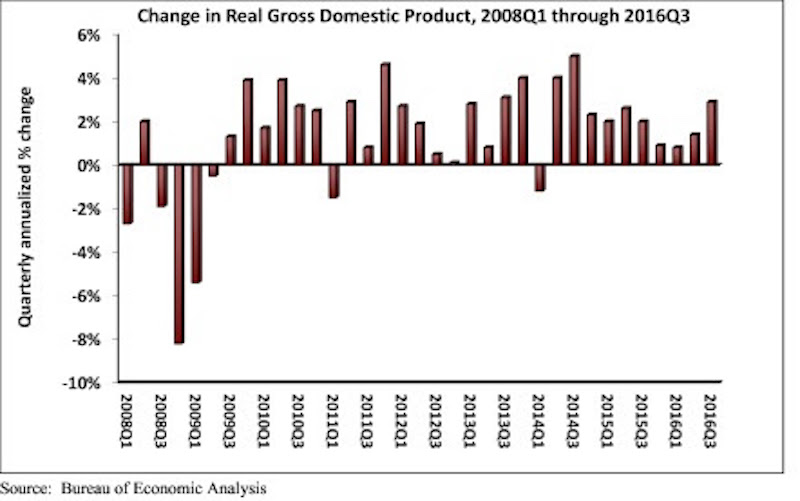

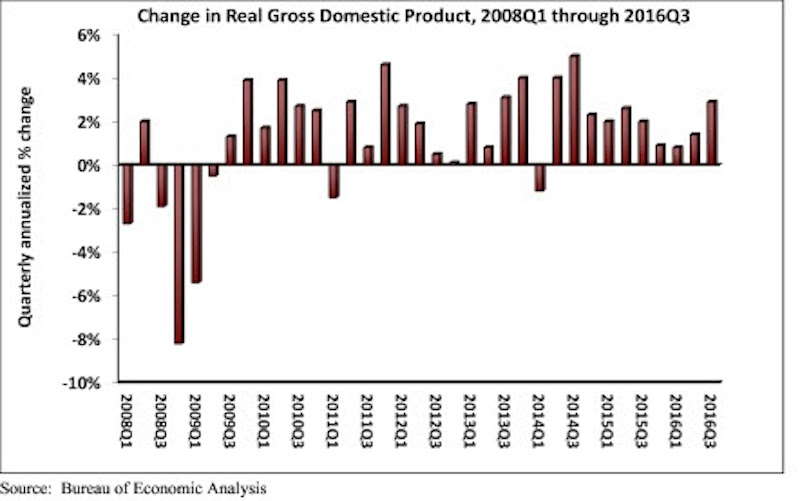

Real gross domestic product (GDP) expanded 2.9 percent on a seasonally adjusted annualized rate during the third quarter of 2016, according to an analysis of Bureau of Economic Analysis data released today by Associated Builders and Contractors (ABC). This follows a 1.4 percent increase during the second quarter and represents the tenth consecutive quarter of economic expansion.

Nonresidential fixed investment, a category closely aligned with construction and other forms of business investment, expanded at a 1.2 percent annualized rate during the third quarter after growing 1 percent during the second. Investment in structures led the way, increasing by 5.4 percent in the third quarter after falling 2.1 percent during the second. Investment in equipment fell 2.7 percent for the quarter, while investment in intellectual property products expanded 4 percent. Residential investment continued to fall, declining 6.2 percent in the third quarter after falling 7.7 percent during the second.

The following highlights emerged from today’s third quarter GDP release. All growth figures are presented as seasonally adjusted annualized rates:

- Personal consumption expenditures expanded 2.1 percent on an annualized basis during the third quarter of 2016 after growing 4.3 percent during the second quarter of 2016.

- Spending on goods rose 2.2 percent during the third quarter after expanding by 7.1 percent during the previous quarter.

- Real final sales of domestically produced output increased 2.3 percent in the third quarter after increasing 2.6 percent in the second.

- Federal government spending expanded 2.5 percent in the year’s third quarter after contracting during each of the prior two quarters.

- Nondefense government spending increased 3 percent during the quarter following an increase of 3.8 percent during the second.

- National defense spending grew by 2.1 percent during the third quarter after registering a 3.2 percent decline in the previous quarter.

- State and local government spending fell by 0.7 percent in the third quarter after falling 2.5 percent in the second quarter.

“The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending. One of the biggest impacts came from greater private inventory investment, likely in response to expectations for reasonably strong consumer spending. Growth in personal consumption expenditures was responsible for almost half of third quarter GDP growth. However, this build in inventories is likely to subtract from economic growth in future quarters, though not massively,” says ABC Chief Economist Anirban Basu.

“Third quarter growth was solid, but future quarters may not be as good,” Basu says. “The economy will have to deal with a number of headwinds going forward, including a stronger dollar, building inflationary pressures and higher interest rates. Consumer spending growth will continue to lead the recovery. While this will help support construction spending in certain categories, including distribution centers, nonresidential investment in structures is likely to expand only slowly in early 2017.”

Related Stories

Market Data | Sep 2, 2020

5 must reads for the AEC industry today: September 2, 2020

Precast concrete tower honors United AIrlines Flight 93 victims and public and private nonresidential construction spending slumps.

Market Data | Sep 2, 2020

Public and private nonresidential construction spending slumps in July

Industry employment declines from July 2019 in two-thirds of metros.

Market Data | Aug 31, 2020

5 must reads for the AEC industry today: August 31, 2020

The world's first LEED Platinum integrated campus and reopening campus performance arts centers.

Market Data | Aug 21, 2020

5 must reads for the AEC industry today: August 21, 2020

Student housing in the COVID-19 era and wariness of elevators may stymie office reopening.

Market Data | Aug 20, 2020

6 must reads for the AEC industry today: August 20, 2020

Japan takes on the public restroom and a look at the evolution of retail.

Market Data | Aug 19, 2020

6 must reads for the AEC industry today: August 19, 2020

July architectural billings remained stalled and Florida becomes third state to adopt concrete repair code.

Market Data | Aug 18, 2020

July architectural billings remained stalled

Clients showed reluctance to sign contracts for new design projects during July.

Market Data | Aug 18, 2020

Nonresidential construction industry won’t start growing again until next year’s third quarter

But labor and materials costs are already coming down, according to latest JLL report.

Market Data | Aug 18, 2020

6 must reads for the AEC industry today: August 18, 2020

The world's first AI-driven facade system and LA's Greek Theatre restoriation completes.

Market Data | Aug 17, 2020

5 must reads for the AEC industry today: August 17, 2020

5 strategies for creating safer hotel experiences and how to manage multifamily assets when residents no longer leave.