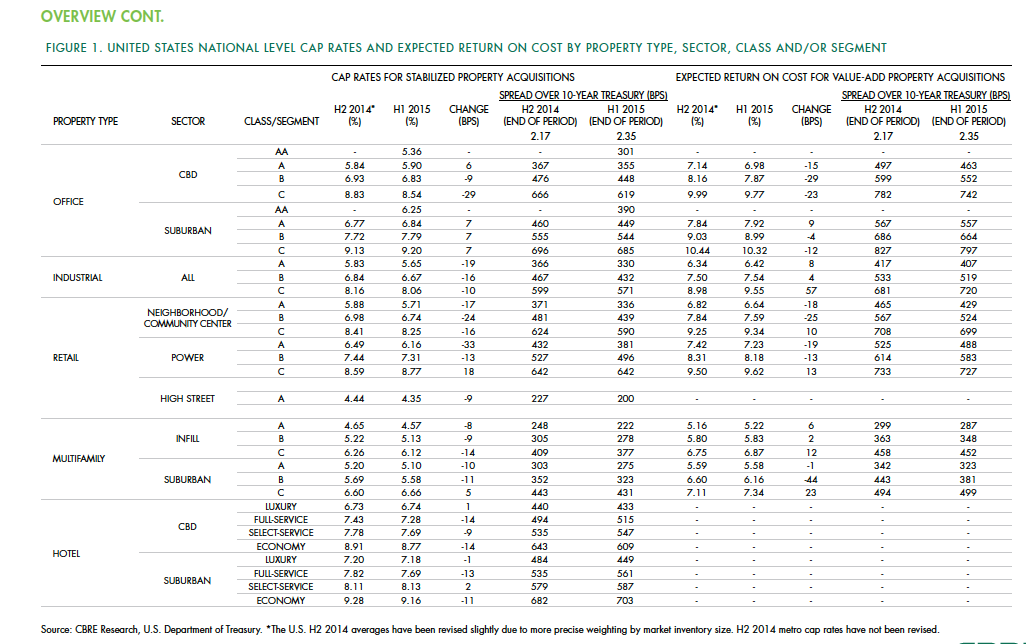

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| Aug 11, 2010

AIA Course: Enclosure strategies for better buildings

Sustainability and energy efficiency depend not only on the overall design but also on the building's enclosure system. Whether it's via better air-infiltration control, thermal insulation, and moisture control, or more advanced strategies such as active façades with automated shading and venting or novel enclosure types such as double walls, Building Teams are delivering more efficient, better performing, and healthier building enclosures.

| Aug 11, 2010

Glass Wall Systems Open Up Closed Spaces

Sectioning off large open spaces without making everything feel closed off was the challenge faced by two very different projects—one an upscale food market in Napa Valley, the other a corporate office in Southern California. Movable glass wall systems proved to be the solution in both projects.

| Aug 11, 2010

Silver Award: Pere Marquette Depot Bay City, Mich.

For 38 years, the Pere Marquette Depot sat boarded up, broken down, and fire damaged. The Prairie-style building, with its distinctive orange iron-brick walls, was once the elegant Bay City, Mich., train station. The facility, which opened in 1904, served the Flint and Pere Marquette Railroad Company when the area was the epicenter of lumber processing for the shipbuilding and kit homebuilding ...

| Aug 11, 2010

Special Recognition: Durrant Group Headquarters, Dubuque, Iowa

Architecture firm Durrant Group used the redesign of its $3.7 million headquarters building as a way to showcase the firm's creativity, design talent, and technical expertise as well as to create a laboratory for experimentation and education. The Dubuque, Iowa, firm's stated desire was to set a high sustainability standard for both itself and its clients by recycling a 22,890-sf downtown buil...

| Aug 11, 2010

Thrown For a Loop in China

While the Bird's Nest and Water Cube captured all the TV coverage during the Beijing Olympics in August, the Rem Koolhaas-designed CCTV Headquarters in Beijing—known as the “Drunken Towers” or “Big Shorts,” for its unusual shape—is certain to steal the show when it opens next year.

| Aug 11, 2010

Top of the rock—Observation deck at Rockefeller Center

Opened in 1933, the observation deck at Rockefeller Center was designed to evoke the elegant promenades found on the period's luxury transatlantic liners—only with views of the city's skyline instead of the ocean. In 1986 this cultural landmark was closed to the public and sat unused for almost two decades.

| Aug 11, 2010

200 Fillmore

Built in 1963, the 32,000-sf 200 Fillmore building in Denver housed office and retail in a drab, outdated, and energy-splurging shell—a “style” made doubly disastrous by 200 Fillmore's function as the backdrop for a popular public plaza and outdoor café called “The Beach.

| Aug 11, 2010

Integrated Project Delivery builds a brave, new BIM world

Three-dimensional information, such as that provided by building information modeling, allows all members of the Building Team to visualize the many components of a project and how they work together. BIM and other 3D tools convey the idea and intent of the designer to the entire Building Team and lay the groundwork for integrated project delivery.

| Aug 11, 2010

Inspiring Offices: Office Design That Drives Creativity

Office design has always been linked to productivity—how many workers can be reasonably squeezed into a given space—but why isn’t it more frequently linked to creativity? “In general, I don’t think enough people link the design of space to business outcome,” says Janice Linster, partner with the Minneapolis design firm Studio Hive.

| Aug 11, 2010

Great Solutions: Products

14. Mod Pod A Nod to Flex Biz Designed by the British firm Tate + Hindle, the OfficePOD is a flexible office space that can be installed, well, just about anywhere, indoors or out. The self-contained modular units measure about seven feet square and are designed to serve as dedicated space for employees who work from home or other remote locations.