Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

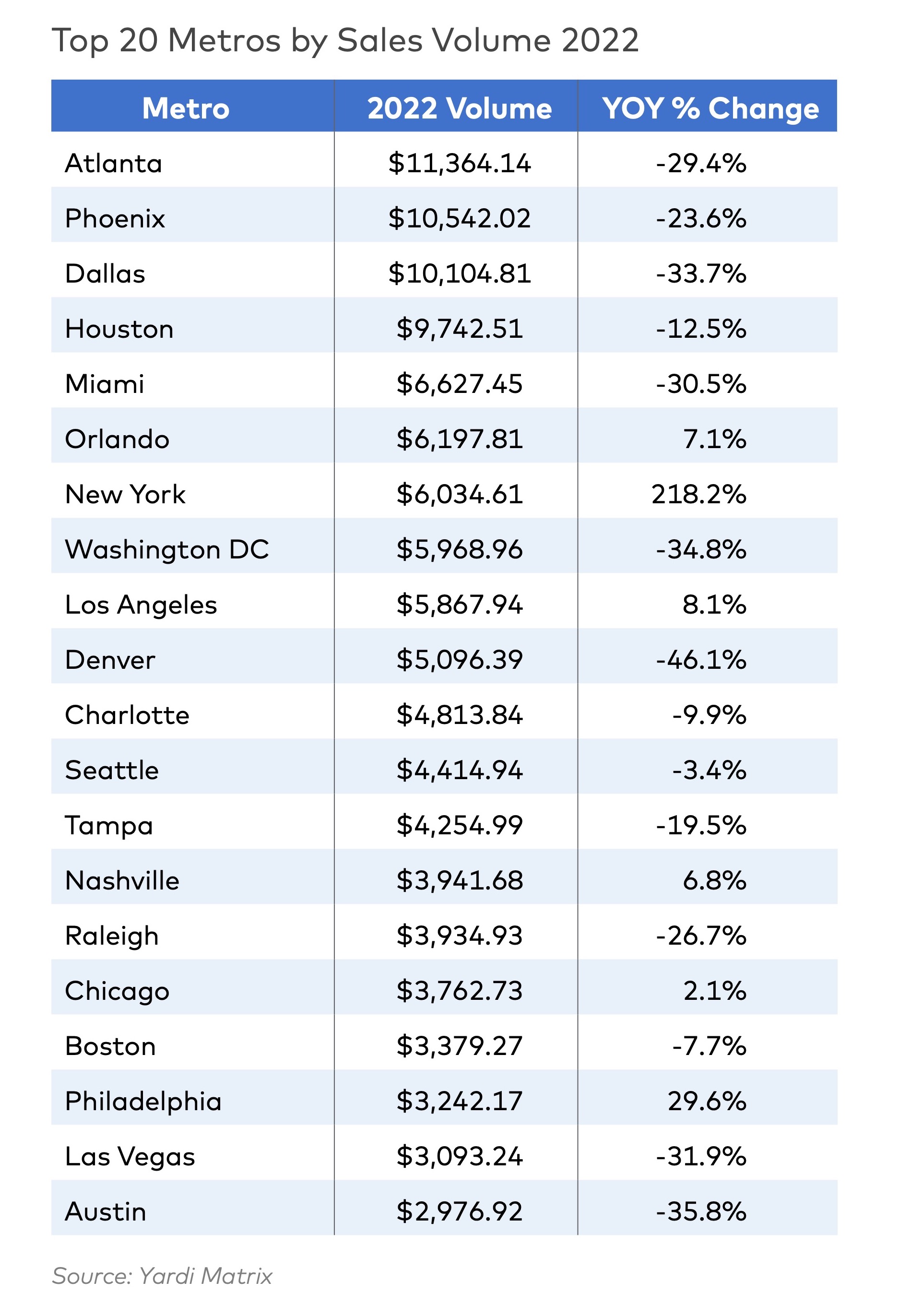

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Multifamily Housing | Sep 13, 2022

Take the Multifamily Kitchen + Bath survey – Maybe win one of 10 $50 gift cards

Preliminary results of 2022 Multifamily Design+Construction exclusive Kitchen + Bath survey.

Senior Living Design | Sep 8, 2022

What’s new with AQ: The top trends in active adult living

Today's 55-or-better buyers are ready to design their lives and their homes as they see fit. With so much growth on tap, builders and developers must stay apprised of trends related to home, environment, and culture of 55+ communities.

Mass Timber | Aug 30, 2022

Mass timber construction in 2022: From fringe to mainstream

Two Timberlab executives discuss the market for mass timber construction and their company's marketing and manufacturing strategies. Sam Dicke, Business Development Manager, and Erica Spiritos, Director of Preconstruction, Timberlab, speak with BD+C's John Caulfield.

Giants 400 | Aug 29, 2022

Top 50 Senior Living Facility Contractors + CM Firms for 2022

Whiting-Turner, Ryan Companies US, W.E. O'Neil Construction, and KBE Building Corp. top the ranking of the nation's largest senior living facility contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 29, 2022

Top 80 Senior Living Facility Architecture + AE Firms for 2022

Perkins Eastman, Hord Coplan Macht, Ryan A+E, and Stantec top the ranking of the nation's largest senior living facility architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 29, 2022

Top 30 Senior Living Facility Engineering + EA Firms for 2022

WSP, Olsson, Kimley-Horn, and KPFF Consulting Engineers top the ranking of the nation's largest senior living facility engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 29, 2022

Top 40 Student Housing Facility Contractors + CM Firms for 2022

J.H. Findorff & Son, PCL Construction Enterprises, Juneau Construction, and Sundt Construction top the ranking of the nation's largest student housing facility contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 29, 2022

Top 35 Student Housing Facility Engineering + EA Firms for 2022

Kimley-Horn, Wiss, Janney, Elstner Associates, KPFF Consulting Engineers, and Jacobs top the ranking of the nation's largest student housing facility engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 29, 2022

Top 70 Student Housing Facility Architecture + AE Firms for 2022

Niles Bolton Associates, Mithun, Gensler, and Perkins and Will top the ranking of the nation's largest student housing facility architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 29, 2022

Top 110 Multifamily Sector Contractors + CM Firms for 2022

Suffolk Construction, Clark Group, AECOM, and Whiting-Turner top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes all multifamily sector work, including apartments, condos, student housing, and senior living facilities.