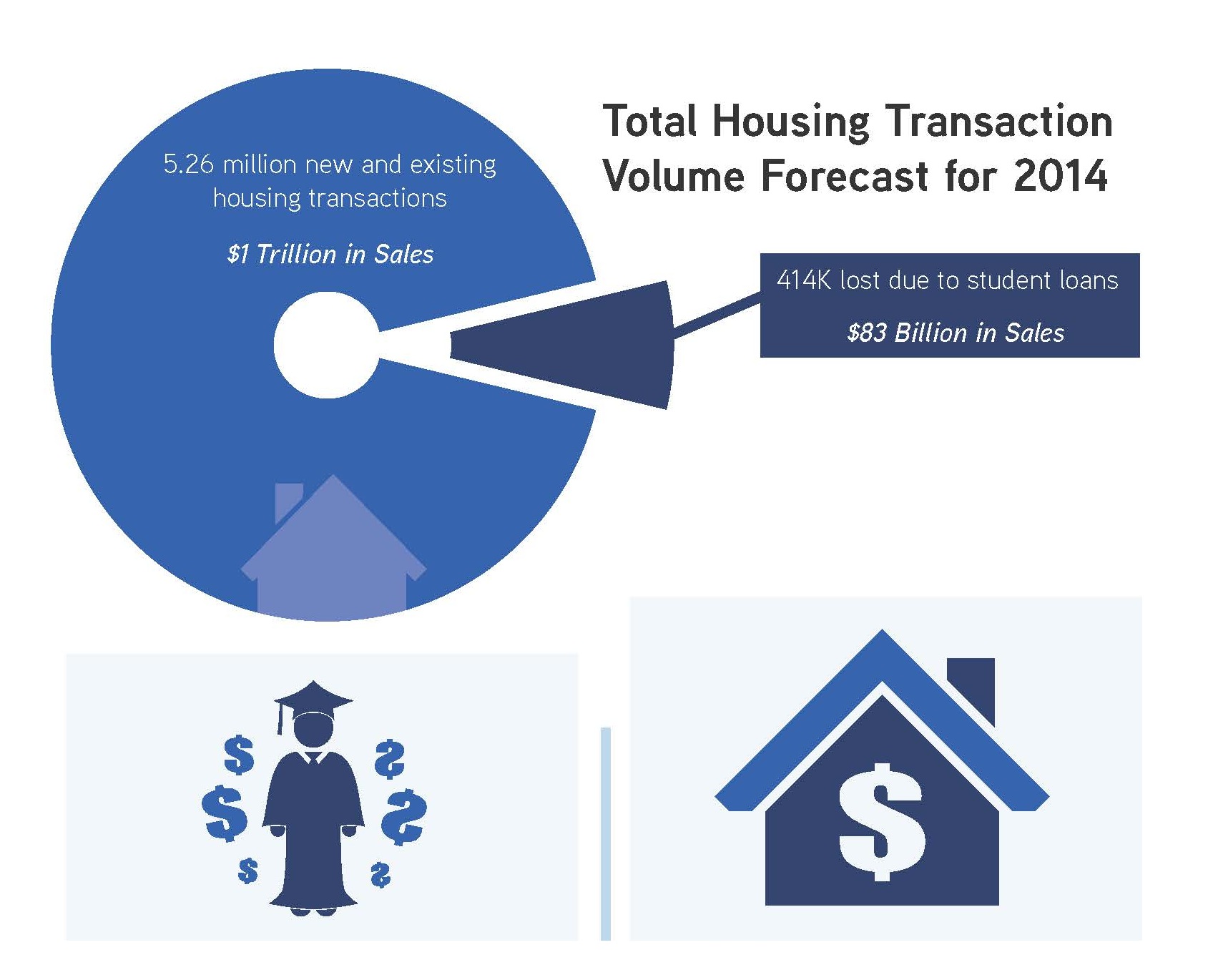

Eight percent fewer homes will transact in 2014 than normal, purely due to student loan debt, according to analysis by Rick Palacios, Jr., and Ali Wolf of John Burns Real Estate Consulting.

In a new 30-page paper, the firm assesses the impact of student loans on home buying for households under the age of 40. Its conclusion: 414,000 transactions will be lost in 2014 due to student debt. At a typical price of $200,000, that equals $83 billion in lost volume.

Palacios and Wolf explain their methodology and findings:

The analysis was quite complicated and involved a few assumptions, but we believe it is conservative, primarily because we looked only at those under the age of 40 with student debt.

At a high level, the math is as follows:

• Student debt has ballooned from $241 billion to $1.1 trillion in just 11 years.

• 29 million of the 86 million people aged 20-39 have some student debt.

• Those 29 million individuals translate to 16.8 million households.

• Of the 16.8 million households, 5.9 million (or 35%) pay more than $250 per month in student loans, which inhibits at least $44,000 per year in mortgage capability for each of them.

• About 8% of the 20-39 age cohort usually buys a home each year, which would be 1.35 million transactions per year.

• Using previous academic literature as a benchmark for our own complicated calculation, we then estimated that today's purchase rate is reduced from the normal 8% depending on the level of student debt--ranging from 6.9% for those paying less than $100 per month in student loans to less than 1% for those paying over $1,300 per month. Other factors contribute to even less entry-level buying today.

While we applaud the increasing education, we need to realize that it comes with a cost known as student debt. We raised the red flag on student debt back in 2011 and continue to believe that this debt will delay homeownership for many, or at least require that they buy a less expensive home.

Related Stories

Multifamily Housing | May 19, 2015

Zaha Hadid unveils 'interlocking lattice' design for luxury apartments in Monterrey, Mexico

Hadid's scheme was inspired by the Mexican tradition of interlocking lattice geometries.

Retail Centers | May 18, 2015

ULI forecast sees clear skies for real estate over next three years

With asset availability declining in several sectors, rents and transactions should rise.

Architects | May 17, 2015

NCARB wants the title ‘architect’ confined to those who are licensed

The Council is urging state licensing boards to come up with a substitute for the pre-licensure title ‘Intern.’

Museums | May 13, 2015

The museum of tomorrow: 8 things to know about cultural institutions in today’s society

Entertainment-based experiences, personal journeys, and community engagement are among the key themes that cultural institutions must embrace to stay relevant, write Gensler's Diana Lee and Richard Jacob.

Industrial Facilities | May 11, 2015

SOM-designed Manufacturing and Design Innovation Institute opens in Chicago

The new space will be a place for academia, industries, and civic bodies to collaborate.

Sponsored | Roofing | May 11, 2015

How architects can tap into the expertise of their metal roof manufacturer, part 2

Here are three things metal roof manufacturers can do to help the architect

BIM and Information Technology | May 10, 2015

How beacons will change architecture

Indoor positioning is right around the corner. Here is why it matters.

Architects | May 10, 2015

Harness the connection between managing risk and increasing profitability, Part 2

In Part 1, we covered taking control of the submittals schedule and managing RFIs. Let’s move on to properly allocating substitutions and limiting change orders.

Architects | May 10, 2015

Harness the connection between managing risk and increasing profitability, Part 1

AE firms need to protect themselves against vague contractual and procedural situations during all phases of the project in order to minimize their liability and exposure to risk, writes AEC industry consultant Steve Whitehorn.

Building Team | May 8, 2015

Construction industry adds 45,000 jobs in April

The construction industry saw an increase in jobs during the month of April after losing approximately 9,000 positions in March.