Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering (AE) firms, roughly the same amount as during the first six months of 2013, and putting 2014 on pace for another strong year for domestic AE M&A activity. This positive momentum has continued into the second half of the year with AECOM’s recently announced agreement to acquire URS.

The deal is one of the most significant in the history of the AE space and creates a global firm with more than 95,000 employees. International deals, on the other hand, lagged through the first six months, with just 43 sales of internationally-based AE firms so far in 2014 compared to 54 during the first six months of 2013. Overall, activity remains strong and hot spots for dealmaking are tracking broader positive economic trends in the U.S. and abroad.

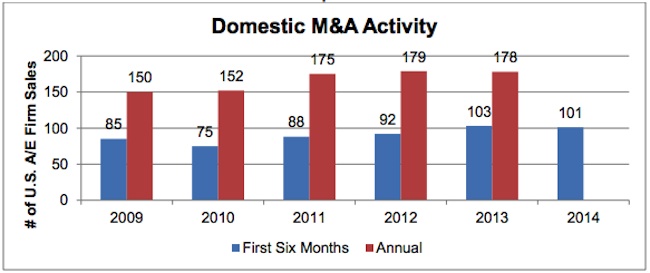

Domestic M&A Activity on Pace for Strong 2014

Domestic M&A activity through the first six months of 2014 was generally on pace with the first six months of 2013 (Graph 1, top). The pace of domestic AE industry consolidation, which accelerated coming out of the great recession in 2011 and carried forward into 2013, has remained relatively steady into 2014.

Industry firms appear to remain cautiously optimistic, with deal activity in 2014 on pace to rise to levels similar to 2012 and 2013 by year end. Firms continue to make bets on the positive economic climate in the U.S. The question will be whether this momentum continues into the back half of the year, as firms work to integrate recent acquisitions and continue to assess the U.S. market. With six months to go in the year, we anticipate domestic M&A activity to be in the 180 to 200 deal range.

Texas and California Lead States in M&A Activity

Regionally, Texas led all states in deal activity with 16 Texas-based AE firm sales through June 30, 2014 (Graph 2). Deals in the Lone Star State continue to be driven by a combination of strong economic growth and oil and gas activity. California, a perennial top state for industry dealmaking, followed with 12 firm sales. Colorado, which was among the top states for firm sales in 2013 with 11, saw seven firms based in the state sell so far in 2014. Notable among the top states was Washington, where we only observed one firm sale in all of 2013, and by comparison has produced 6 firm sales so far in 2014.

The U.K. and Canada Lead International Destinations

The United Kingdom and Canada were the top destinations for international firm sales through the first half of 2014 (Graph 3). Australia, New Zealand, and South Africa were also bright spots. With the Eurozone and BRIC countries continuing to face economic challenges, buyers looked to more stable markets for M&A opportunities.

The Megadeal is Back

On the heels of several large deals in the back half of 2013, megadeals continued into the first half of 2014. AE firms continued to seek transformational opportunities to differentiate their businesses. A few of the notable large deals so far in 2014 included:

-

AECOM’s agreement to acquire 50,000-person URS

-

AMEC’s agreement to acquire 14,000-person Foster Wheeler

-

3,000-person Conestoga-Rovers’ merger with 5,500-person GHD

-

Cardno’s acquisition of 760-person PPI Group

-

WSP Group’s acquisition of 1,700-person Focus Group

-

Parsons’ acquisition of 800-person Delcan

It remains to be seen how large scale consolidation will play out as the industry landscape continues to evolve.

Oil & Gas Driving Activity

Oil and gas has been a major driver of AE dealmaking, particularly in the U.S. Industry firms have sought to capitalize on a boom in domestic production and transportation of fossil fuels in places like Texas, Pennsylvania, Ohio, Colorado, and North Dakota. Just a few of the notable oil and gas related deals through June 30th included: Jacobs’ acquisition of Eagleton Engineering, Halff Associates’ acquisition of TriTex Technologies, Zachry’s acquisition of Commonwealth Engineering and Construction, NV5’s acquisition of AK Environmental, and GZA’s acquisition of Laurel Oil and Gas Corp.

One of the largest deals in the space was defense contractor Huntington Ingalls Industries’ acquisition of Universal Pegasus – a play to further diversify into the red hot oil and gas market.

Related Stories

| Sep 4, 2013

Last chance to pre-register for BUILDINGChicago/Greening the Heartland Conference at 20% savings

Attendees of the BUILDINGChicago/Greening the Heartland Expo and Conference can still save 20% off the at-site registration fee by registering online in these final days before the event opens on September 9 and concludes on September 11.

| Sep 3, 2013

'School in a box' project will place school in San Diego public library

Thinking outside the box, LPA Inc. is designing a school inside a box. With an emphasis on three E’s—Engage, Educate, and Empower—e3 Civic High is now being constructed on the sixth and seventh floors of a public library in downtown San Diego. Library patrons will be able to see into the school via glass elevators, but will not have physical access to the school.

| Sep 3, 2013

Delinquency rate for commercial real estate loans at lowest level in three years

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago.

| Sep 3, 2013

EDGE studio, GBBN announce merger

GBBN Architects and EDGE studio of Pittsburgh, Pennsylvania are very pleased to announce the merger of their firms under GBBN Architects effective September 1, 2013.

| Sep 3, 2013

Jon Pettit (1952-2013) - DLR Group Managing Principal

Jonathan (Jon) E. Pettit, AIA, died August 19, 2013 in Seattle following treatment for cancer. He was 61. Pettit was a DLR Group managing principal and practiced for his entire professional career with DLR Group.

| Aug 30, 2013

Modular classrooms gaining strength with school boards

With budget, space needs, and speed-to-market pressures bearing down on school districts, modular classroom assemblies are often a go-to solution.

| Aug 30, 2013

Local Government Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest local government design and construction firms, as reported in the 2013 Giants 300 Report.

| Aug 30, 2013

A new approach to post-occupancy evaluations

As a growing number of healthcare institutions become more customer-focused, post-occupancy evaluations (POE) are playing a bigger role in new construction and renovation projects. Advocate Health Care is among the healthcare organizations to institute a detailed post-occupancy assessment process for its projects.

| Aug 29, 2013

First look: K-State's Bill Snyder Family Stadium expansion

The West Side Stadium Expansion Project at Kansas State's Bill Snyder Family Stadium is the largest project in K-State Athletics history.

| Aug 27, 2013

Industrial Sector Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest industrial sector design and construction firms, as reported in the 2013 Giants 300 Report.