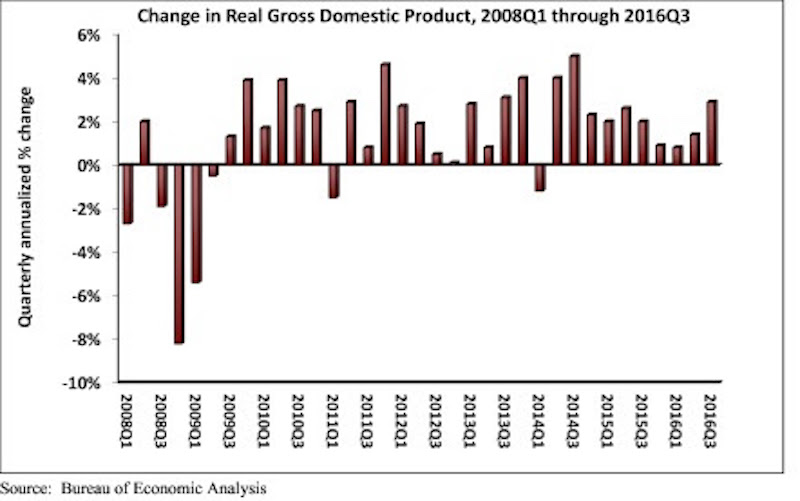

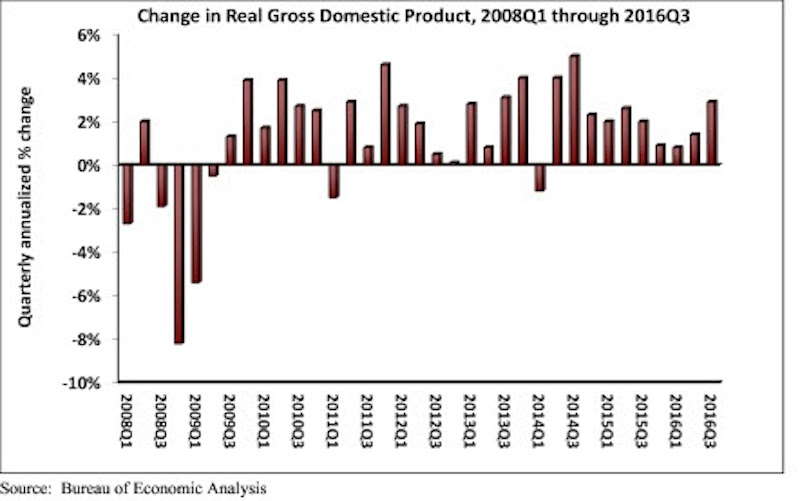

Real gross domestic product (GDP) expanded 2.9 percent on a seasonally adjusted annualized rate during the third quarter of 2016, according to an analysis of Bureau of Economic Analysis data released today by Associated Builders and Contractors (ABC). This follows a 1.4 percent increase during the second quarter and represents the tenth consecutive quarter of economic expansion.

Nonresidential fixed investment, a category closely aligned with construction and other forms of business investment, expanded at a 1.2 percent annualized rate during the third quarter after growing 1 percent during the second. Investment in structures led the way, increasing by 5.4 percent in the third quarter after falling 2.1 percent during the second. Investment in equipment fell 2.7 percent for the quarter, while investment in intellectual property products expanded 4 percent. Residential investment continued to fall, declining 6.2 percent in the third quarter after falling 7.7 percent during the second.

The following highlights emerged from today’s third quarter GDP release. All growth figures are presented as seasonally adjusted annualized rates:

- Personal consumption expenditures expanded 2.1 percent on an annualized basis during the third quarter of 2016 after growing 4.3 percent during the second quarter of 2016.

- Spending on goods rose 2.2 percent during the third quarter after expanding by 7.1 percent during the previous quarter.

- Real final sales of domestically produced output increased 2.3 percent in the third quarter after increasing 2.6 percent in the second.

- Federal government spending expanded 2.5 percent in the year’s third quarter after contracting during each of the prior two quarters.

- Nondefense government spending increased 3 percent during the quarter following an increase of 3.8 percent during the second.

- National defense spending grew by 2.1 percent during the third quarter after registering a 3.2 percent decline in the previous quarter.

- State and local government spending fell by 0.7 percent in the third quarter after falling 2.5 percent in the second quarter.

“The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending. One of the biggest impacts came from greater private inventory investment, likely in response to expectations for reasonably strong consumer spending. Growth in personal consumption expenditures was responsible for almost half of third quarter GDP growth. However, this build in inventories is likely to subtract from economic growth in future quarters, though not massively,” says ABC Chief Economist Anirban Basu.

“Third quarter growth was solid, but future quarters may not be as good,” Basu says. “The economy will have to deal with a number of headwinds going forward, including a stronger dollar, building inflationary pressures and higher interest rates. Consumer spending growth will continue to lead the recovery. While this will help support construction spending in certain categories, including distribution centers, nonresidential investment in structures is likely to expand only slowly in early 2017.”

Related Stories

Market Data | Dec 29, 2020

Multifamily transactions drop sharply in 2020, according to special report from Yardi Matrix

Sales completions at end of Q3 were down over 41 percent from the same period a year ago.

Market Data | Dec 28, 2020

New coronavirus recovery measure will provide some needed relief for contractors coping with project cancellations, falling demand

Measure’s modest amount of funding for infrastructure projects and clarification that PPP loans may not be taxed will help offset some of the challenges facing the construction industry.

Market Data | Dec 28, 2020

Construction employment trails pre-pandemic levels in 35 states despite gains in industry jobs from October to November in 31 states

New York and Vermont record worst February-November losses, Virginia has largest pickup.

Market Data | Dec 16, 2020

Architecture billings lose ground in November

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5.

AEC Tech | Dec 8, 2020

COVID-19 affects the industry’s adoption of ConTech in different ways

A new JLL report assesses which tech options got a pandemic “boost.”

Market Data | Dec 7, 2020

Construction sector adds 27,000 jobs in November

Project cancellations, looming PPP tax bill will undercut future job gains.

Market Data | Dec 3, 2020

Only 30% of metro areas add construction jobs in latest 12 months

Widespread project postponements and cancellations force layoffs.

Market Data | Dec 2, 2020

New Passive House standards offers prescriptive path that reduces costs

Eliminates requirement for a Passive House consultant and attendant modeling.

Market Data | Dec 2, 2020

Nonresidential construction spending remains flat in October

Residential construction expands as many commercial projects languish.

Market Data | Nov 30, 2020

New FEMA study projects implementing I-Codes could save $600 billion by 2060

International Code Council and FLASH celebrate the most comprehensive study conducted around hazard-resilient building codes to-date.