The war in Ukraine, global port congestion, and the persistent spread of COVID variants will conspire to raise prices on equipment and key building products by 7-9 percent this year, according to the general contractor Consigli’s latest market update, which it released a few days ago.

Authors Peter Capone and Jared Lachapelle, Consigli’s director of construction and vice president of preconstruction, respectively, wrote that while the nonresidential construction industry continues to be resilient, it can’t completely alleviate forces that are reducing or delaying the supply of raw materials and finished goods.

Russia’s invasion of Ukraine has reduced the supply of manufacturing materials such as aluminum and copper, and is putting a strain on production and delivery across Europe. Meanwhile shipping congestion “is showing little sign of improvement” worldwide, especially at ports in Asia.

Other factors contributing to rising construction prices include spikes in fuel costs, and wage increases that are jacking up labor costs. “Acquiring workforce, [in] the Northeast in particular, remains an area of concern,” the authors state. Union and non-union subcontractors “are booking up to capacity for 2022,” and are already focused on next year and beyond.

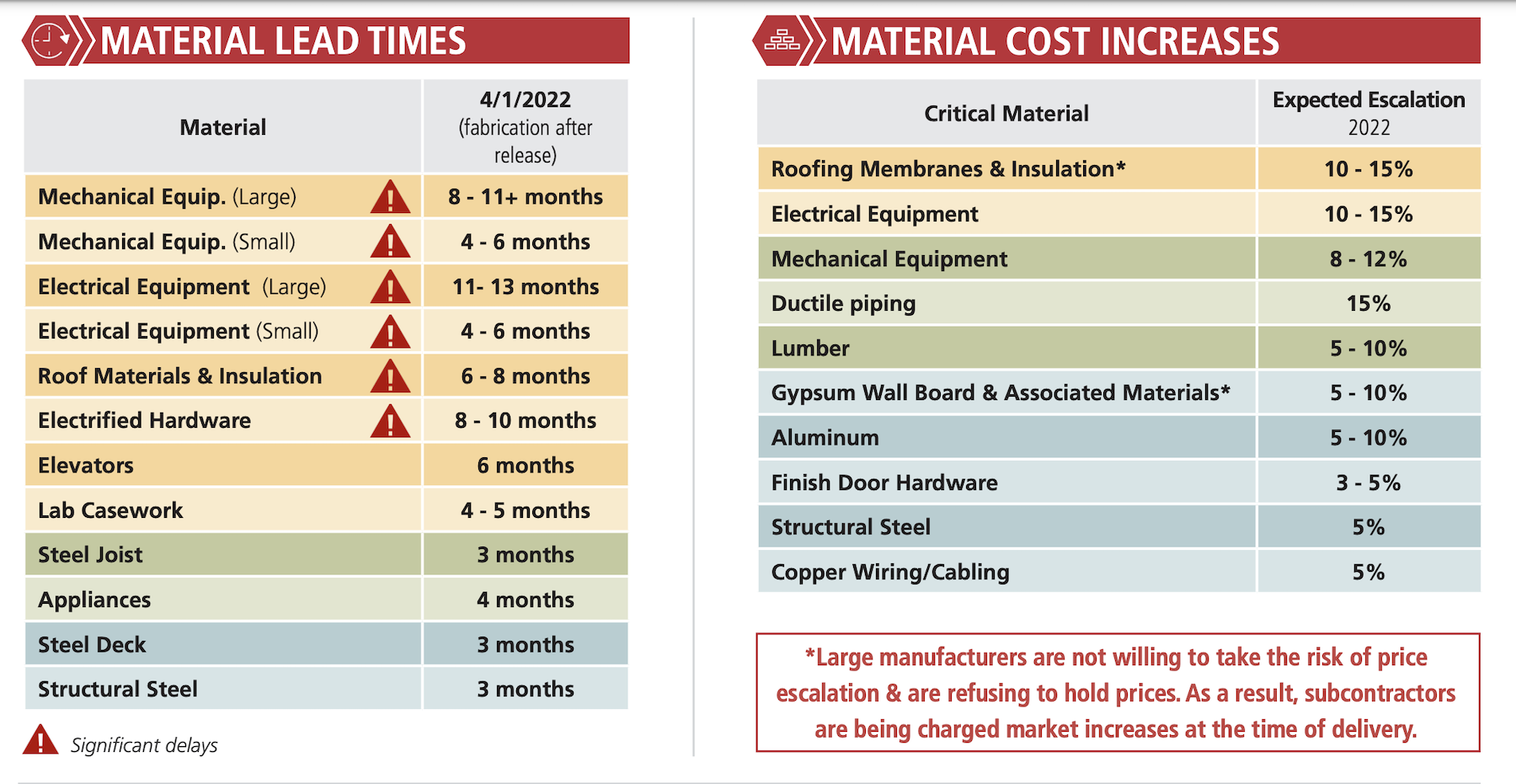

Electrical equipment and hardware, and roofing materials, are stalled in long lead times. As a result, price inflation for these products is expected to be double digit this year.

Consigli is also keeping an eye on a few things that could affect prices, such as contract negotiations with the International Longshoreman Warehouse Union that are scheduled for this July and will impact 22,000 workers at 79 ports.

The federal infrastructure bill, as it rolls out, will place more stress on an already tight labor market. Consigli notes that half of its larger subcontractors have secured 85 percent of their backlog for this year, and are “quickly filling” their projected backlog for 2023.

Related Stories

Market Data | May 29, 2020

House-passed bill making needed improvements to paycheck protection program will allow construction firms to save more jobs

Construction official urges senate and White House to quickly pass and sign into law the Paycheck Protection Program Flexibility Act.

Market Data | May 29, 2020

7 must reads for the AEC industry today: May 29, 2020

Using lighting IoT data to inform a safer office reentry strategy and Ghafari joins forces with Eview 360.

Market Data | May 27, 2020

5 must reads for the AEC industry today: May 28, 2020

Biophilic design on the High Line and the office market could be a COVID-19 casualty.

Market Data | May 27, 2020

6 must reads for the AEC industry today: May 27, 2020

AIA's COTE Top Ten Awards and OSHA now requires employers to track COVID-19 cases.

Market Data | May 26, 2020

6 must reads for the AEC industry today: May 26, 2020

Apple's new Austin hotel and is CLT really a green solution?

Market Data | May 21, 2020

7 must reads for the AEC industry today: May 21, 2020

'Creepy' tech invades post-pandemic offices, and meet the new darling of commercial real estate.

Market Data | May 20, 2020

6 must reads for the AEC industry today: May 20, 2020

A wave 'inside' a South Korean building and architecture billings continues historic contraction.

Market Data | May 20, 2020

Architecture billings continue historic contraction

AIA’s Architecture Billings Index (ABI) score of 29.5 for April reflects a decrease in design services provided by U.S. architecture firms.

Market Data | May 19, 2020

5 must reads for the AEC industry today: May 19, 2020

Clemson's new mass timber building and empty hotels as an answer for the affordable housing shortage.

Market Data | May 18, 2020

5 must reads for the AEC industry today: May 18, 2020

California's grid can support all-electric buildings and you'll miss your office when it's gone.