The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

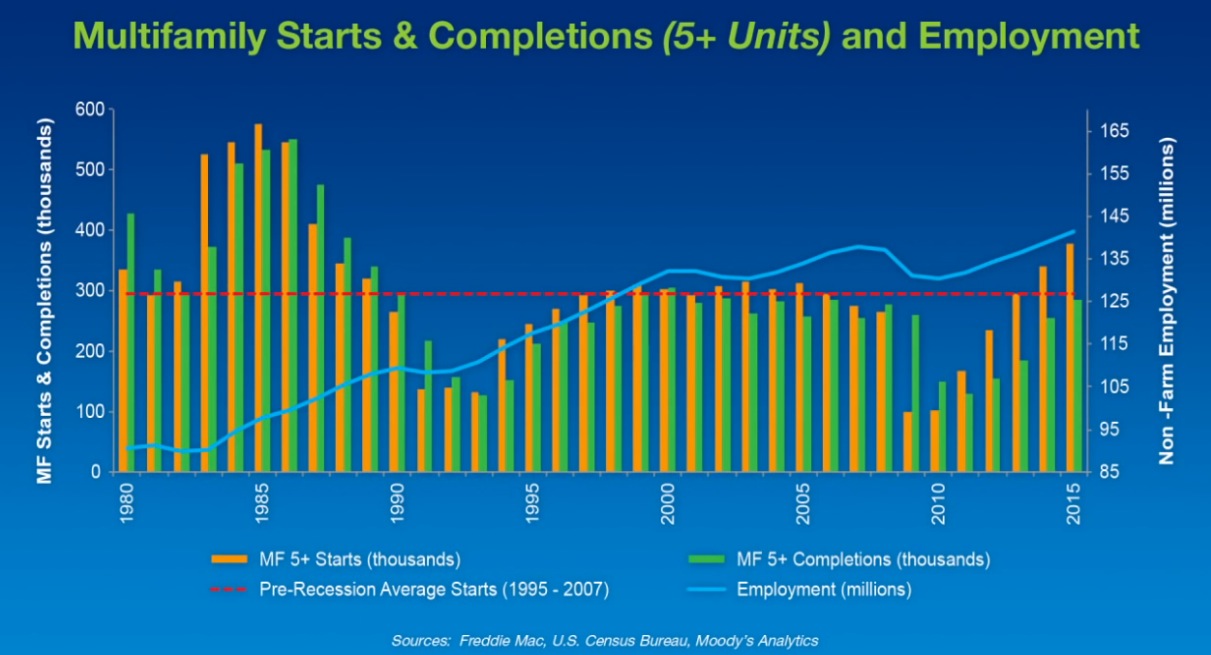

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Multifamily Housing | May 29, 2020

New multifamily project includes energy storage as an amenity

Each battery is linked to an on-site solar panel array.

Coronavirus | May 26, 2020

Multifamily developers report mounting delays in permitting and starts due to coronavirus pandemic

More than half (53%) of multifamily developer respondents reported construction delays in the jurisdictions where they operate, according to the third edition of the National Multifamily Housing Council (NMHC) COVID-19 Construction Survey.

Multifamily Housing | May 8, 2020

Nashville's newest residential tower will rise 416 feet

Goettsch Partners is designing the project.

Multifamily Housing | May 8, 2020

'Lakehouse' is the first multifamily project in Colorado to receive WELL Precertification

Stantec and Muñoz + Albin are the project's architects.

Senior Living Design | May 5, 2020

5 memory care communities with a strong sense of mission

Communities in California, Colorado, Florida, Maryland, and Virginia display excellence in memory care facility development, design, and construction.

Multifamily Housing | Apr 23, 2020

Tankless water heaters: 12 things to know about these energy savers for multifamily housing

Twelve factors to consider in using tankless water heaters in multifamily housing.

Multifamily Housing | Apr 20, 2020

Multifamily market flattens as construction proposal activity sinks

Multifamily has consistently been one of the strongest performers among 58 submarkets measured in PSMJ Resources’ quarterly survey.

Coronavirus | Apr 15, 2020

COVID-19 alert: 93% of renters in professionally managed multifamily housing paid some or all of their rent, says NMHC

In its second survey of 11.5 million units of professionally managed apartment units across the country, the National Multifamily Housing Council (NMHC) found that 84% of apartment households made a full or partial rent payment by April 12, up 15 percentage points from April 5.

Multifamily Housing | Apr 15, 2020

Related Group picks Stantec to design and engineer Manor Miramar residences in Florida

Related Group picks Stantec to design and engineer Manor Miramar residences in Florida.