Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

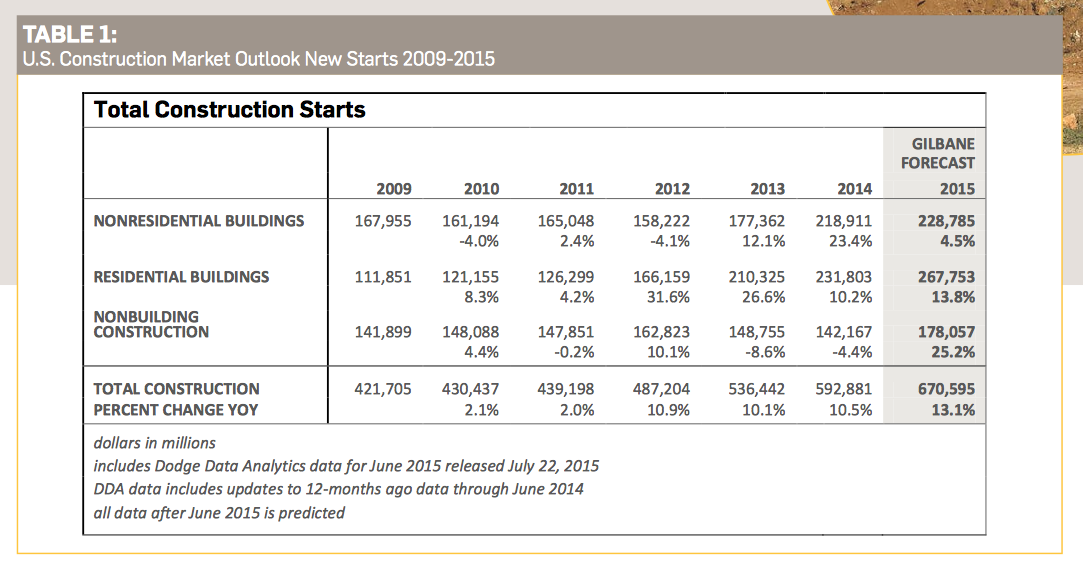

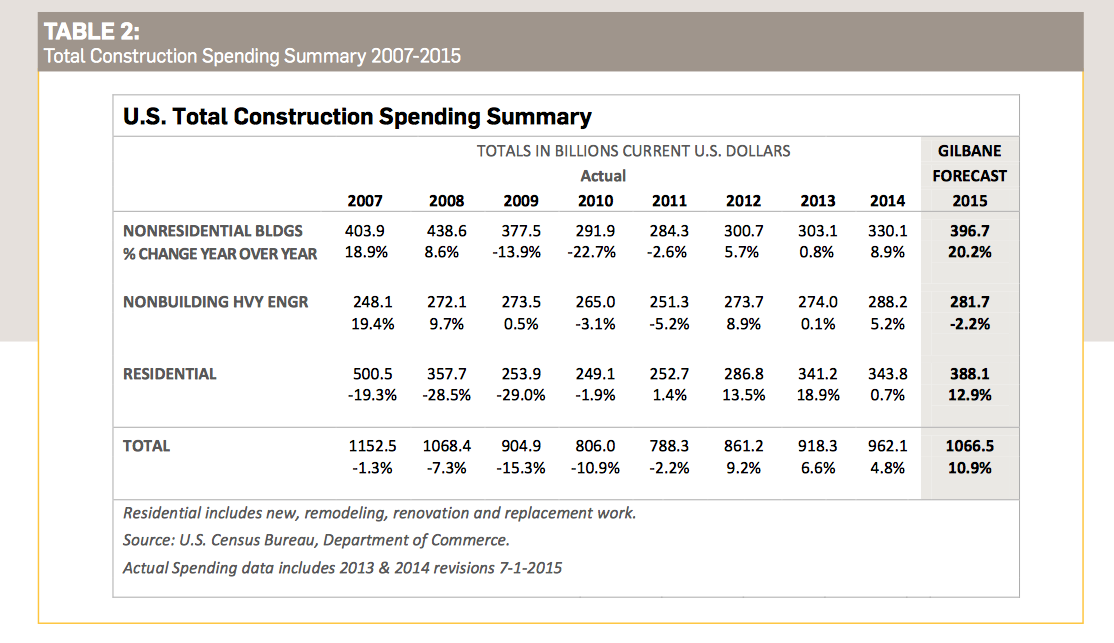

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

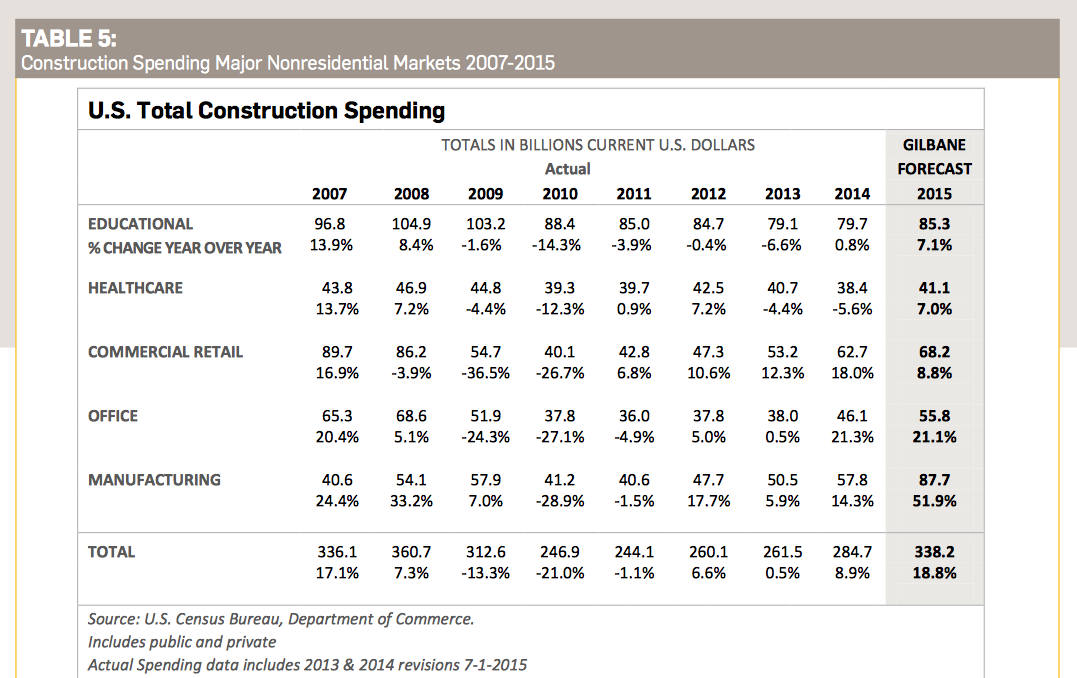

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

| Sep 3, 2014

Ranked: Top local government sector AEC firms [2014 Giants 300 Report]

STV, HOK, and Turner top BD+C's rankings of the nation's largest local government design and construction firms, as reported in the 2014 Giants 300 Report.

| Sep 3, 2014

WSP to acquire Parsons Brinckerhoff in $1.35 billion deal

The deal, which has been approved by the boards of WSP and Balfour Beatty, has an enterprise value of $1.243 billion, plus another $110 million in cash retained by PB.

| Sep 3, 2014

New designation launched to streamline LEED review process

The LEED Proven Provider designation is designed to minimize the need for additional work during the project review process.

| Sep 2, 2014

Melbourne's tallest residential tower will have 'optically transformative façade'

Plans for Melbourne's tallest residential tower have been released by Elenberg Fraser Architects. Using an optically transformative façade and botanical aesthetic, the project seeks to change the landscape of Australia's Victoria state.

| Sep 1, 2014

Ranked: Top federal government sector AEC firms [2014 Giants 300 Report]

Clark Group, Fluor, and HOK top BD+C's rankings of the nation's largest federal government design and construction firms, as reported in the 2014 Giants 300 Report.

| Aug 28, 2014

Arthur Platt and Julie Engh to lead AIANY architectural boat tour at BD+C Under40 Leadership Summit

The tour, which will circumnavigate Manhattan, will provide U40 Summit attendees with information about the history and architectural details of numerous buildings visible from the 1920s-era yacht.

| Aug 27, 2014

Turkish government orders demolition of residential towers in Istanbul

Citing negative effects to a world heritage site, the Turkish central government has ruled that the recently completed OnaltiDokuz Residence towers must be demolished.

| Aug 26, 2014

Ranked: Top industrial sector AEC firms [2014 Giants 300 Report]

Stantec, Jacobs, and Turner top BD+C's rankings of the nation's largest industrial sector design and construction firms, as reported in the 2014 Giants 300 Report.

| Aug 26, 2014

High-rise concept uses 'sky street' to link towers [slideshow]

The design for a new complex in Shenzhen’s bay area consists of highly reflective glass towers, expansive garden space, and a horizontal glass structure that connects the buildings.

| Aug 25, 2014

Ranked: Top cultural facility sector AEC firms [2014 Giants 300 Report]

Arup, Gensler, and Turner head BD+C's rankings of design and construction firms with the most revenue from cultural facility projects, as reported in the 2014 Giants 300 Report.