The most likely beneficiaries of new infrastructure investment in the U.S. would be the engineering, construction, and industrial manufacturing sectors. And as government officials debate the next major infrastructure stimulus plan, PwC, the accounting and consulting firm, argues in a new study that industrial products and services companies must think proactively about positioning themselves as suppliers, planners, and even investors to help direct which infrastructure projects get funded, and how they are paid for.

The Trump Administration and the leadership of the Democratic Party have each come up with programs to infuse an estimated $1 trillion of infrastructure spending into the economy over the next decade. Those plans roughly align on where that investment is most heavily needed. Where they diverge—or at least are presumed to diverge, as details remain unclear—is primarily over how projects would be funded.

The Democrats’ plan would be chiefly debt financed, but also includes a $10 billion provision for an infrastructure bank to extend loan guarantees and low-cost loans to spur investment. Trump’s plan—which includes paying for a security wall across the U.S.-Mexico that alone could cost up to $25 billion—favors some combination of tax incentives and public-private partnerships, as long as what gets built subscribes to Trump’s “America First” mantra for hiring and product purchasing.

(A stumbling block to new legislation could be Republican budget hawks who have expressed opposition to any plan that isn’t revenue neutral. House Speaker Paul Ryan has gone so far as to state that every dollar of federal money for infrastructure spending must be matched by $40 of private investment. Some Democrats have also objected to the developer-heavy council Trump has assembled to pick and choose projects worthy of stimulus money.)

The U.S. seriously lags behind other industrial nations in the quality of its infrastructure. Image: PwC study “What a U.S. Infrastructure Stimulus Could Mean for the Industrial Sector.”

Meanwhile, the clock keeps ticking on the country’s crumbling bridges, roads, tunnels, and airports. The American Society of Civil Engineers (ASCE) estimates $3.3 trillion of investment is needed to maintain, repair and build new infrastructure through 2025, and sees a funding gap of $1.4 trillion to meet those needs. ASCE expects the gap to widen if current public and private investment trends continue unchanged, and further estimate that the economic impact of not filling the gap will sideline a potential $3.9 trillion GDP boost and 2.5 million jobs.

The public wants dramatic action to be taken, but continues to send out mixed signals about stimulus spending: PwC quotes a recent poll, conducted by Politico and Harvard’s T. H. Chan School of Public Health, which found 61% of Americans favor major new tax credits for business to build roads, bridges, waterways, airports and other infrastructure, while 75% says it was important for these projects to be federally funded.

PwC, though, thinks the time is “ripe” for more P3 activity in the U.S., partly because many states, restricted by balanced budget mandates and their unwillingness to raise taxes, simply can’t afford to take on big projects.

The question, though, is how to get more investors into the game. Through mid 2016, infrastructure funds that target North American assets were sitting on $75 billion in unspent capital. “The attractiveness of U.S. infrastructure [as an investment] needs to improve,” observes PwC.

The accounting firm thinks it “makes sense” to focus more on projects that enhance the America’s global competitiveness. In the latest World Economic Forum’s annual Global Competitive Index, a global ranking of the quality of the business environment, U.S. infrastructure lags other economies across several categories, ranking 12th overall, 13th in quality of roads, and ninth in air transport. Since 1980, public spending in transportation and water infrastructure, as a percentage of GDP, has held at around 2.5% compared to its 1959 peak of 3%. “The trend is hard to dislodge,” states PwC.

The irony is that greater investment pays dividends, if the Obama Administration’s $831 billion stimulus package through the American Recovery and Reinvestment Act of 2009 is any barometer. The Congressional Budget Office (CBO) estimated that real GDP in 2010 was between 0.7% and 4.1% higher and that employment was between 700,000 and 3.3 million jobs greater (measured in employment years) than had the stimulus not been carried out. Over the 2009–2011 period, the number of jobs saved or created by ARRA investment was estimated by CBO to be between 1.4 million and 6.8 million.

PwC asserts that if the Trump Administration dedicated $100 billion per year to rebuilding infrastructure, job creation and business activity in the industrial sector would inevitably follow. “For a sustained effect, a strong emphasis should be placed not only on short-term jobs creation and economic stimulus, but also on long- term impact on productivity rates, sustainability and efficiencies that have strong fiscal multiplier effects. For example, embedding ‘smart’ technology in all new infrastructure is critical, to ensure that infrastructure assets are ‘future proof.’ ”

Perhaps the most controversial part of PwC’s report—and one Trump and many of his supporters would find hard to swallow—is its business-centric view that any infrastructure stimulus plan shouldn’t get too hung up on how many jobs it generates.

“Considering the ongoing shifting nature of jobs,” PwC continues, “as manufacturers adopt advanced manufacturing technologies is just as important as—and perhaps more important than—the number of jobs in the industrial labor force.”

Related Stories

Sponsored | Reconstruction & Renovation | Sep 13, 2016

Daytona International Speedway becomes racing’s first modern stadium

Daytona International Speedway has undergone a $400 million full-scale makeover to update the facilities first built in 1959.

Mixed-Use | Sep 8, 2016

Former sports stadium to become landscaped gardens, housing, and shops

According to the architects, Maison Edouard François, the project will act as a new green lung for the densely populated neighborhood.

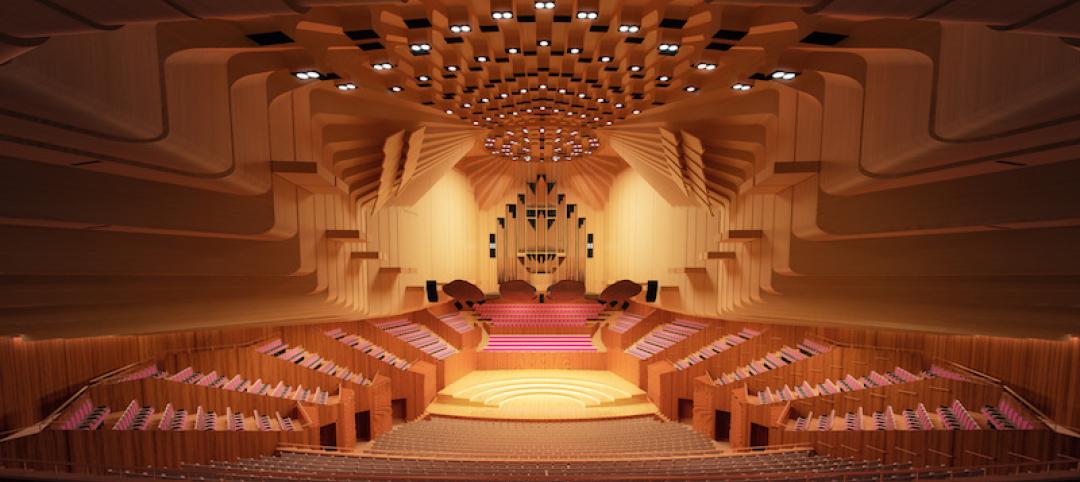

Performing Arts Centers | Aug 31, 2016

Sydney Opera House scheduled for $200 million upgrade

Acoustical improvements will be made alongside upgrades in accessibility, efficiency, and flexibility.

Reconstruction & Renovation | Aug 29, 2016

Home maintenance 101: How uninformed homeowners can cause developers big headaches, and what to do about it

By taking a proactive stance, the home-building industry can both educate the public about the importance of home maintenance and raise awareness within the construction community about protecting their professional rights and reputations.

Great Solutions | Aug 23, 2016

Reusable infection control barriers ease hospital renovation

Clark Construction Group pilots the Edge Guard system on the Fair Oaks (Va.) Hospital reconstruction project.

| Aug 19, 2016

RECONSTRUCTION GIANTS: Facelifts give buildings new identities, even as they keep a few wrinkles

Reconstruction is always a balancing act between the client’s pro forma and what the building needs to be vibrant again.

| Aug 19, 2016

Top 70 Reconstruction Engineering Firms

Jacobs, Robins & Morton, and The Boldt Company top Building Design+Construction’s annual ranking of the nation’s largest reconstruction sector engineering and E/A firms, as reported in the 2016 Giants 300 Report.

| Aug 19, 2016

Top 110 Reconstruction Construction Firms

Gilbane Building Co., Turner Construction Co., and The Whiting-Turner Contracting Co. top Building Design+Construction’s annual ranking of the nation’s largest reconstruction sector construction and construction management firms, as reported in the 2016 Giants 300 Report.

| Aug 19, 2016

Top 130 Reconstruction Architecture Firms

The Beck Group, Stantec, and IMC Consruction top Building Design+Construction’s annual ranking of the nation’s largest reconstruction sector architecture and A/E firms, as reported in the 2016 Giants 300 Report.

Reconstruction & Renovation | Aug 16, 2016

Community organization celebrating 25 years of safer, healthier homes

Rebuilding Together Metro Chicago’s work engages 3,500 volunteers every year to work on more than 100 repair projects for local residents in need.