Industrial development continues to be a growth sector for many metros, especially in the western U.S. But aggressive building may be finally catching up with that sector’s demand, at least temporarily.

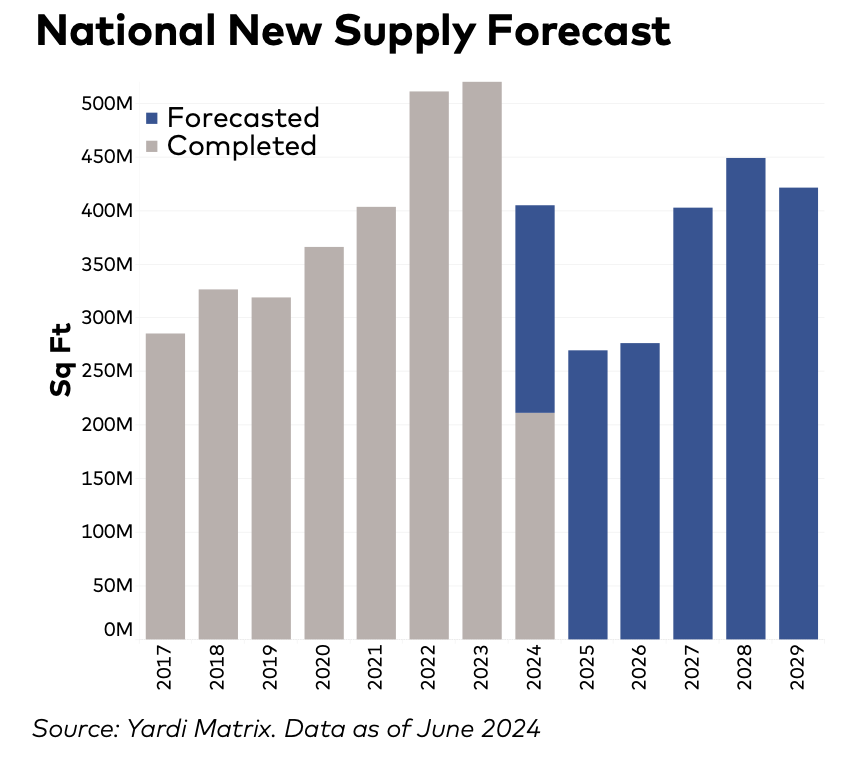

After two years of record-smashing deliveries, the industrial pipeline has slowed in a number of markets. In its latest National Industrial Report, CommercialEdge estimates that 97.8 million sf of industrial space were started in the first half of 2024, a 33% decline from the same period a year earlier. By comparison, 1.1 billion sf were started between 2021 and 2022, with 313 million sf started in the first half of 2022 alone. The latest slowdown in starts has been occurring for the past six quarters, says CommercialEdge, which attributes the erosion to “normalized” tenant demand, oversupply, rising construction costs, and “economic uncertainty.”

Nationwide, 375.7 million sf of industrial space were in various stages of construction through the first half of 2024, representing 1.9% of total stock. In the latest six-month period, 209 million sf of new space were delivered, compared to 160 million sf in the first half of 2022. “This growth underscores the market’s capacity to bring projects to completion despite the decline in construction starts,” CommercialEdge states.

This sector has gotten a big bump from manufacturing, which accounted for 16.1% of annualized industrial construction starts through June, compared to an estimated 7.5% in 2018 through 2021, and more than 13% in 2022 and 2023. As more manufacturing returns to the U.S., demand for industrial space is expected to benefit.

Indeed, CommercialEdge forecasts that the new development pipeline will grow in the next few years, but at a slower clip. It points out that developers have disclosed plans for 561.2 million sf of new space. “Once the market absorbs the recently completed stock, and the cost of capital begins to decrease, we expect many of these projects to see shovels in the ground,” predicts CommercialEdge.

Vacancy rates and rents for industrial space rising

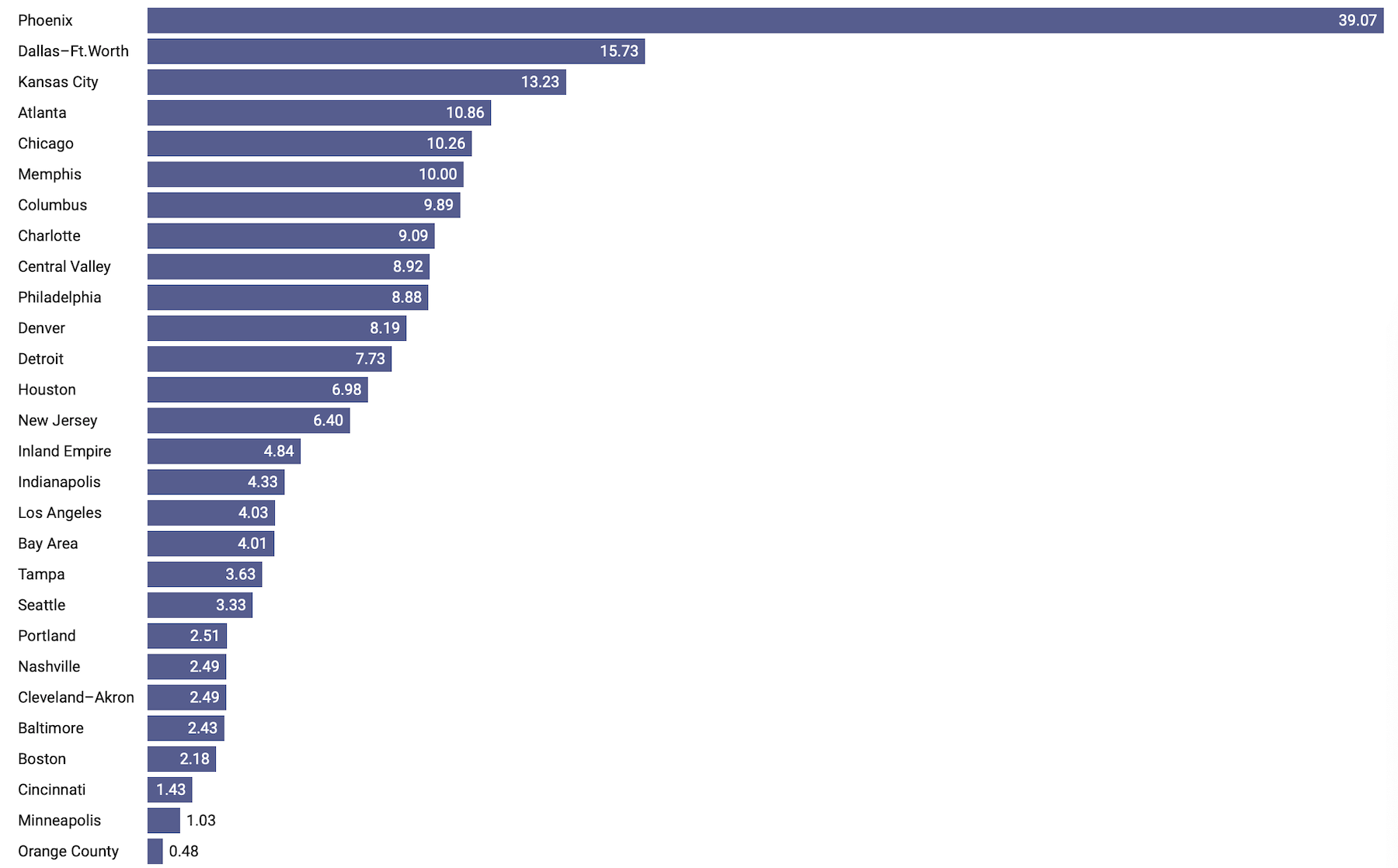

Phoenix leads the country by far in industrial space under construction, with 39.07 million sf under construction. The next-closest metro was Dallas-Fort Worth, at 15.23 million sf. DFW’s vacancy rate sat at a relatively manageable 6.5%, but it appears this market is “hitting the brakes” on new development after delivering 126.4 million sf of industrial space since the start of 2022.

Nationally, the vacancy rate for industrial space stood at 6.1%, up slightly. The national average rent in June was $8.04 per sf, although the average for contracts signed over the previous 12 months was $10.56. The San Francisco Bay Area recorded the highest average rent, at $13.34, and $16.24 per sf for newer contracts. Miami experienced the largest premium for new leases that, at $17.35, cost tenants $5.85 more than the national average.

California’s Inland Empire led the nation in rent growth, with in-place rents rising 12.5% year-over-year. Conversely, the Midwest saw the slowest rent growth: In Kansas City, for example, in-place rents increased only 2.5%; in St. Louis, 3.4%.

Bay Area leads industrial sales

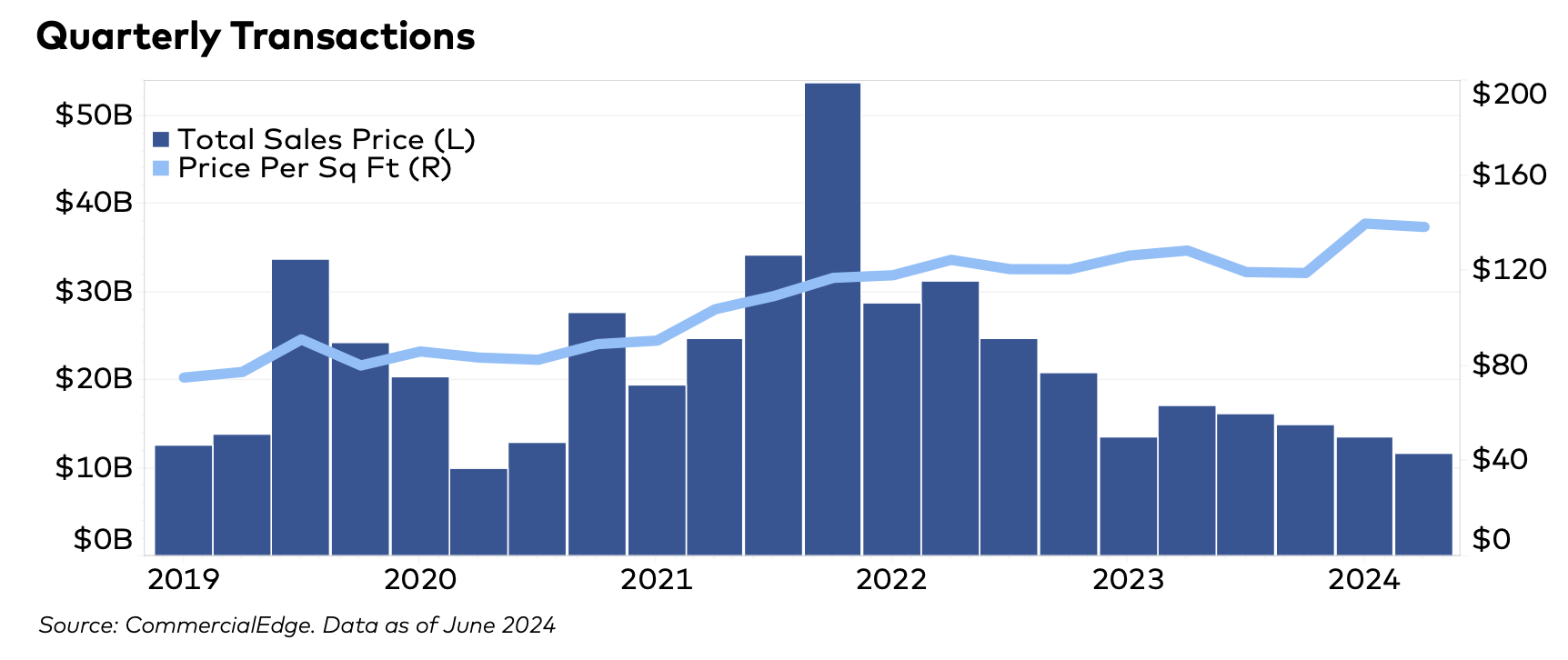

The sale of industrial buildings totaled $25.1 billion through the first half of 2024, and demand remains strong, with the average sale price of $139 per sf rising 12.9% over the same period in 2023, according to CommercialEdge estimates.

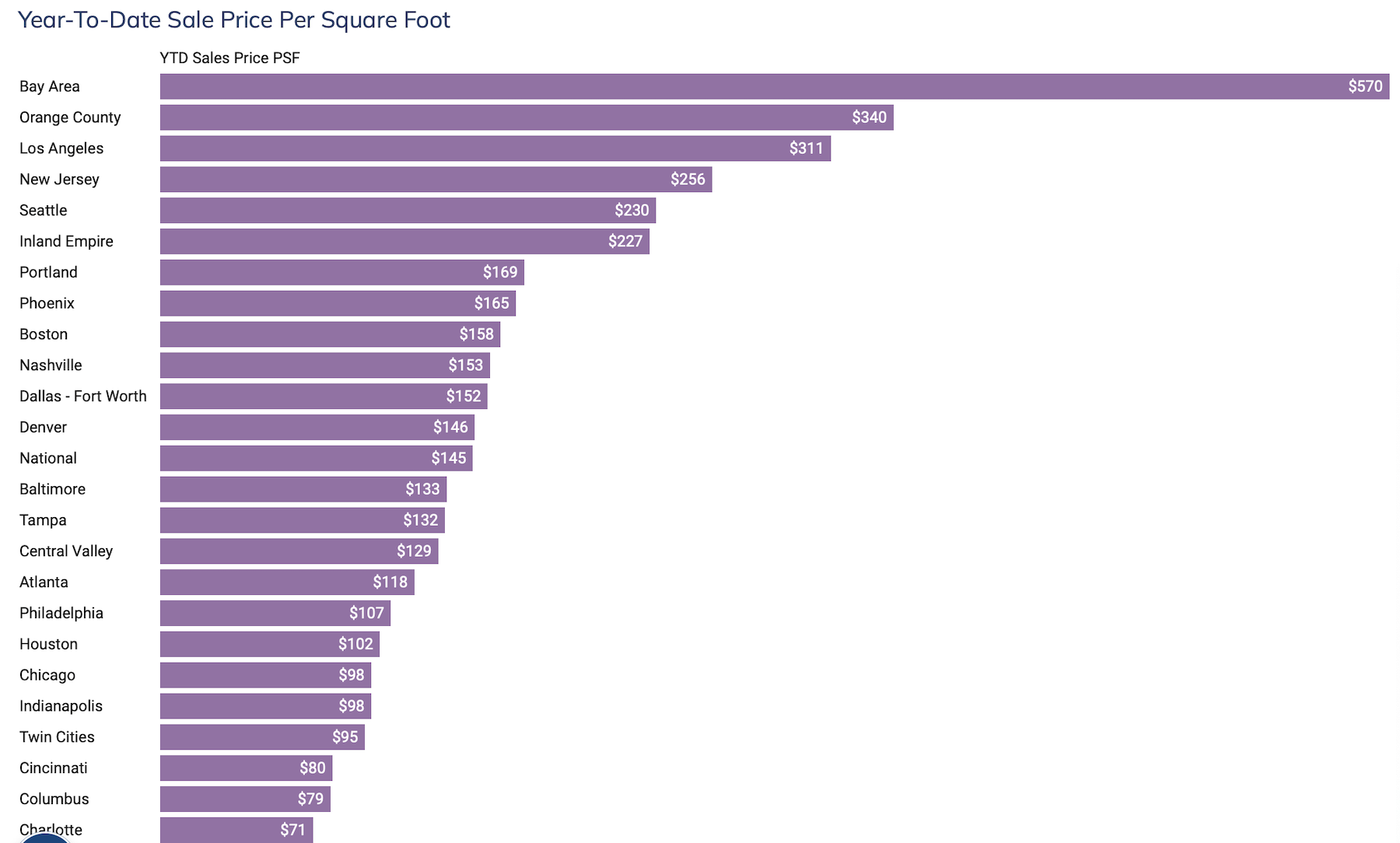

Again, the Bay Area led all markets in year-to-date industrial sales, at $2.285 billion. San Francisco was followed by Dallas-Fort Worth ($2.006 billion), Los Angeles ($1.581 billion, and Chicago ($1.314 billion).

Southern California remains the most sought-after location for distribution center and warehouse sales and development. CommercialEdge notes that earlier this year Rexford Industrial Realty paid $1 billion for 3 million sf across 48 properties in L.A. and Orange counties.

The Bay Area led the nation in average sales price per sf, at $570. This market has seen a spike in demand for advanced manufacturing space. Over 4 million sf of industrial space are under construction in the Bay Area.

In the South, the surge in Texas’s population—it’s the fastest-growing state in the U.S.—drove demand for industrial space, with DFW serving as a hub from products arriving from Mexico, which recently surpassed Canada as America’s largest trading partner, according to the Census Bureau. That positioning is why CommercialEdge expects Dallas-Fort Worth’s industrial development and construction to eventually pick up steam again.

Other markets worth keeping an eye on include Charlotte and Nashville, with their low vacancy rates and tight supply.

On the other hand, Boston—one of the country’s most expensive markets—reported the highest industrial vacancy rate, at 8.8%. New Jersey, another pricy rent market, nevertheless remained a regional leader in industrial sales, with over $1 billion in transactions closing through June.

Related Stories

Codes and Standards | Mar 2, 2015

Proposed energy standard for data centers, telecom buildings open for public comment

The intent of ASHRAE Standard 90.4P is to create a performance-based approach that would be more flexible and accommodating of innovative change.

Industrial Facilities | Feb 27, 2015

Massive windmill will double as mixed-use entertainment tower in Rotterdam

The 571-foot structure will house apartments, a hotel, restaurants, even a roller coaster.

Cultural Facilities | Feb 25, 2015

Bjarke Ingels designs geodesic dome for energy production, community use

A new building in Uppsala, Sweden, will serve as a power plant during the winter and a venue for shows, festivals, and music events during the warm months.

Industrial Facilities | Feb 24, 2015

Starchitecture meets agriculture: OMA unveils design for Kentucky community farming facility

The $460 million Food Port project will define a new model for the relationship between consumer and producer.

Codes and Standards | Feb 12, 2015

New Appraisal Institute form aids in analysis of green commercial building features

The Institute’s Commercial Green and Energy Efficient Addendum offers a communication tool that lenders can use as part of the scope of work.

Contractors | Feb 6, 2015

Census Bureau: Capital spending by U.S. businesses increased 4.5%

Of the 19 industry sectors covered in the report, only one had a statistically significant year-to-year decrease in capital spending: the utilities sector.

Public Health Labs | Jan 29, 2015

Breaking out of the box: Pirbright Institute’s radical approach to biocontainment facility design

The novel scheme turns the typical containment lab building inside out, placing the high-containment spaces at the perimeter to provide researchers with daylight and views.

| Jan 21, 2015

Tesla Motors starts construction on $5 billion battery plant in Nevada

Tesla Motors’ “gigafactory,” a $5 billion project on 980 acres in Sparks, Nev., could annually produce enough power for 500,000 electric cars.

| Jan 2, 2015

Construction put in place enjoyed healthy gains in 2014

Construction consultant FMI foresees—with some caveats—continuing growth in the office, lodging, and manufacturing sectors. But funding uncertainties raise red flags in education and healthcare.

| Dec 29, 2014

'Russian nesting doll' design provides unique fire protection solution for movie negatives

A major movie studio needed a new vault to protect its irreplaceable negatives for films released after 1982. SmithGroupJJR came up with a box-in-a-box design solution. It was named a Great Solution by the editors of Building Design+Construction.