Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

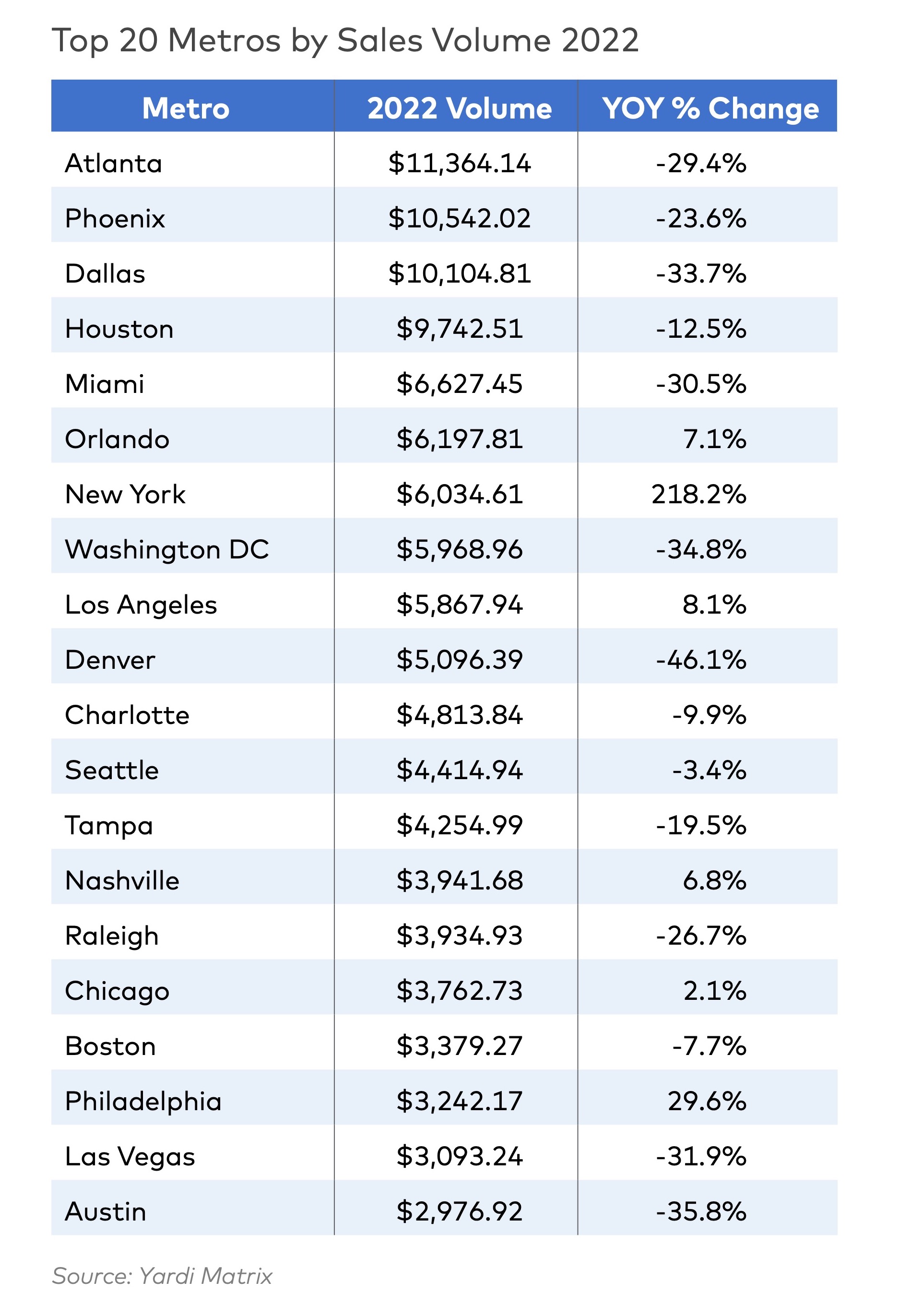

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Multifamily Housing | Jul 28, 2022

GM working to make EV charging accessible to multifamily residents

General Motors, envisioning a future where electric vehicles will be commonplace, is working to boost charging infrastructure for those who live in multifamily residences.

Multifamily Housing | Jul 26, 2022

All-electric buildings – great! But where's all that energy going to be stored?

There's a call for all-electric buildings, but can we generate and store enough electricity to meet that need?

Green | Jul 26, 2022

Climate tech startup BlocPower looks to electrify, decarbonize the nation's buildings

The New York-based climate technology company electrifies and decarbonizes buildings—more than 1,200 of them so far.

Sponsored | Multifamily Housing | Jul 19, 2022

Engineering Solutions for a More Inclusive Community

Affordable housing complex uses engineered wood to keep construction costs low, tackle a public predicament and give rise to a stronger, more inclusive community.

Multifamily Housing | Jul 14, 2022

Multifamily rents rise again in June, Yardi Matrix reports

Average U.S. multifamily rents rose another $19 in June to edge over $1,700 for the first time ever, according to the latest Yardi® Matrix Multifamily Report.

Building Team | Jul 7, 2022

Amenity-rich rental property in Chicago includes seven-story atrium with vertical landscaping

The recently opened 198-unit Optima Lakeview luxury rental apartment building in Chicago is bursting with amenities such as the region’s first year-round rooftop pool, contact-free in-home package delivery, housekeeping services, on-site room service, fitness programming, and a virtual personal assistant.

Multifamily Housing | Jul 6, 2022

The power of contextual housing development

Creating urban villages and vibrant communities starts with a better understanding of place, writes LPA's Matthew Porreca.

Green | Jun 22, 2022

The business case for passive house multifamily

A trio of Passive House experts talk about the true costs and benefits of passive house design and construction for multifamily projects.

Multifamily Housing | Jun 21, 2022

Two birds, one solution: Can we solve urban last-mile distribution and housing challenges at the same time?

When it comes to the development of both multifamily housing and last-mile distribution centers, particularly in metropolitan environments, each presents its own series of challenges and hurdles. One solution: single-use structures.