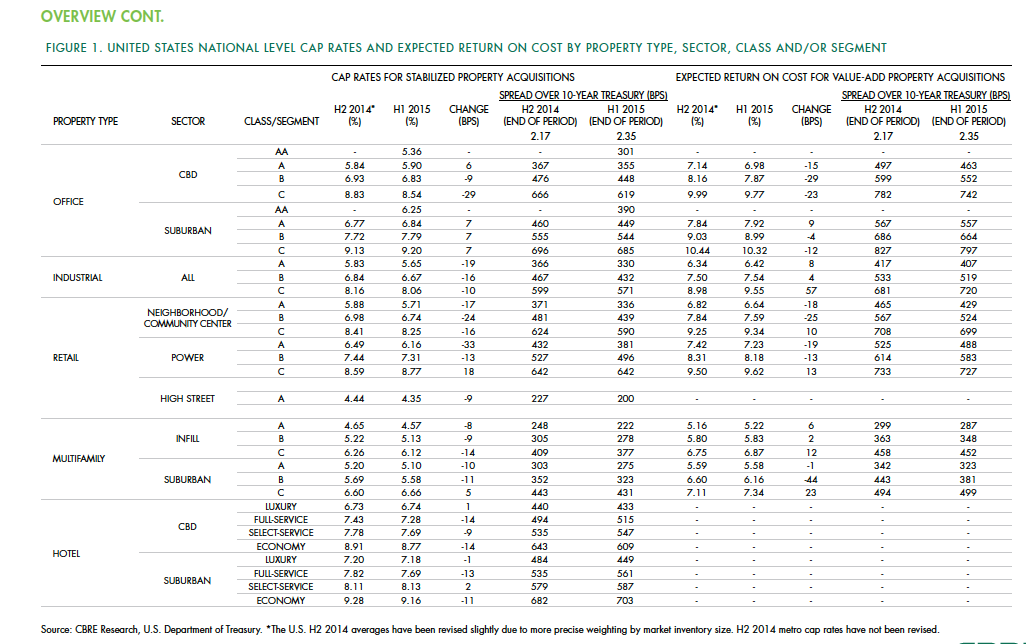

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| Dec 20, 2011

Aragon Construction leading build-out of foursquare office

The modern, minimalist build-out will have elements of the foursquare “badges” in different aspects of the space, using glass, steel, and vibrantly painted gypsum board.

| Dec 19, 2011

Chicago’s Aqua Tower wins international design award

Aqua was named both regional and international winner of the International Property Award as Best Residential High-Rise Development.

| Dec 19, 2011

Davis Construction breaks ground on new NIAID property

The new offices will total 490,998 square feet in a 10-story building with two wings of 25,000 square feet each.

| Dec 14, 2011

Belfer Research Building tops out in New York

Hundreds of construction trades people celebrate reaching the top of concrete structure for facility that will accelerate treatments and cures at world-renowned institution.

| Dec 13, 2011

Lutron’s Commercial Experience Center awarded LEED Gold

LEED certification of the Lutron facility was based on a number of green design and construction features that positively impact the project itself and the broader community. These features include: optimization of energy performance through the use of lighting power, lighting controls and HVAC, plus the use of daylight.

| Dec 12, 2011

AIA Chicago announces Skidmore, Owings & Merrill as 2011 Firm of the Year

SOM has been a leader in the research and development of specialized technologies, new processes and innovative ideas, many of which have had a palpable and lasting impact on the design profession and the physical environment.

| Dec 12, 2011

CRSI design awards deadline extended to December 31

The final deadline is extended until December 31st, with judging shortly thereafter at the World of Concrete.

| Dec 12, 2011

Mojo Stumer takes top honors at AIA Long Island Design Awards

Firm's TriBeCa Loft wins "Archi" for interior design.

| Dec 10, 2011

10 Great Solutions

The editors of Building Design+Construction present 10 “Great Solutions” that highlight innovative technology and products that can be used to address some of the many problems Building Teams face in their day-to-day work. Readers are encouraged to submit entries for Great Solutions; if we use yours, you’ll receive a $25 gift certificate. Look for more Great Solutions in 2012 at: www.bdcnetwork.com/greatsolutions/2012.

| Dec 10, 2011

Energy performance starts at the building envelope

Rainscreen system installed at the west building expansion of the University of Arizona’s Meinel Optical Sciences Center in Tucson, with its folded glass wall and copper-paneled, breathable cladding over precast concrete.