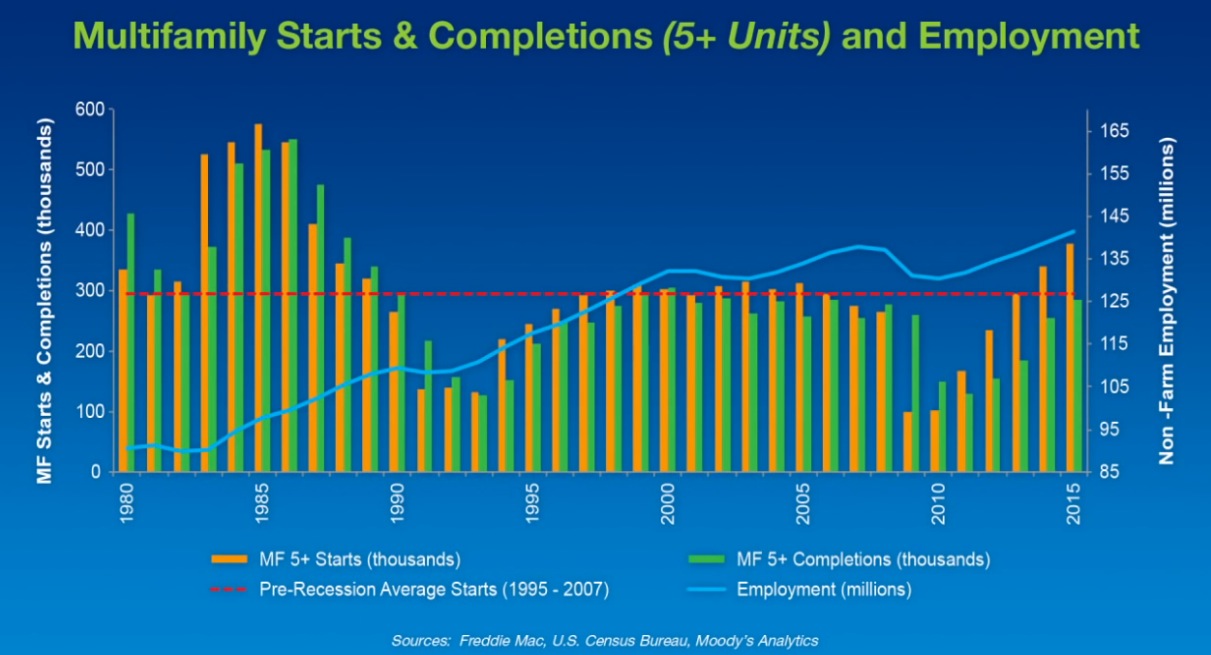

The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Multifamily Housing | Oct 22, 2020

The Weekly show: Universal design in multifamily housing, reimagining urban spaces, back to campus trends

BD+C editors speak with experts from KTGY Architecture + Planning, LS3P, and Omgivning on the October 22 episode of "The Weekly." The episode is available for viewing on demand.

Multifamily Housing | Oct 20, 2020

New multifamily complex completes in Austin

Charlan Brock Associates and Britt Design Group designed the project.

Multifamily Housing | Oct 15, 2020

Miami’s yacht-inspired UNA Residences begins construction

AS+GG designed the tower.

Multifamily Housing | Oct 15, 2020

L.A., all the way

KFA Architecture has hitched its wagon to Los Angeles’s star for more than 40 years.

Multifamily Housing | Oct 2, 2020

Everyone's getting a fire pit!

Skeleton fire pit in Chicago, October 2020

Coronavirus | Oct 2, 2020

With revenues drying up, colleges reexamine their student housing projects

Shifts to online learning raise questions about the value of campus residence life.

Multifamily Housing | Oct 1, 2020

Glass railings installed at 300-unit rental complex in Columbus, Ohio

Vision Communities chose Viewrail railings for the main entrance of The Ave, a 300-unit rental enterprise in Columbus, Ohio.

Multifamily Housing | Sep 29, 2020

Washington, D.C.’s first modular apartment building breaks ground

Eric Colbert & Associates designed the building.

Multifamily Housing | Sep 22, 2020

AIA/HUD Secretary's Awards celebrate affordable, accessible, and well-designed housing

Each year, the AIA and HUD partner to celebrate projects that demonstrate affordable, accessible and well-designed housing, proving that good design is not exclusive.

Multifamily Housing | Sep 16, 2020

8 (more) noteworthy multifamily projects to debut in 2020

An office-to-apartment conversion in Clearwater, Fla., and a modular affordable housing community in Portland, Ore., highlight the latest multifamily developments to open this year.