Multifamily properties above ground-floor grocers continue to see positive rental premiums

By Quinn Purcell, Managing Editor

Optimizing land usage is becoming an even bigger priority for developers. In some city centers, many large grocery stores sprawl across valuable land. This inefficient use of space doesn't reflect the best possible use for these desirable locations, according to the recent RCLCO report The Supermarket Rental Sweep: Analyzing Multifamily Rent Premiums Generated by Grocery Store Anchors.

One way for grocers and retail outlets to increase interest in a desirable location is by partnering with multifamily developers. The strategy of building housing above a ground floor store not only adds an extra amenity for residents, but increases the rental premium desired by developers.

Rental Rate Premiums from Ground-Floor Grocers

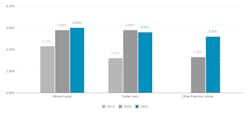

The multifamily performance of such partnerships is nothing to scoff at. The RCLCO analysis finds that apartment communities with a ground-floor Whole Foods achieve a rental rate premium of 6% on average—comparable to similar communities in the immediate area.

A similar figure is present for Trader Joe communities; these premiums average out to 5.6% which is down only slightly from 5.8% in 2020. In other premium grocers like Fairway, Safeway, Sprouts, and Harris Teeter, the above-ground community premium increased from 3.3% in 2020 to 5.2% in the 2023 study.

Rent Premium by Grocer

For its analysis, RCLCO looked at the scale, age, type of construction, quality, and market positioning of nearly 100 mixed-use centers compared to their local counterparts. These include 37 multifamily properties with a ground-floor Whole Foods, 21 with Trader Joe’s, and 30 with other premium grocers.

RCLCO identified two to five similar apartment buildings in each local neighborhood and adjusted the rents to account for size differences. Then, they compared the adjusted rents of these similar buildings to the average rent in the grocer-anchored case study building. The researchers believe this methodology led to a quality-adjusted comparison that could point to the direct impact that a ground-floor grocer has on a community (as opposed to rent prices being higher due to higher quality amenities and finishes).

In general, the strong performance of apartments with ground-floor grocers since RCLCO’s 2016 study indicates that “the momentum for these mixed-use offerings continues to grow.”

Click here to read the full findings of the RCLCO report: The Supermarket Rental Sweep: Analyzing Multifamily Rent Premiums Generated by Grocery Store Anchors