Get ready for a surge in prefabrication activity by contractors.

FMI, the consulting and investment banking firm, recently polled contractors about how much time they were spending, in craft labor hours, on prefabrication for construction projects. More than 250 contractors participated in the survey, and the average response to that question was 18%. More revealing, however, was the participants’ anticipation that craft hours dedicated to prefab would essentially double, to 34%, within the next five years.

The study—a sequel to FMI’s 2023 Labor Productivity Study—reiterates how the industry’s receptivity to prefab solutions corresponds with its ongoing labor shortages and compressed project schedules. (Contractors experienced approximately $30 billion to $40 billion in lost profits due to labor inefficiencies in 2022.) In its latest study, contractors told FMI that “improved quality” was prefab’s greatest perceived benefit. “Reducing the risk and variability” is how one contractor put it. Other benefits cited include reductions in construction schedules and improved worker safety.

(Nearly three fifths of the respondents to FMI’s study are MEP contractors, with another 15% being framing and drywall contractors.)

Contractors that consider prefabrication must determine how to do it at scale, profitably, and in a way that increases company earnings. Successful prefab practices, says FMI, require long-term strategic thinking and planning across an organization, along with the development of a comprehensive operational blueprint.

Which prefab model is right for pros?

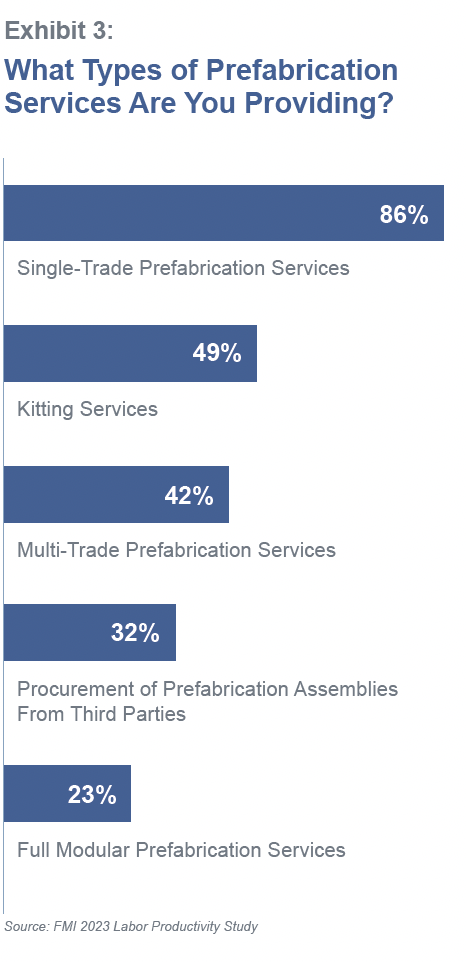

It’s not like prefabrication is an alien concept for contractors. FMI’s study found that 86% of respondents currently offer single-trade prefab services. Three quarters of the concrete contractors surveyed said they are prefabricating on their jobsites; 57% of self-performing general contractors polled are prefabbing on-site, too.

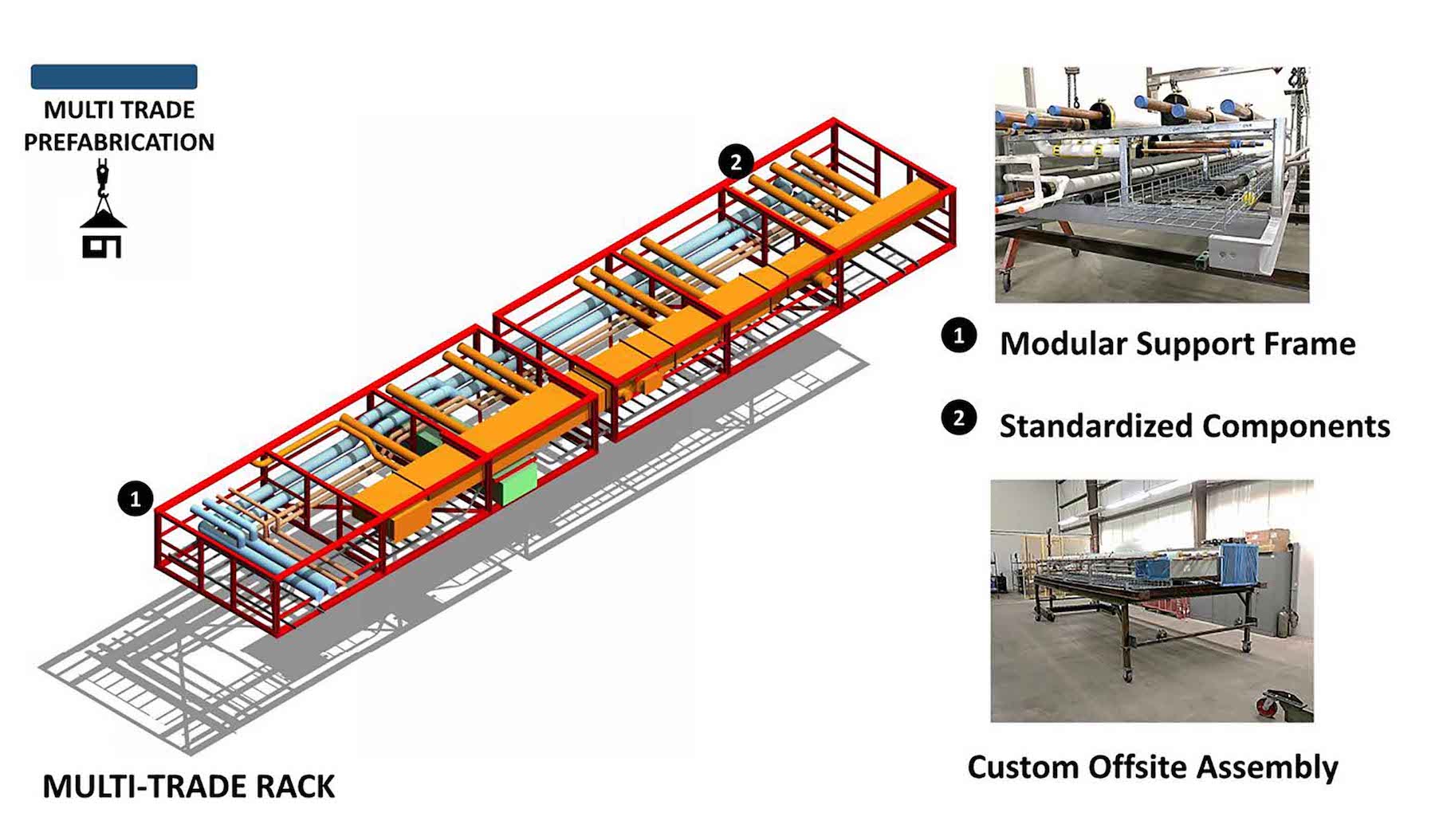

What’s often lacking, however, is a clear vision of what they want their prefab capabilities to become. To make prefab work, says FMI, contractors need to shift their operating models, processes and systems. Contractors also need to decide which prefab models and combinations would work best for their companies; these include kitting services, multi-trade services, procurement, and modular services.

In making these determinations, contractors should be asking themselves:

•Why do we want to do more prefabrication?

•What is the total addressable portion of our work mix (today) that could be prefabricated?

•What investments would need to be made to scale our prefabrication capabilities to capture that opportunity?

•When fully optimized, what does the earnings stream from prefabrication look like?

•What does the return on investment look like for the enterprise?

•Do we have alternative investment options for other initiatives in the business? How do those options stack up against our prefabrication ambitions?

•Will prefab make the company better, more profitable, and resilient?

Prefabrication a different kind of business

Prefabrication is a manufacturing endeavor that’s different from building construction. Contractors diving into prefab in a bigger way need to think about whether prefab will be a unique business or separate entity, and how autonomously construction and prefabrication operate? Will prefab services be proprietary or available to other contractors? Will prefab be a profit or cost center? How will manufacturing cost overruns, if there are any, be accounted for?

FMI says that contractors need to establish clear project management lines that encompass how prefabricated products are tracked, stored, and billed for. Tracking labor productivity across prefabrication and field installation is key.

Owners and designers need to buy in more

One of the contractors whom FMI polled mentioned a recent casino and hotel project that required 25% less labor in the field, and cut nearly two months off of its installation time, by using prefabrication methods.

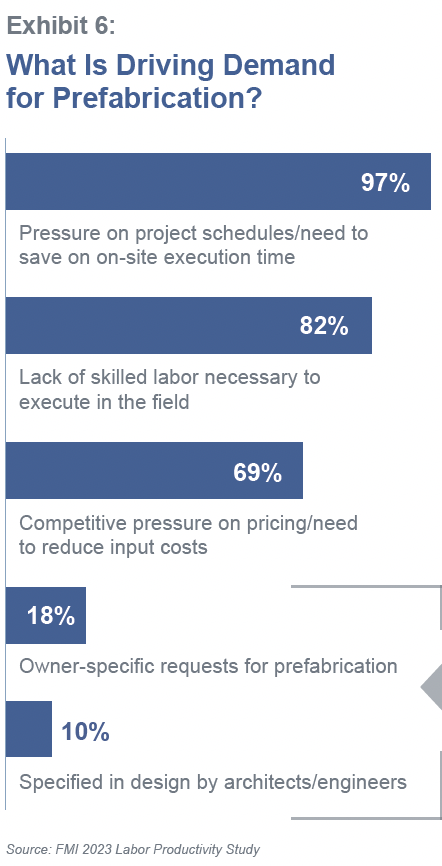

Scheduling is driving prefab demand, says FMI. But expanding that demand depends on acceptance by owners and AEC firms, and right now, that acceptance is middling: only 18% of the contractors polled by FMI said that owner-specific requests drove prefab, and only 10% said that prefab was specified by architects or engineers.

“For the industry to realize substantial gains in prefabrication and productivity, owners and designers need to be a bigger part of the demand equation,” says FMI.

FMI’s study found that the industry still struggles with broad adoption. The biggest challenges to adopting prefab are a project’s design and coordination, stakeholder awareness and education, the mindset and culture of a project’s active players, and the investment in facilities and equipment.

But given current and projected labor force limitations, “it’s clear that prefabrication will need to become part of the solution.” For that to happen, building teams need to demonstrate a bolder vision, strategic planning, commitment to investing, consistent communication, and a proactive engagement by external stakeholders.

Related Stories

Green | Dec 18, 2023

Class B commercial properties gain more from LEED certification than Class A buildings

Class B office properties that are LEED certified command a greater relative benefit than LEED-certified Class A buildings, according to analysis from CBRE. The Class B LEED rent advantage over non-LEED is about three times larger than the premium earned by Class A LEED buildings.

Codes and Standards | Dec 18, 2023

ASHRAE releases guide on grid interactivity in the decarbonization process

A guide focusing on the critical role of grid interactivity in building decarbonization was recently published by ASHRAE. The Grid-Interactive Buildings for Decarbonization: Design and Operation Resource Guide provides information on maximizing carbon reduction through buildings’ interaction with the electric power grid.

Sustainable Design and Construction | Dec 14, 2023

Suffolk Construction establishes Suffolk Sustainability Group

Design veterans Steven Burke and Michael Swenson will lead the new sustainability initiative for Suffolk.

75 Top Building Products | Dec 13, 2023

75 top building products for 2023

From a bladeless rooftop wind energy system, to a troffer light fixture with built-in continuous visible light disinfection, innovation is plentiful in Building Design+Construction's annual 75 Top Products report.

Giants 400 | Dec 12, 2023

Top 15 Veterans Affairs Facility Construction Firms for 2023

Walsh Group, Turner Construction, BL Harbert, and Hoar Construction top BD+C's ranking of the nation's largest Veterans Affairs facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 35 Military Facility Construction Firms for 2023

Hensel Phelps, DPR Construction, Walsh Group, and Whiting-Turner top BD+C's ranking of the nation's largest military facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Contractors | Dec 12, 2023

The average U.S. contractor has 8.5 months worth of construction work in the pipeline, as of November 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Giants 400 | Dec 11, 2023

Top 80 Local Government Building Construction Firms for 2023

Turner Construction, Clark Group, Holder Construction, and Pepper Construction top BD+C's ranking of the nation's largest local government building general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 11, 2023

Top 50 State Government Building Construction Firms for 2023

Hensel Phelps, Turner Construction, Clark Group, and PCL Construction top BD+C's ranking of the nation's largest state government building general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Codes and Standards | Dec 11, 2023

Washington state tries new approach to phase out fossil fuels in new construction

After pausing a heat pump mandate earlier this year after a federal court overturned Berkeley, Calif.’s ban on gas appliances in new buildings, Washington state enacted a new code provision that seems poised to achieve the same goal.