Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

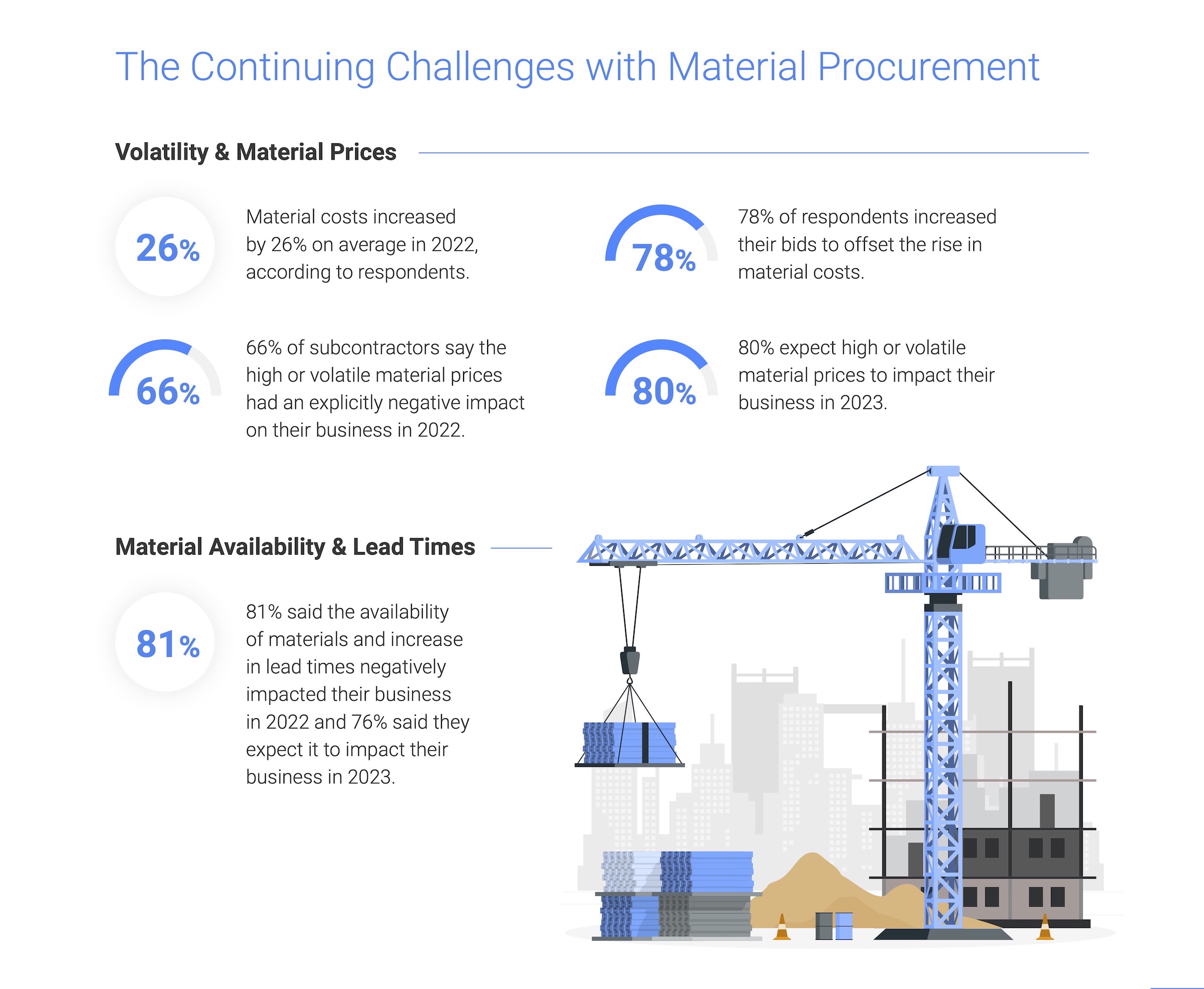

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

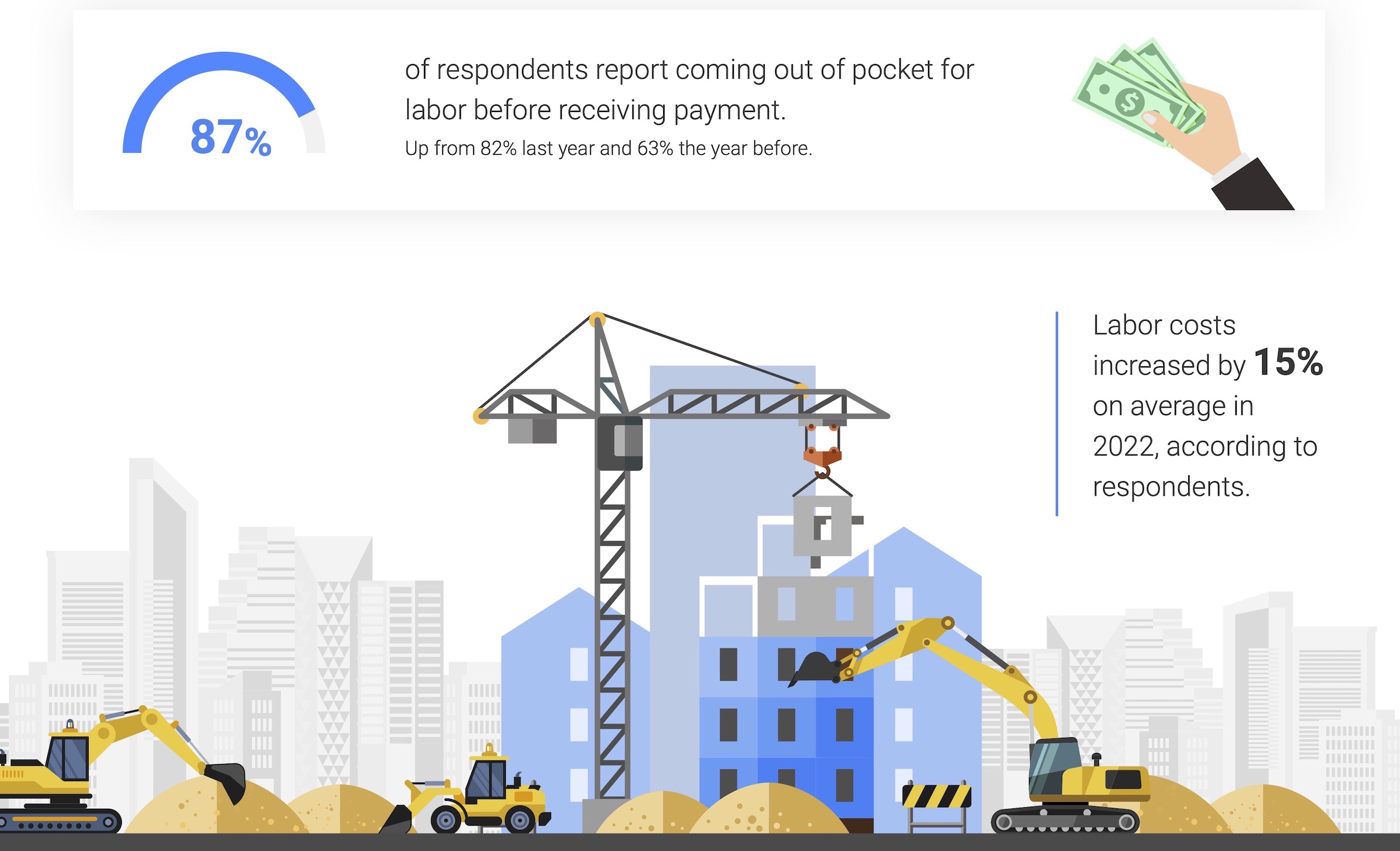

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Building Team | May 6, 2022

Atlanta’s largest adaptive reuse project features cross laminated timber

Global real estate investment and management firm Jamestown recently started construction on more than 700,000 sf of new live, work, and shop space at Ponce City Market.

Sponsored | BD+C University Course | May 5, 2022

Designing with architectural insulated metal wall panels

Insulated metal wall panels (IMPs) offer a sleek, modern, and lightweight envelope system that is highly customizable. This continuing education course explores the characteristics of insulated metal wall panels, including how they can offer a six-in-one design solution. Discussions also include design options, installation processes, code compliance, sustainability, and available warranties.

Higher Education | May 5, 2022

To keep pace with demand, higher ed will have to add 45,000 beds by year-end

The higher education residential sector will have to add 45,000 beds by the end of 2022 to keep pace with demand, according to a report by Humphreys & Partners Architects.

Multifamily Housing | May 5, 2022

An Austin firm touts design and communal spaces in its student housing projects

Rhode Partners has multiple towers in various development stages.

Legislation | May 4, 2022

Washington is first state to mandate all-electric heat for new large buildings

Washington recently became the first state to require all electric heat for new buildings.

Building Team | May 4, 2022

Mancini Acquires Gertler & Wente Architects, Expanding the Firm's Opportunities in New Market Sectors

National design firm Mancini Duffy - with a 100+-year-old history and tech-forward approach based in New York City - announces the acquisition of Gertler & Wente Architects to further expand its footprint in the healthcare, multi-family residential, restoration, institutional, and religious sectors.

Contractors | May 4, 2022

CFC Construction names Pat Smith president

CFC Construction is proud to announce that Pat Smith has been promoted to President of the Colorado-based general contractor.

Sponsored | Healthcare Facilities | May 3, 2022

Planning for hospital campus access that works for people

This course defines the elements of hospital campus access that are essential to promoting the efficient, stress-free movement of patients, staff, family, and visitors. Campus access elements include signage and wayfinding, parking facilities, transportation demand management, shuttle buses, curb access, valet parking management, roadways, and pedestrian walkways.

Sponsored | BD+C University Course | May 3, 2022

For glass openings, how big is too big?

Advances in glazing materials and glass building systems offer a seemingly unlimited horizon for not only glass performance, but also for the size and extent of these light, transparent forms. Both for enclosures and for indoor environments, novel products and assemblies allow for more glass and less opaque structure—often in places that previously limited their use.