Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering (AE) firms, roughly the same amount as during the first six months of 2013, and putting 2014 on pace for another strong year for domestic AE M&A activity. This positive momentum has continued into the second half of the year with AECOM’s recently announced agreement to acquire URS.

The deal is one of the most significant in the history of the AE space and creates a global firm with more than 95,000 employees. International deals, on the other hand, lagged through the first six months, with just 43 sales of internationally-based AE firms so far in 2014 compared to 54 during the first six months of 2013. Overall, activity remains strong and hot spots for dealmaking are tracking broader positive economic trends in the U.S. and abroad.

Domestic M&A Activity on Pace for Strong 2014

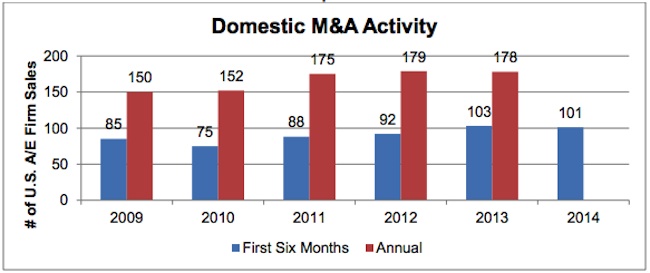

Domestic M&A activity through the first six months of 2014 was generally on pace with the first six months of 2013 (Graph 1, top). The pace of domestic AE industry consolidation, which accelerated coming out of the great recession in 2011 and carried forward into 2013, has remained relatively steady into 2014.

Industry firms appear to remain cautiously optimistic, with deal activity in 2014 on pace to rise to levels similar to 2012 and 2013 by year end. Firms continue to make bets on the positive economic climate in the U.S. The question will be whether this momentum continues into the back half of the year, as firms work to integrate recent acquisitions and continue to assess the U.S. market. With six months to go in the year, we anticipate domestic M&A activity to be in the 180 to 200 deal range.

Texas and California Lead States in M&A Activity

Regionally, Texas led all states in deal activity with 16 Texas-based AE firm sales through June 30, 2014 (Graph 2). Deals in the Lone Star State continue to be driven by a combination of strong economic growth and oil and gas activity. California, a perennial top state for industry dealmaking, followed with 12 firm sales. Colorado, which was among the top states for firm sales in 2013 with 11, saw seven firms based in the state sell so far in 2014. Notable among the top states was Washington, where we only observed one firm sale in all of 2013, and by comparison has produced 6 firm sales so far in 2014.

The U.K. and Canada Lead International Destinations

The United Kingdom and Canada were the top destinations for international firm sales through the first half of 2014 (Graph 3). Australia, New Zealand, and South Africa were also bright spots. With the Eurozone and BRIC countries continuing to face economic challenges, buyers looked to more stable markets for M&A opportunities.

The Megadeal is Back

On the heels of several large deals in the back half of 2013, megadeals continued into the first half of 2014. AE firms continued to seek transformational opportunities to differentiate their businesses. A few of the notable large deals so far in 2014 included:

-

AECOM’s agreement to acquire 50,000-person URS

-

AMEC’s agreement to acquire 14,000-person Foster Wheeler

-

3,000-person Conestoga-Rovers’ merger with 5,500-person GHD

-

Cardno’s acquisition of 760-person PPI Group

-

WSP Group’s acquisition of 1,700-person Focus Group

-

Parsons’ acquisition of 800-person Delcan

It remains to be seen how large scale consolidation will play out as the industry landscape continues to evolve.

Oil & Gas Driving Activity

Oil and gas has been a major driver of AE dealmaking, particularly in the U.S. Industry firms have sought to capitalize on a boom in domestic production and transportation of fossil fuels in places like Texas, Pennsylvania, Ohio, Colorado, and North Dakota. Just a few of the notable oil and gas related deals through June 30th included: Jacobs’ acquisition of Eagleton Engineering, Halff Associates’ acquisition of TriTex Technologies, Zachry’s acquisition of Commonwealth Engineering and Construction, NV5’s acquisition of AK Environmental, and GZA’s acquisition of Laurel Oil and Gas Corp.

One of the largest deals in the space was defense contractor Huntington Ingalls Industries’ acquisition of Universal Pegasus – a play to further diversify into the red hot oil and gas market.

Related Stories

| Oct 7, 2013

10 award-winning metal building projects

The FDNY Fireboat Firehouse in New York and the Cirrus Logic Building in Austin, Texas, are among nine projects named winners of the 2013 Chairman’s Award by the Metal Construction Association for outstanding design and construction.

| Oct 7, 2013

Progressive steel joist and metal decking design [AIA course]

This three-part course takes a building owner’s perspective on the range of cost and performance improvements that are possible when using a more design-analytical and collaborative approach to steel joist and metal decking construction.

Sponsored | | Oct 7, 2013

Bridging the digital divide between the BIM haves and have nots

There's no doubt that BIM is the future of design. But for many firms, finding a bridge to access rich model data and share it with those typically left on the sidelines can be the difference between winning a bid or not.

| Oct 7, 2013

How to streamline your operations

The average U.S. office worker generates two pounds of paper each day, according to the EPA. Ninety percent of that trash is made up of printed materials: marketing reports, project drafts, copy machine mistakes, and unwanted mail. Here are a few ways AEC firms can streamline their management processes.

| Oct 7, 2013

Reimagining the metal shipping container

With origins tracing back to the mid-1950s, the modern metal shipping container continues to serve as a secure, practical vessel for transporting valuable materials. However, these reusable steel boxes have recently garnered considerable attention from architects and constructors as attractive building materials.

| Oct 4, 2013

Sydney to get world's tallest 'living' façade

The One Central Park Tower development consists of two, 380-foot-tall towers covered in a series of living walls and vertical gardens that will extend the full height of the buildings.

| Oct 4, 2013

Nifty video shows planned development of La Sagrada Familia basilica

After 144 years, construction on Gaudi's iconic Barcelona edifice is picking up speed, with a projected end date of 2026.

| Oct 4, 2013

Mack Urban, AECOM acquire six acres for development in LA's South Park district

Mack Urban and AECOM Capital, the investment fund of AECOM Technology Corporation (NYSE: ACM), have acquired six acres of land in downtown Los Angeles’ South Park district located in the central business district (CBD).

| Oct 4, 2013

CRB opens Atlanta office

Georgia’s status as a burgeoning hub for the life sciences industry has fueled CRB’s decision to open an office in Atlanta to better serve its clients in the market. CRB is a leading provider of engineering, design and construction services for customers in the biotech, pharmaceutical and life sciences industries.

| Sep 27, 2013

NYC releases first year-to-year energy performance data on commercial properties

A new report provides information on energy performance of New York City's largest buildings (mostly commercial, multi-family residential). It provides an analysis of 2011 data from city-required energy “benchmarking”—or the tracking and comparison of energy performance—in more than 24,000 buildings that are over 50,000 square feet.