Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

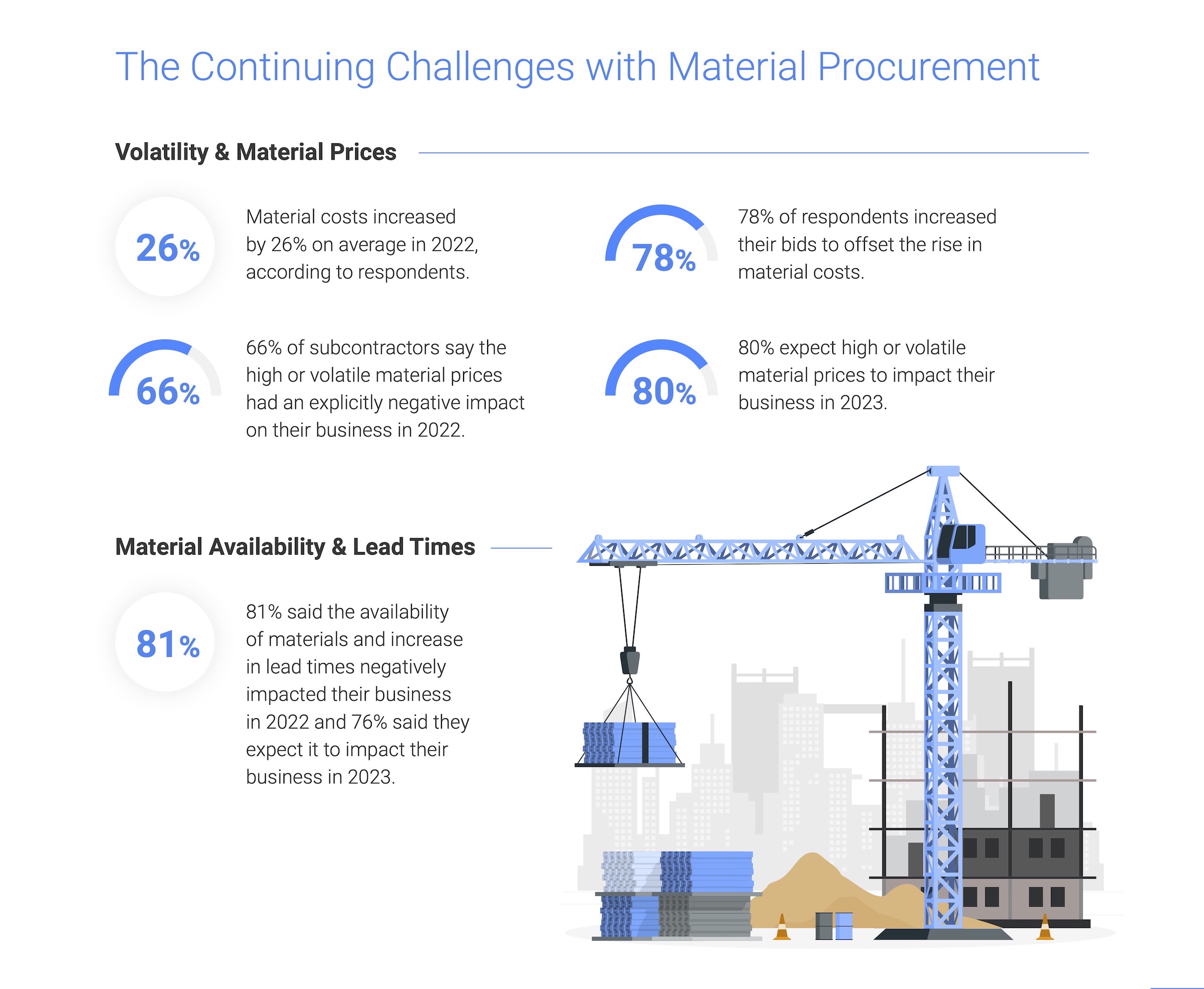

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

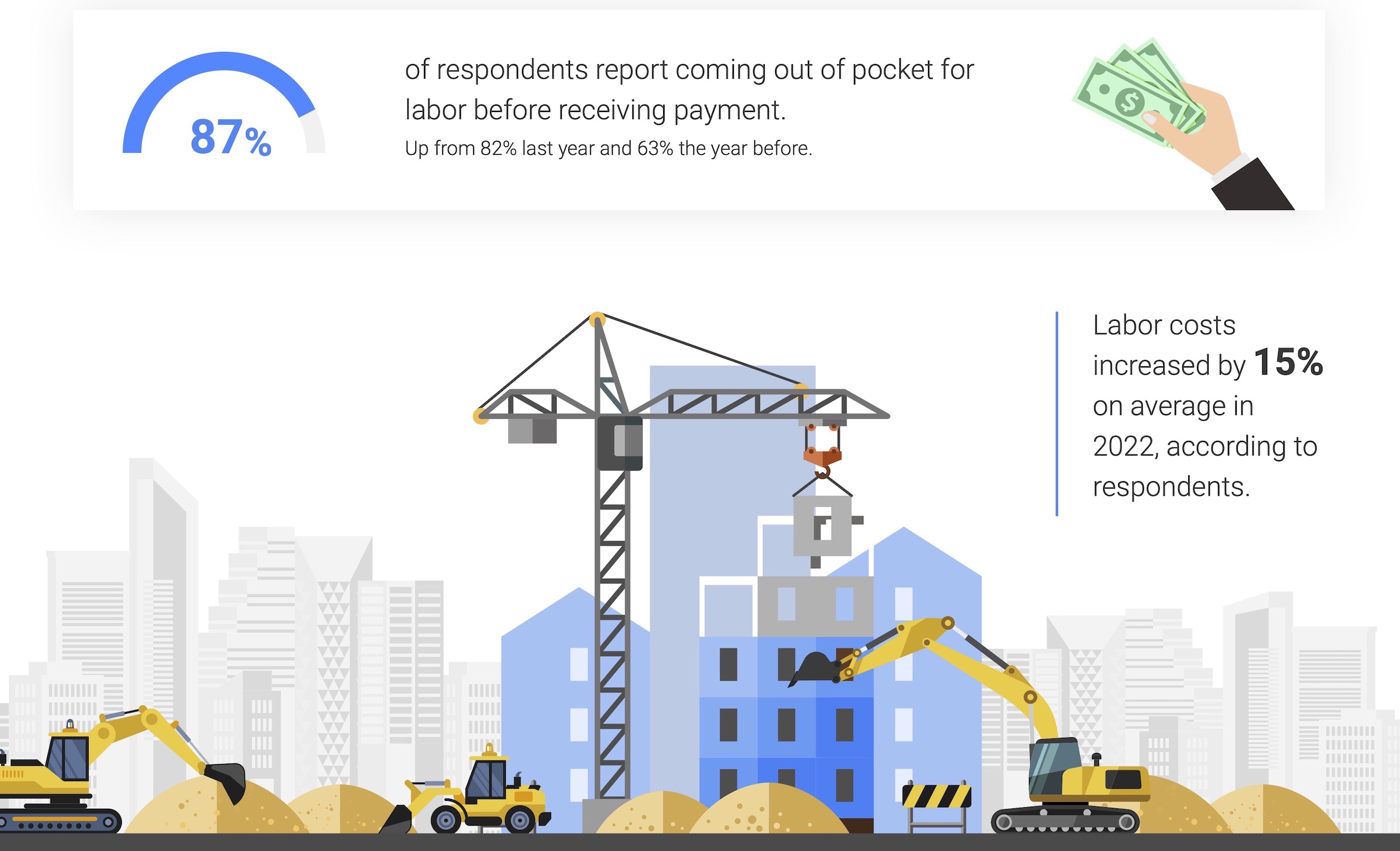

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

Building Team | Apr 18, 2022

Shive-Hattery Acquires WSM Architects

Shive-Hattery announces that it has acquired WSM Architects, Inc., a 13-person architecture firm in Tucson, Arizona.

University Buildings | Apr 18, 2022

SmithGroup to design new Univ. of Colorado Denver engineering, design, computing building

The University of Colorado Denver selected SmithGroup to design a new engineering, design, and computing building that will serve as anchor of new downtown innovation district.

Building Team | Apr 15, 2022

Frank Gehry to design his largest building yet for his hometown of Toronto

Famed architect Frank Gehry will design his largest building to date for his hometown of Toronto, Canada.

Healthcare Facilities | Apr 14, 2022

Healthcare construction veteran creates next-level IPD process for hospital projects

Can integrated project delivery work without incentives for building team members? Denton Wilson thinks so.

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

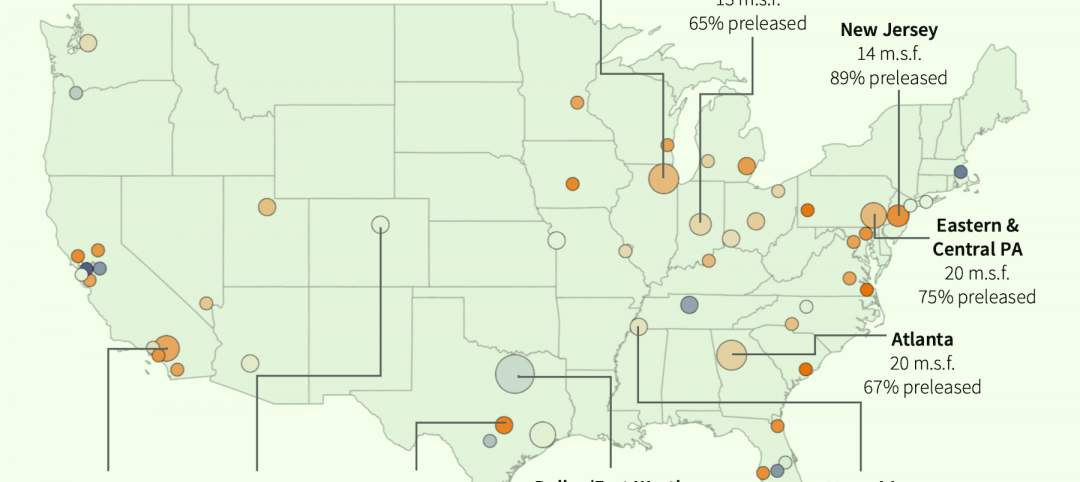

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

High-rise Construction | Apr 14, 2022

Seattle’s high-rise convention center nears completion

The new Washington State Convention Center Summit Building—billed as the first high-rise convention center in North America—is on track to complete most of its construction later this year.

Building Team | Apr 14, 2022

TLC Engineering Solutions, Inc. acquires Moye I.T. Consulting, LLC

TLC Engineering Solutions, Inc. (TLC) is excited to announce that Moye I.T. Consulting, LLC (Moye Consulting) has joined the TLC team, expanding the breadth of its IT and Technology capabilities, as well as its national portfolio.

Wood | Apr 13, 2022

Mass timber: Multifamily’s next big building system

Mass timber construction experts offer advice on how to use prefabricated wood systems to help you reach for the heights with your next apartment or condominium project.

AEC Tech | Apr 13, 2022

Morphosis designs EV charging station for automaker Genesis

LA-based design and architecture firm Morphosis has partnered with automotive luxury brand Genesis to bring their signature brand and styling, attention-to-detail, and seamless customer experience to the design of Electric Vehicle Charging (EVC) Stations.