Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

By Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report.

The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

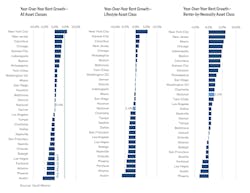

Rent growth turned negative in 14 of Yardi Matrix’s top 30 metros, and most of these markets, particularly in the Sun Belt, are impacted by a recent influx of supply and rapid rent increases over the past two and a half years.

Even though rents dropped for the second consecutive month, demand and absorption continue at levels consistent with pre-pandemic years. During the first three quarters of 2023, more than 250,000 units were absorbed nationally, in line with the 300,000-plus units absorbed annually between 2017 and 2020.

“While the economy continues to produce solid results, market attention is focusing on the seeming inevitability of slowing job growth and the capital markets conundrum of higher interest rates. The longer rates stay in the 4.5 percent to 5 percent range (or higher), the more multifamily properties will face capital gaps when loans come up for refinancing,” states the report.

Asking rents declined in the Lifestyle property segment, down 0.4 percent in October, while Renter-by-Necessity rents remained flat.

Single family rental rates fell $2 in October to $2,121, up 1.0% year-over-year, down 30 basis points from September. Operators are focusing on reducing operating costs, as expenses rose 12.2% on a trailing 12-month basis through September.

Gain more insight in the new Yardi Matrix National Multifamily Report.