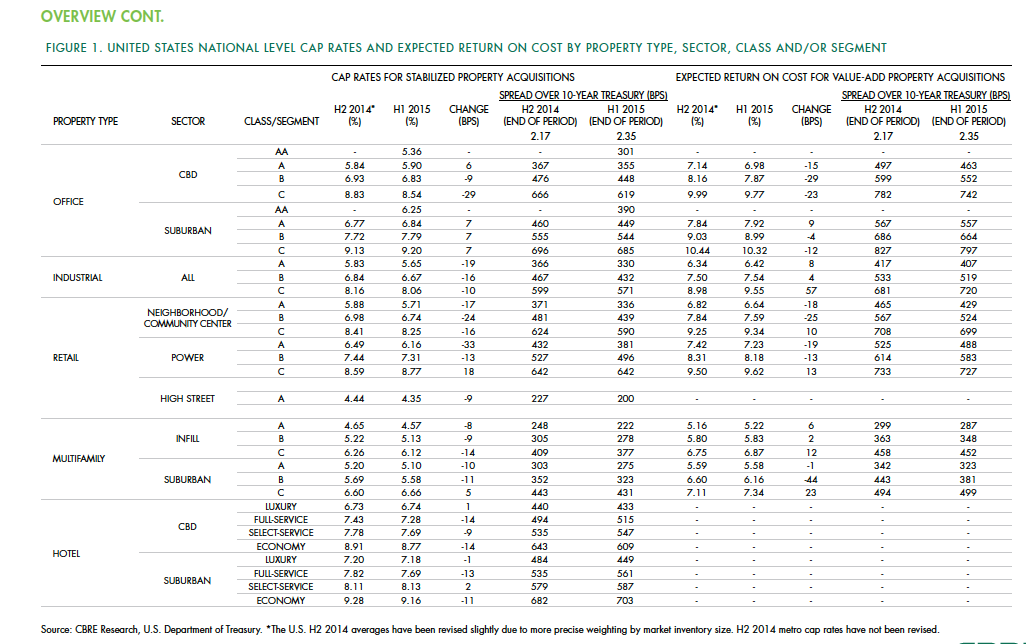

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| Feb 17, 2014

Developer plans to 'crowdfund' extended stay hotel in Manhattan

Want to own a piece of Manhattan hotel real estate? Developer Rodrigo Nino is inviting individual investors to put up $100,000 each for his latest project, 17 John.

| Feb 14, 2014

Crowdsourced Placemaking: How people will help shape architecture

The rise of mobile devices and social media, coupled with the use of advanced survey tools and interactive mapping apps, has created a powerful conduit through which Building Teams can capture real-time data on the public. For the first time, the masses can have a real say in how the built environment around them is formed—that is, if Building Teams are willing to listen.

| Feb 13, 2014

Related Companies, LargaVista partner to develop mixed-use tower in SoHo

The site is located at the gateway to the booming SoHo retail market, where Class A office space is scarce yet highly in demand.

| Feb 12, 2014

First Look: Futuristic Silicon Valley campus designed to draw tech startups

The curved campus will consist of four different buildings, one exclusively for amenities like a coffee bar, bike shop, and bank.

| Feb 7, 2014

Zaha Hadid's 'white crystal' petroleum research center taking shape in the desert [slideshow]

Like a crystalline form still in the state of expansion, the King Abdullah Petroleum Studies and Research Center will rise from the desert in dramatic fashion, with a network of bright-white, six-sided cells combining to form an angular, shell-like façade.

| Feb 6, 2014

End of the open workplace?

If you’ve been following news about workplace design in the popular media, you might believe that the open workplace has run its course. While there’s no shortage of bad open-plan workplaces, there are two big flaws with the now common claim that openness is bad.

| Feb 5, 2014

Extreme conversion: Atlanta turns high-rise office building into high school

Formerly occupied by IBM, the 11-story Lakeside building is the new home for North Atlanta High School.

| Feb 5, 2014

7 towers that define the 'skinny skyscraper' boom [slideshow]

Recent advancements in structural design, combined with the loosening of density and zoning requirements, has opened the door for the so-called "superslim skyscraper."

| Jan 30, 2014

See how architects at NBBJ are using computational design to calculate the best views on projects [video]

In an ideal world, every office employee would have a beautiful view from his or her desk. While no one can make that happen in real life, computational design can help architects maximize views from every angle.

| Jan 30, 2014

The evolving workplace: One designer's inspiration board

"Open office" has been a major buzzword for decades, and like any buzzword, some of the novelty has worn off. I don't believe we will abandon the open office, but I do think we need to focus on providing a dynamic mix of open and closed spaces.