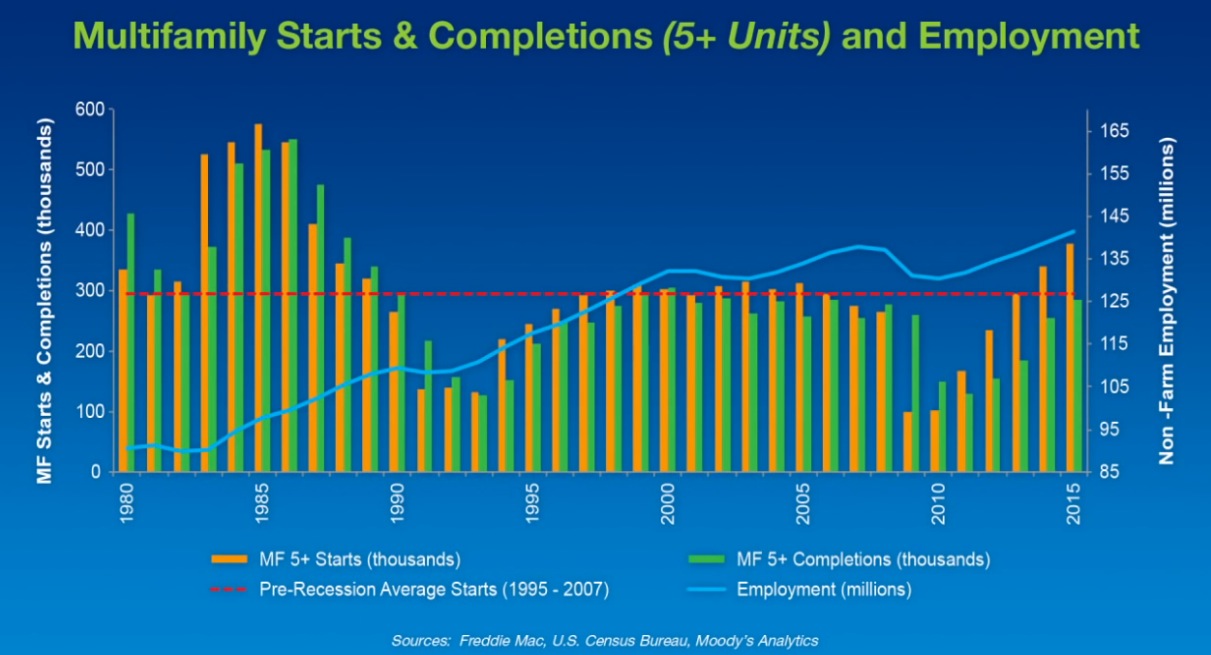

The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

| May 30, 2018

Accelerate Live! talk: From micro schools to tiny houses: What’s driving the downsizing economy?

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), micro-buildings design expert Aeron Hodges, AIA, explores the key drivers of the micro-buildings movement, and how the trend is spreading into a wide variety of building typologies.

Codes and Standards | May 30, 2018

Silicon Valley cities considering taxes aimed at large employers

The aim is to offset the impact on housing costs and homelessness by tech companies.

Multifamily Housing | May 30, 2018

Concentrated redevelopment: Apartment complex takes mixed use to the next level

An “intergenerational” mixed-use apartment complex may be a prototype for reenergizing neglected neighborhoods in America’s largest county.

| May 24, 2018

Accelerate Live! talk: Security and the built environment: Insights from an embassy designer

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), embassy designer Tom Jacobs explores ways that provide the needed protection while keeping intact the representational and inspirational qualities of a design.

BD+C University Course | May 24, 2018

Building passively [AIA course]

17 tips from our experts on the best way to carry out passive house design and construction for your next multifamily project. This AIA CES course is worth 1.0 AIA LU/HSW.

Multifamily Housing | May 23, 2018

Yankee Dandies: Century-old New England mills become multifamily residences

Having long outlived their original uses, two century-old New England mills have become valuable community assets once again—as multifamily residences.

Multifamily Housing | May 16, 2018

Pampering the pups: Why dog-washing stations are a must-have in multifamily developments

Self-serve dog-washing stations are reinforcing strong bonds between multifamily residents and their beloved canines.

Mixed-Use | May 16, 2018

Los Angeles mixed-use building uses prefabricated wood frame to reduce costs

SPF:architects designed the building.

Multifamily Housing | May 14, 2018

Yardi Matrix report shows U.S. rent surge in April

Year-over-year rent growth leaders in April were Orlando, Fla., Sacramento, Calif., Las Vegas, Tampa, Fla., and Phoenix.

Multifamily Housing | May 9, 2018

6 noteworthy projects: Transit-oriented rental community, micro-unit residences, and an office tower becomes a mixed-use community

These six recently completed projects represent some of the newest trends in multifamily housing.