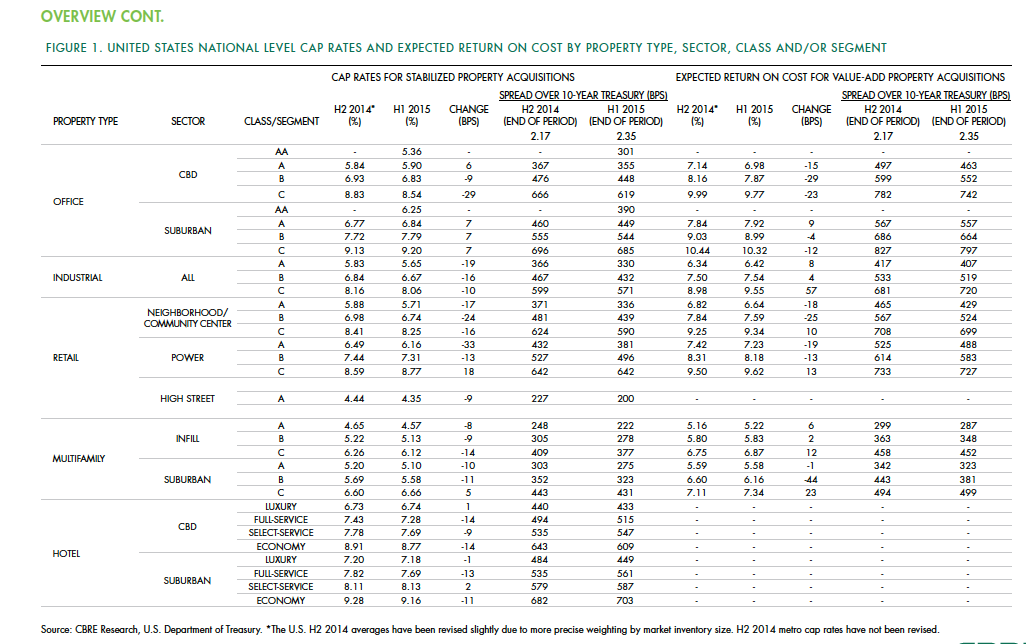

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| Sep 4, 2013

Twenty-nine-acre brick building complex in Watertown, Mass., to be renovated as innovation hub

The owner of a 29-acre cluster of brick buildings in Watertown, Mass., wants to reinvent the site as a 21st-century innovation hub.

| Sep 3, 2013

Delinquency rate for commercial real estate loans at lowest level in three years

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago.

| Aug 30, 2013

Local Government Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest local government design and construction firms, as reported in the 2013 Giants 300 Report.

| Aug 30, 2013

State Government Report [2013 Giants 300 Report]

Stantec, Jacobs, PCL Construction among nation's top state government design and construction firms, according to BD+C's 2013 Giants 300 Report.

| Aug 28, 2013

Federal Government Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest federal government design and construction firms, as reported in the 2013 Giants 300 Report.

| Aug 26, 2013

What you missed last week: Architecture billings up again; record year for hotel renovations; nation's most expensive real estate markets

BD+C's roundup of the top construction market news for the week of August 18 includes the latest architecture billings index from AIA and a BOMA study on the nation's most and least expensive commercial real estate markets.

| Aug 23, 2013

5 most (and least) expensive commercial real estate markets

With an average cost per square foot of $16.11, Stamford, Conn., is the most costly U.S. market for commercial real estate, according to a new study by the Building Owners and Managers Association International. New York and San Francisco are also among the nation's priciest markets.

| Aug 22, 2013

Energy-efficient glazing technology [AIA Course]

This course discuses the latest technological advances in glazing, which make possible ever more efficient enclosures with ever greater glazed area.

| Aug 22, 2013

6 visionary strategies for local government projects

Civic projects in Boston, Las Vegas, Austin, and suburban Atlanta show that a ‘big vision’ can also be a spur to neighborhood revitalization. Here are six visionary strategies for local government projects.

| Aug 22, 2013

Warehouse remake: Conversion project turns derelict freight terminal into modern office space [slideshow]

The goal of the Freight development is to attract businesses to an abandoned industrial zone north of downtown Denver.