While suspended, lay-in ceilings have long been the norm in commercial design, the open-plenum ceiling has become trendy and economical, particularly in office and retail environments. However, calculating the tradeoffs between cost and performance can be tricky.

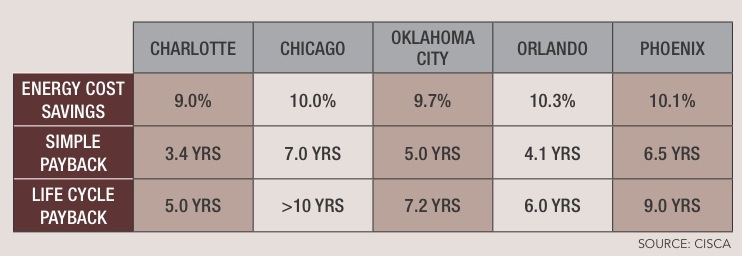

Very little data exists comparing suspended ceilings with open ceilings on the basis of cost and performance. The most recent study came from the Ceilings & Interior Systems Construction Association (www.cisca.org) five years ago. In the study, office and retail spaces were modeled in Chicago, Charlotte, Oklahoma City, Orlando, and Phoenix to reflect the differences in energy costs, climate, and installation costs. Initial construction costs were determined using RSMeans data; annual operating costs for HVAC, lighting, and maintenance were calculated according to Building Owners and Managers Association data.

The study found initial construction costs for suspended ceilings to be 15-22% higher in offices, and 4-11% higher in retail spaces. However, total energy savings for lay-in ceilings vs. open plenums were 9-10.3% in offices and 12.7-17% for retail. A 10.5% energy reduction qualifies buildings for a LEED EA credit, and a 14% reduction is good for two points.

The study attributed the energy performance advantage of suspended ceilings to the use of a return air plenum with low static pressures and fan horsepower vs. ducted air returns with higher static pressures and fan horsepower in open-plenum systems. In addition, return air plenums more efficiently remove heat from lighting systems and reduce the AC load. Suspended ceilings also offer about 20% higher light reflectance, thereby reducing lighting costs.

For more information, see: http://www.cisca.org/files/public/LCS_brochure_rev_9-08_lo-res.pdf.

Related Stories

Giants 400 | Oct 30, 2023

Top 100 K-12 School Construction Firms for 2023

CORE Construction, Gilbane, Balfour Beatty, Skanska USA, and Adolfson & Peterson top BD+C's ranking of the nation's largest K-12 school building contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 80 K-12 School Engineering Firms for 2023

AECOM, CMTA, Jacobs, WSP, and IMEG head BD+C's ranking of the nation's largest K-12 school building engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Smart Buildings | Oct 27, 2023

Cox Communities partnership levels up smart tech for multifamily customers

Yesterday, Cox Communities announced its partnership with Level Home Inc., a provider of next-generation smart IoT solutions for multifamily customers.

Student Housing | Oct 25, 2023

Pierce Education Properties acquires Penn State student housing

The two communities offer a wide range of amenities, including swimming pools with sun decks, study rooms with complimentary printing services, fitness centers, tennis court, and sand volleyball courts.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Warehouses | Oct 19, 2023

JLL report outlines 'tremendous potential' for multi-story warehouses

A new category of buildings, multi-story warehouses, is beginning to take hold in the U.S. and their potential is strong. A handful of such facilities, also called “urban logistics buildings” have been built over the past five years, notes a new report by JLL.

Building Materials | Oct 19, 2023

New white papers offer best choices in drywall, flooring, and insulation for embodied carbon and health impacts

“Embodied Carbon and Material Health in Insulation” and “Embodied Carbon and Material Health in Gypsum Drywall and Flooring,” by architecture and design firm Perkins&Will in partnership with the Healthy Building Network, advise on how to select the best low-carbon products with the least impact on human health.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.