More than 10 years after the end of the most severe financial crisis since the Great Depression, the U.S. economy is again making history by continuing its longest-ever expansion. Nevertheless, emerging weakness in business investment has been hinting at softening outlays, giving commercial and industrial construction contractors cause for concern, according to a mid-year economic outlook by Anirban Basu, chief economist of Associated Builders and Contractors.

“Given that every expansion in U.S. history has ended in recession, leaders of construction firms are rightly wondering when the record-setting expansion will end,” said Basu. “Looking at conditions on the ground, it likely won’t be in 2019, but 2020 could be problematic for the broader economy and 2021 for a significant number of contractors.”

Basu cites numerous vulnerabilities that could trigger a recession in 2020, including:

— Trade wars

— Softening corporate earnings

— Slowing job growth

— Elevated levels of household, corporate and government debt

— Election 2020

But there are plenty of reasons to remain optimistic. “For the most part, the economy has held up better than anticipated,” said Basu. “During the first quarter of 2019, gross domestic product expanded at a smart 3.1% annualized rate. The U.S. Bureau of Economic Analysis’ initial estimate suggests that the economy slowed to 2.1% growth during the second quarter, but that neatly beat economists’ expectation that that growth had fallen below 2%.”

“The economy could continue to prove resilient,” says Basu. “To date, the economy has navigated ongoing trade disputes and associated tariffs with aplomb. It has also withstood serial interest rate hikes, the longest federal government shutdown in history, extreme weather, shifting immigration policy, ongoing labor market shortages and a lengthy investigation regarding foreign influence in U.S. elections.”

To read the full economic outlook story, visit ConstructionExec.com.

Related Stories

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

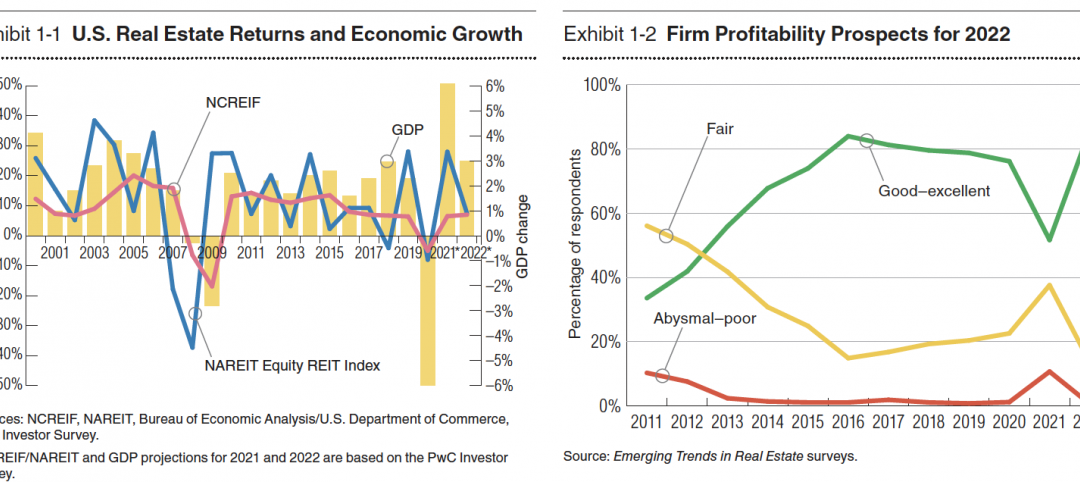

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

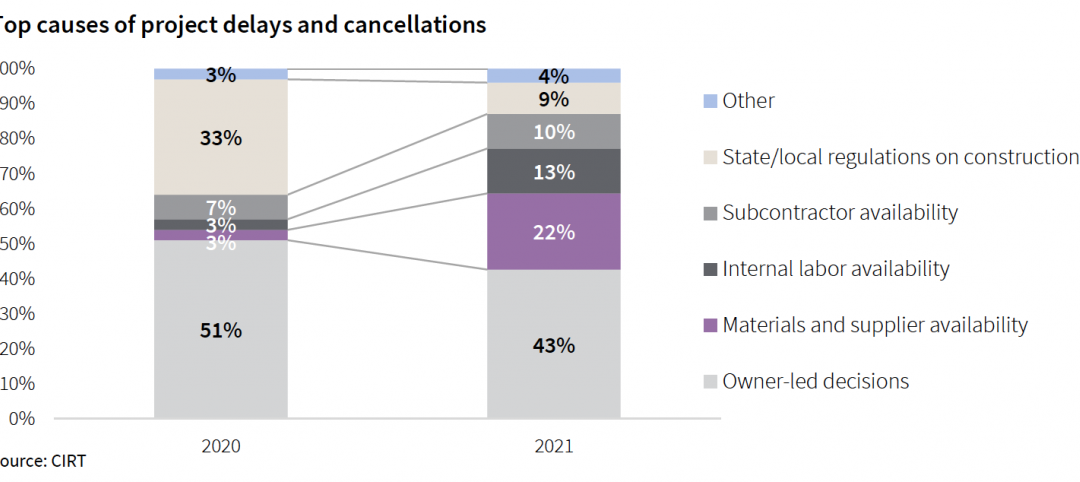

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

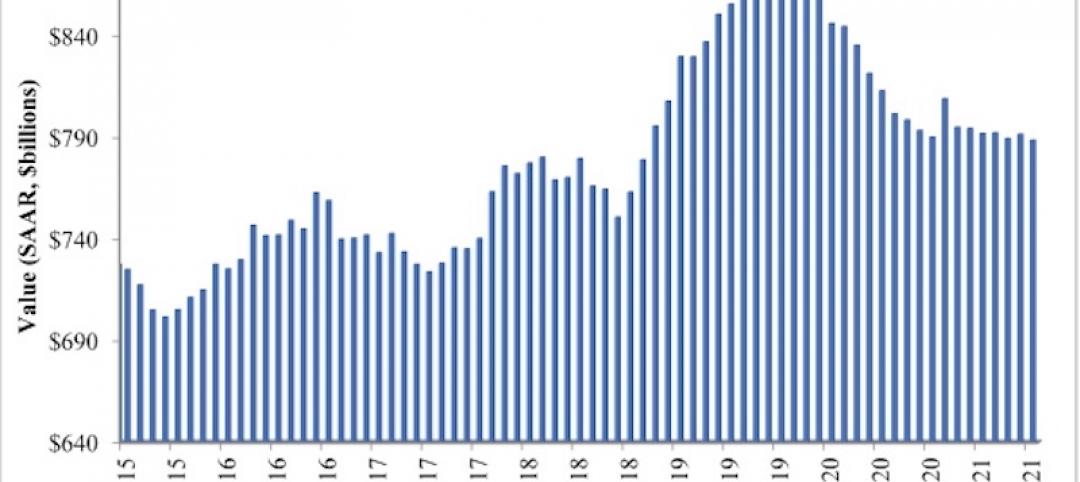

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.