The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

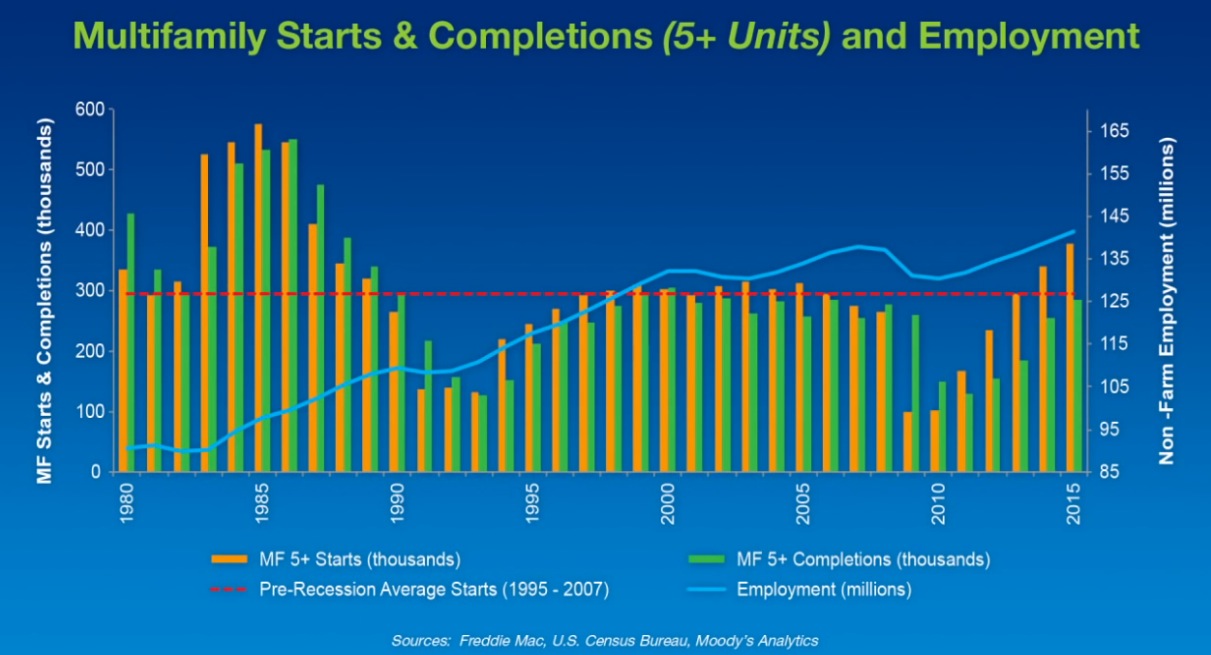

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Multifamily Housing | Apr 10, 2018

Studio Gang’s 11 Hoyt brings over 480 apartments and 50,000-sf of amenity space to NYC

The tower is Tishman Speyer’s first ground up condominium project in New York City.

Multifamily Housing | Mar 28, 2018

The latest data in the multifamily ‘amenities war’

Download Multifamily Design+Construction’s free 16-page report on the amenities multifamily architects, builders, and developers are providing their tenants and code buyers.

Multifamily Housing | Mar 21, 2018

Apartments outperform office, retail, industrial properties: NMHC research

Apartments offer strong returns and relatively low risk, according to new research from the National Multifamily Housing Council Research Foundation.

Multifamily Housing | Mar 14, 2018

How to solve the housing crunch on college campuses

A growing number of public and private academic institutions are turning to designers and architects for alternative housing strategies—particularly in high-density areas on the East and West Coasts.

Hotel Facilities | Mar 6, 2018

A New Hampshire college offers student housing as hotel rooms during the summer

The opening of a new residence hall could help with Plymouth State University’s hospitality marketing.

Multifamily Housing | Mar 4, 2018

Katerra, a tech-driven GC, plots ambitious expansion

Investors flock to this vertically integrated startup, which automates its design and construction processes.

Multifamily Housing | Feb 28, 2018

Transwestern data points to demand for larger rental units among baby boomers

As baby boomers seek to downsize from large homes, developers are increasingly designing apartments specifically for this demographic.

Multifamily Housing | Feb 27, 2018

Victorian era gasholders become modern residences in London

The new residences are part of the King’s Cross redevelopment scheme.

Multifamily Housing | Feb 22, 2018

Multifamily building with 25,000 sf of amenities rises on the shore of the Potomac River

The building is part of the National Gateway mixed-use development at Potomac yard.

Multifamily Housing | Feb 15, 2018

United States ranks fourth for renter growth

Renters are on the rise in 21 of the 30 countries examined in RentCafé’s recent study.