improved quality” was prefab’s greatest perceived benefit. “Reducing the risk and variability” is how one contractor put it. Other benefits cited include reductions in construction schedules and improved worker safety.

(Nearly three fifths of the respondents to FMI’s study are MEP contractors, with another 15% being framing and drywall contractors.)

Contractors that consider prefabrication must determine how to do it at scale, profitably, and in a way that increases company earnings. Successful prefab practices, says FMI, require long-term strategic thinking and planning across an organization, along with the development of a comprehensive operational blueprint.

Which prefab model is right for pros?

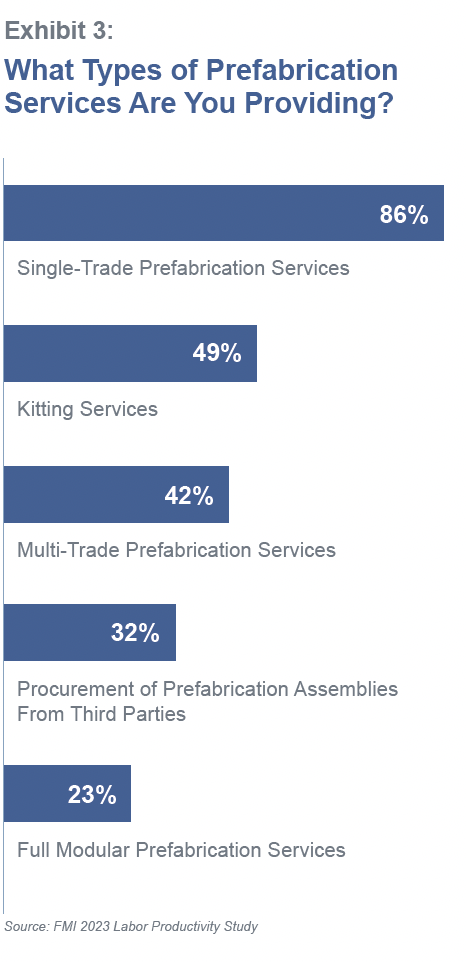

It’s not like prefabrication is an alien concept for contractors. FMI’s study found that 86% of respondents currently offer single-trade prefab services. Three quarters of the concrete contractors surveyed said they are prefabricating on their jobsites; 57% of self-performing general contractors polled are prefabbing on-site, too.

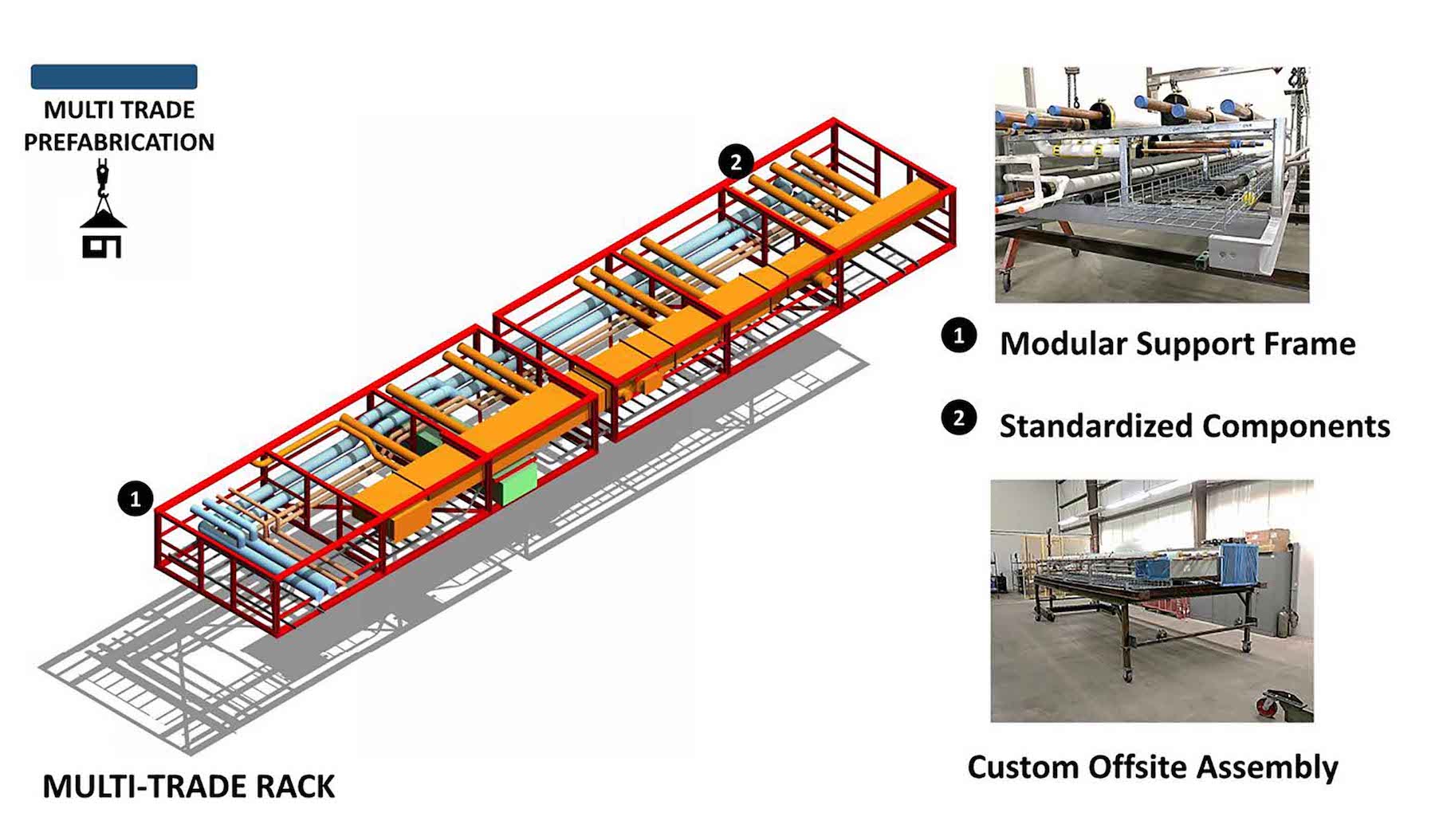

What’s often lacking, however, is a clear vision of what they want their prefab capabilities to become. To make prefab work, says FMI, contractors need to shift their operating models, processes and systems. Contractors also need to decide which prefab models and combinations would work best for their companies; these include kitting services, multi-trade services, procurement, and modular services.

In making these determinations, contractors should be asking themselves:

•Why do we want to do more prefabrication?

•What is the total addressable portion of our work mix (today) that could be prefabricated?

•What investments would need to be made to scale our prefabrication capabilities to capture that opportunity?

•When fully optimized, what does the earnings stream from prefabrication look like?

•What does the return on investment look like for the enterprise?

•Do we have alternative investment options for other initiatives in the business? How do those options stack up against our prefabrication ambitions?

•Will prefab make the company better, more profitable, and resilient?

Prefabrication a different kind of business

Prefabrication is a manufacturing endeavor that’s different from building construction. Contractors diving into prefab in a bigger way need to think about whether prefab will be a unique business or separate entity, and how autonomously construction and prefabrication operate? Will prefab services be proprietary or available to other contractors? Will prefab be a profit or cost center? How will manufacturing cost overruns, if there are any, be accounted for?

FMI says that contractors need to establish clear project management lines that encompass how prefabricated products are tracked, stored, and billed for. Tracking labor productivity across prefabrication and field installation is key.

Owners and designers need to buy in more

One of the contractors whom FMI polled mentioned a recent casino and hotel project that required 25% less labor in the field, and cut nearly two months off of its installation time, by using prefabrication methods.

Scheduling is driving prefab demand, says FMI. But expanding that demand depends on acceptance by owners and AEC firms, and right now, that acceptance is middling: only 18% of the contractors polled by FMI said that owner-specific requests drove prefab, and only 10% said that prefab was specified by architects or engineers.

“For the industry to realize substantial gains in prefabrication and productivity, owners and designers need to be a bigger part of the demand equation,” says FMI.

FMI’s study found that the industry still struggles with broad adoption. The biggest challenges to adopting prefab are a project’s design and coordination, stakeholder awareness and education, the mindset and culture of a project’s active players, and the investment in facilities and equipment.

But given current and projected labor force limitations, “it’s clear that prefabrication will need to become part of the solution.” For that to happen, building teams need to demonstrate a bolder vision, strategic planning, commitment to investing, consistent communication, and a proactive engagement by external stakeholders.

Related Stories

Contractors | Nov 15, 2023

Clune Construction expands Southwest reach with launch of Phoenix office

Clune Construction (Clune) is pleased to announce its newest location in Phoenix, marking another milestone in their national growth. The official move comes after several years of sustained success in the Phoenix region.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Giants 400 | Nov 14, 2023

Top 50 Justice Facility Construction Firms for 2023

Turner Construction, Whiting-Turner, STO Building Group, Clark Group, and CORE Construction top BD+C's ranking of the nation's largest justice facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes revenue from all public safety/justice facilities buildings work, including correctional facilities, fire stations, jails, police stations, and prisons.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.

Giants 400 | Nov 13, 2023

Top 60 Airport Facility Construction Firms for 2023

Hensel Phelps, Turner Construction, AECOM, and Walsh Group top BD+C's ranking of the nation's largest airport terminal and airport facilities general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Data Centers | Nov 13, 2023

Data center sector trends for 2023-2024

Demand for more data centers is soaring, but delivery can be stymied by supply delays, manpower shortages, and NIMBYism.

Education Facilities | Nov 9, 2023

Oakland schools’ central kitchen cooks up lessons along with 30,000 meals daily

CAW Architects recently completed a facility for the Oakland, Calif., school district that feeds students and teaches them how to grow, harvest, and cook produce grown onsite. The production kitchen at the Unified School District Central Kitchen, Instructional Farm, and Education Center, (“The Center”) prepares and distributes about 30,000 meals a day for district schools lacking their own kitchens.

Laboratories | Nov 8, 2023

Boston’s FORUM building to support cutting-edge life sciences research and development

Global real estate companies Lendlease and Ivanhoé Cambridge recently announced the topping-out of FORUM, a nine-story, 350,000-sf life science building in Boston. Located in Boston Landing, a 15-acre mixed-use community, the $545 million project will achieve operational net zero carbon upon completion in 2024.

Retail Centers | Nov 7, 2023

Omnichannel experiences, mixed-use development among top retail design trends for 2023-2024

Retailer survival continues to hinge on retail design trends like blending online and in-person shopping and mixing retail with other building types, such as offices and residential.