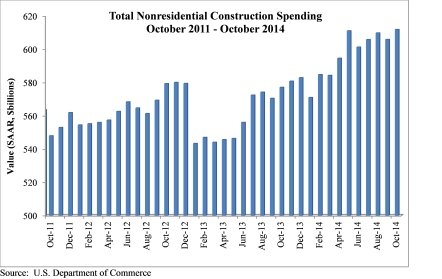

Nonresidential construction spending bounced back in October, expanding 1 percent on a monthly basis and 4.3 percent year over year, according to a Dec. 2 release from the U.S. Census Bureau. Spending for the month totaled $611.8 billion on a seasonally adjusted, annualized basis. Additionally, the government revised the September spending figure up to $605.8 billion from $596.1 billion.

"This month's increase in nonresidential construction spending is far more consistent with the anecdotal information floating around the industry, which generally indicates that firms are becoming busier and that backlog is expanding," said Associated Builders and Contractors (ABC) Chief Economist Anirban Basu. "Although last month's numbers for nonresidential construction spending and employment were disappointing and could have implied the nation's nonresidential construction recovery is stalling, that is not the case.

"The outlook for 2015 remains upbeat," said Basu. "The economy has gained momentum over the past six to seven months and that is consistent with more aggressive construction starts and spending during the year to come. Even as the economy has gained momentum, the Federal Reserve has remained extraordinarily accommodative due in part to benign inflation readings. Low interest rates combined with solid economic momentum likely mean expansion for the nonresidential construction industry during the year ahead."

Eleven of the 16 nonresidential construction subsectors posted monthly increases in spending. Here's a recap:

• Office-related construction spending grew by 2 percent in October and is up 16.3 percent from the same time one year ago.

• Lodging construction spending is up 3.3 percent on a monthly basis and is up 15.9 percent on a year-over-year basis.

• Conservation and development-related construction spending grew 4.6 percent for the month and is up 33.1 percent on a yearly basis.

• Spending in the water supply category expanded 0.9 percent on a monthly basis, but is down 1.8 percent on a year-over-year basis.

• Amusement and recreation-related construction spending expanded 2.2 percent in October and is up 1.4 percent from the same time last year.

• Manufacturing-related spending expanded 3.4 percent on a monthly basis and is up 22.2 percent on an annual basis.

• Healthcare-related construction spending expanded 0.6 percent for the month but is down 8.4 percent from the same time last year.

• Education-related construction spending expanded 1.8 percent for the month and is up 3.6 percent on a year-over-year basis.

• Construction spending in the transportation category expanded 2.7 percent on a monthly basis and has expanded 1.6 percent on an annual basis.

• Highway and street-related construction spending expanded 1.2 percent in October and is up 0.1 percent compared to the same time last year.

• Public safety-related construction spending expanded 11.6 percent on a monthly basis but is down 1.2 percent on a year-over-year basis.

Monthly spending in five nonresidential construction subsectors declined in October. They are:

• Commercial construction spending fell 2.2 percent for the month but has grown 9.1 percent on a year-over-year basis.

• Communication construction spending declined 1.9 percent for the month and is down 9.4 percent for the year.

• Religious construction spending fell 3.7 percent for the month and is down 4.6 percent from the same time last year.

• Sewage and waste disposal-related construction spending declined 0.4 percent for the month and is down 0.2 percent on a 12-month basis.

• Power construction spending fell 1 percent for the month but is 0.7 percent higher than at the same time one year ago.

To view the previous spending report, click here.

Related Stories

Engineers | Jan 12, 2022

Private equity: An increasingly attractive alternative for AEC firm sellers

Private equity firms active in the AEC sector work quietly in the background to partner with management, hold for longer periods, and build a win-win for investors and the firm. At a minimum, AEC firms contemplating ownership transition should consider private equity as a viable option. Here is why.

Sponsored | BD+C University Course | Jan 12, 2022

Total steel project performance

This instructor-led video course discusses actual project scenarios where collaborative steel joist and deck design have reduced total-project costs. In an era when incomplete structural drawings are a growing concern for our industry, the course reveals hidden costs and risks that can be avoided.

University Buildings | Jan 11, 2022

Designing for health sciences education: supporting student well-being

While student and faculty health and well-being should be a top priority in all spaces within educational facilities, this article will highlight some key considerations.

Green | Jan 10, 2022

The future of regenerative building is performance-based

Why measuring performance results is so critical, but also easier said than done.

Senior Living Design | Jan 5, 2022

Top Senior Living Facility Design and Construction Firms

Perkins Eastman, Kimley-Horn, WSP USA, Whiting-Turner Contracting Co., and Ryan Companies US top BD+C's rankings of the nation's largest senior living sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Giants 400 | Jan 3, 2022

2021 Government Sector Giants: Top architecture, engineering, and construction firms in the U.S. government buildings sector

Stantec, Jacobs, Turner Construction, and Hensel Phelps top BD+C's rankings of the nation's largest government sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Architects | Dec 20, 2021

Digital nomads are influencing design

As our spaces continue to adapt to our future needs, we’ll likely see more collaborative, communal zones where people can relax, shop, and work.

Architects | Dec 17, 2021

What I wish I had learned in architecture school

Bradford Perkins, FAIA, offers a 3-point plan for upgrading architecture education.

Urban Planning | Dec 15, 2021

EV is the bridge to transit’s AV revolution—and now is the time to start building it

Thinking holistically about a technology-enabled customer experience will make transit a mode of choice for more people.

Sports and Recreational Facilities | Dec 15, 2021

Trends in sports stadium construction, with Turner Construction's Dewey Newton

Turner Construction's Dewey Newton discusses trends in sports stadium renovation and construction with BD+C's John Caulfield. Newton is a Senior Vice President who heads up Turner Construction’s Sports Group.