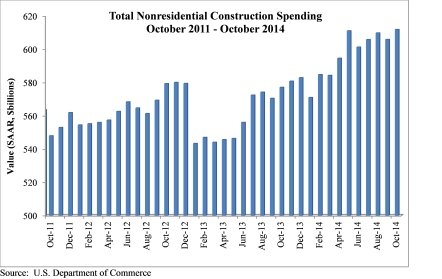

Nonresidential construction spending bounced back in October, expanding 1 percent on a monthly basis and 4.3 percent year over year, according to a Dec. 2 release from the U.S. Census Bureau. Spending for the month totaled $611.8 billion on a seasonally adjusted, annualized basis. Additionally, the government revised the September spending figure up to $605.8 billion from $596.1 billion.

"This month's increase in nonresidential construction spending is far more consistent with the anecdotal information floating around the industry, which generally indicates that firms are becoming busier and that backlog is expanding," said Associated Builders and Contractors (ABC) Chief Economist Anirban Basu. "Although last month's numbers for nonresidential construction spending and employment were disappointing and could have implied the nation's nonresidential construction recovery is stalling, that is not the case.

"The outlook for 2015 remains upbeat," said Basu. "The economy has gained momentum over the past six to seven months and that is consistent with more aggressive construction starts and spending during the year to come. Even as the economy has gained momentum, the Federal Reserve has remained extraordinarily accommodative due in part to benign inflation readings. Low interest rates combined with solid economic momentum likely mean expansion for the nonresidential construction industry during the year ahead."

Eleven of the 16 nonresidential construction subsectors posted monthly increases in spending. Here's a recap:

• Office-related construction spending grew by 2 percent in October and is up 16.3 percent from the same time one year ago.

• Lodging construction spending is up 3.3 percent on a monthly basis and is up 15.9 percent on a year-over-year basis.

• Conservation and development-related construction spending grew 4.6 percent for the month and is up 33.1 percent on a yearly basis.

• Spending in the water supply category expanded 0.9 percent on a monthly basis, but is down 1.8 percent on a year-over-year basis.

• Amusement and recreation-related construction spending expanded 2.2 percent in October and is up 1.4 percent from the same time last year.

• Manufacturing-related spending expanded 3.4 percent on a monthly basis and is up 22.2 percent on an annual basis.

• Healthcare-related construction spending expanded 0.6 percent for the month but is down 8.4 percent from the same time last year.

• Education-related construction spending expanded 1.8 percent for the month and is up 3.6 percent on a year-over-year basis.

• Construction spending in the transportation category expanded 2.7 percent on a monthly basis and has expanded 1.6 percent on an annual basis.

• Highway and street-related construction spending expanded 1.2 percent in October and is up 0.1 percent compared to the same time last year.

• Public safety-related construction spending expanded 11.6 percent on a monthly basis but is down 1.2 percent on a year-over-year basis.

Monthly spending in five nonresidential construction subsectors declined in October. They are:

• Commercial construction spending fell 2.2 percent for the month but has grown 9.1 percent on a year-over-year basis.

• Communication construction spending declined 1.9 percent for the month and is down 9.4 percent for the year.

• Religious construction spending fell 3.7 percent for the month and is down 4.6 percent from the same time last year.

• Sewage and waste disposal-related construction spending declined 0.4 percent for the month and is down 0.2 percent on a 12-month basis.

• Power construction spending fell 1 percent for the month but is 0.7 percent higher than at the same time one year ago.

To view the previous spending report, click here.

Related Stories

Affordable Housing | Oct 20, 2023

Cracking the code of affordable housing

Perkins Eastman's affordable housing projects show how designers can help to advance the conversation of affordable housing.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Warehouses | Oct 19, 2023

JLL report outlines 'tremendous potential' for multi-story warehouses

A new category of buildings, multi-story warehouses, is beginning to take hold in the U.S. and their potential is strong. A handful of such facilities, also called “urban logistics buildings” have been built over the past five years, notes a new report by JLL.

Building Materials | Oct 19, 2023

New white papers offer best choices in drywall, flooring, and insulation for embodied carbon and health impacts

“Embodied Carbon and Material Health in Insulation” and “Embodied Carbon and Material Health in Gypsum Drywall and Flooring,” by architecture and design firm Perkins&Will in partnership with the Healthy Building Network, advise on how to select the best low-carbon products with the least impact on human health.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.

Luxury Residential | Oct 18, 2023

One Chicago wins 2023 International Architecture Award

One Chicago, a two-tower luxury residential and mixed-use complex completed last year, has won the 2023 International Architecture Award. The project was led by JDL Development and designed in partnership between architecture firms Goettsch Partners and Hartshorne Plunkard Architecture.

Giants 400 | Oct 17, 2023

Top 130 Sports Facility Architecture Firms for 2023

Populous, Gensler, HOK, and HKS head BD+C's ranking of the nation's largest sports facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Office Buildings | Oct 16, 2023

The impact of office-to-residential conversion on downtown areas

Gensler's Duanne Render looks at the incentives that could bring more office-to-residential conversions to life.

Giants 400 | Oct 11, 2023

Top 100 Industrial Sector Architecture Firms for 2023

Ware Malcomb, Arcadis, Stantec, and Gresham Smith top the ranking of the nation's largest industrial facility sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.