Real gross domestic product (GDP) expanded 2.6% (seasonally adjusted annual rate) during the fourth quarter of 2014, following a 5% increase in the third quarter, according to the Bureau of Economic Analysis Jan. 30 release. Nonresidential fixed investment grew by only 1.9% after expanding 8.9% in the third quarter. Investment in equipment declined 1.9%, while investment in nonresidential structures increased 2.6%.

"Today's headline GDP number will be broadly viewed as disappointing as many economists had expected to see a quarterly number in excess of 3%," said Associated Builders and Contractors Chief Economist Anirban Basu. "However, it is important to note that the federal spending category subtracted more than half a percentage point, which means the non-federal portion of the economy expanded faster than 3%.

"In addition to the impact of federal spending which shrank farther than expected, it is also worth noting that spending on nonresidential structures continues to climb," said Basu. "With the economic recovery persisting and with job growth accelerating, business confidence has generally been on the rise, translating into shrinking office and retail vacancy rates and rising hotel occupancy rates. All of this creates a context in which nonresidential construction spending, particularly private construction spending, is likely to expand, which is consistent with ABC's view that the nonresidential construction recovery will continue.

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

"Though today's release indicates that the economy enters 2015 with somewhat less momentum than had been thought, the fact of the matter is that the past nine months represents the strongest period of growth in the current recovery cycle," said Basu. "Undoubtedly, financial markets will continue to be roiled by ongoing fluctuations in input prices and uncertainties regarding the strengthening of the U.S. dollar. But with gas prices low and with job creation now brisk, consumers are likely to continue to push the U.S. economy forward in 2015."

The following segments expanded during the fourth quarter and/or contributed to GDP.

- Personal consumption expenditures added 2.9% to GDP after contributing 2.2% in the third quarter.

- Spending on goods grew 5.4% after increasing by 4.7% in the previous quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 1.8% for the quarter after a 5% increase in the third quarter.

- Nondefense spending expanded 1.7% after increasing by 0.4% in the previous quarter.

- State and local government spending expanded 1.3% during the fourth quarter after growing 1.1% in the third quarter.

- A number of key segments did not experience growth for the quarter.

- Federal government spending contracted by 7.5% in the fourth quarter following a -9.9% increase in the prior quarter.

- National defense spending declined by 12.5% after expanding by a full 16% in the third quarter.

To view the previous GDP report, click here.

Related Stories

| Sep 21, 2010

New BOMA-Kingsley Report Shows Compression in Utilities and Total Operating Expenses

A new report from the Building Owners and Managers Association (BOMA) International and Kingsley Associates shows that property professionals are trimming building operating expenses to stay competitive in today’s challenging marketplace. The report, which analyzes data from BOMA International’s 2010 Experience Exchange Report® (EER), revealed a $0.09 (1.1 percent) decrease in total operating expenses for U.S. private-sector buildings during 2009.

| Sep 21, 2010

Forecast: Existing buildings to earn 50% of green building certifications

A new report from Pike Research forecasts that by 2020, nearly half the green building certifications will be for existing buildings—accounting for 25 billion sf. The study, “Green Building Certification Programs,” analyzed current market and regulatory conditions related to green building certification programs, and found that green building remain robust during the recession and that certifications for existing buildings are an increasing area of focus.

| Sep 21, 2010

Middough Inc. Celebrates its 60th Anniversary

Middough Inc., a top ranking U.S. architectural, engineering and management services company, announces the celebration of its 60th anniversary, says President and CEO, Ronald R. Ledin, PE.

| Sep 16, 2010

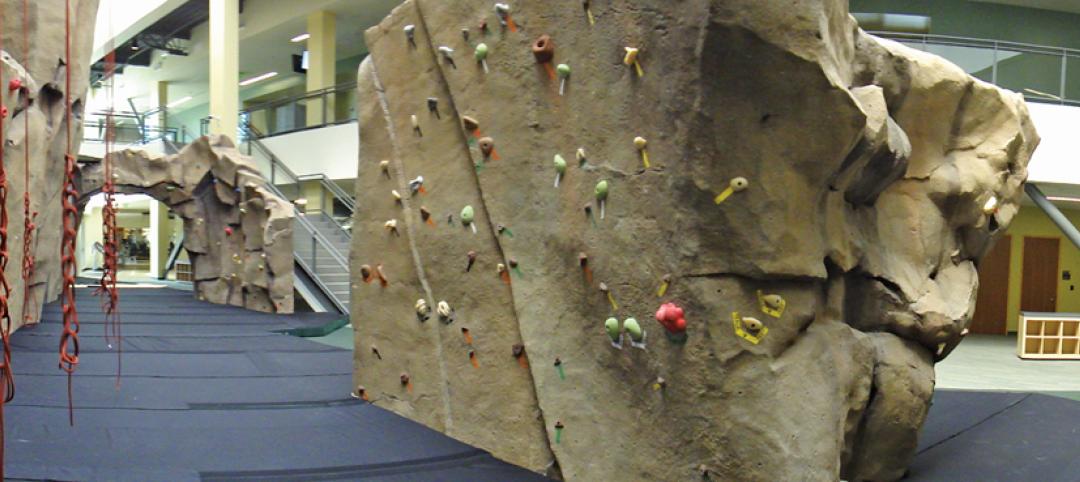

Green recreation/wellness center targets physical, environmental health

The 151,000-sf recreation and wellness center at California State University’s Sacramento campus, called the WELL (for “wellness, education, leisure, lifestyle”), has a fitness center, café, indoor track, gymnasium, racquetball courts, educational and counseling space, the largest rock climbing wall in the CSU system.

| Sep 13, 2010

Community college police, parking structure targets LEED Platinum

The San Diego Community College District's $1.555 billion construction program continues with groundbreaking for a 6,000-sf police substation and an 828-space, four-story parking structure at San Diego Miramar College.

| Sep 13, 2010

Campus housing fosters community connection

A 600,000-sf complex on the University of Washington's Seattle campus will include four residence halls for 1,650 students and a 100-seat cafe, 8,000-sf grocery store, and conference center with 200-seat auditorium for both student and community use.