The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

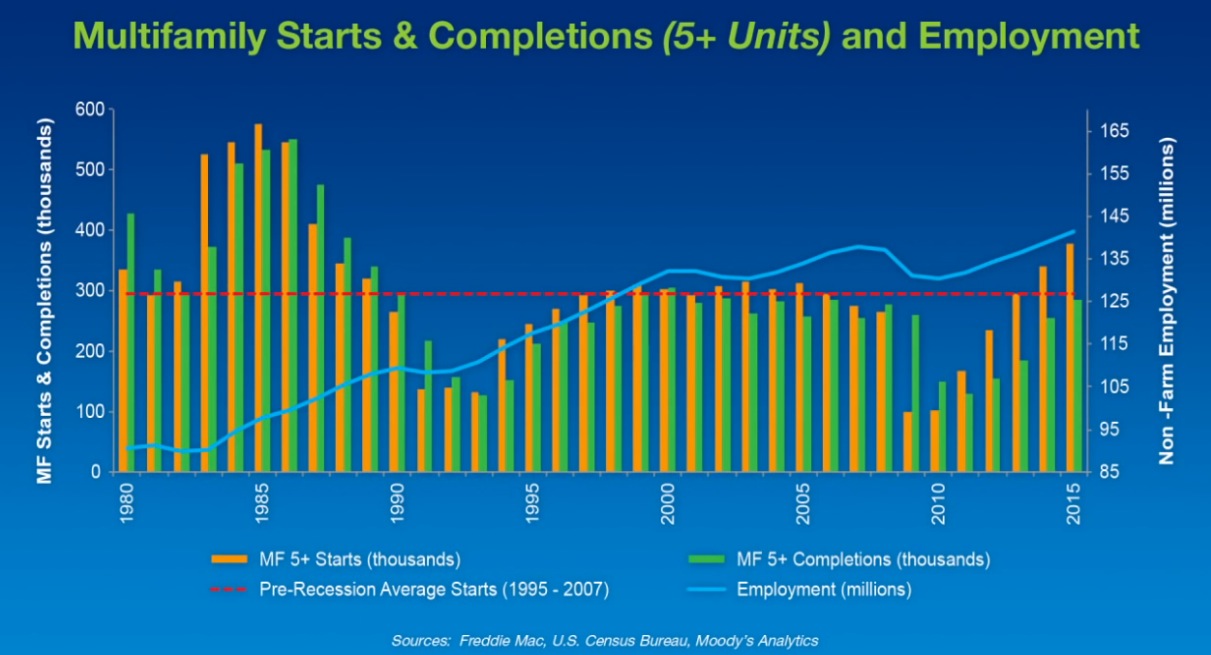

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Projects | Mar 18, 2022

Former department store transformed into 1 million sf mixed-use complex

Sibley Square, a giant mixed-use complex project that transformed a nearly derelict former department store was recently completed in Rochester, N.Y.

Multifamily Housing | Mar 15, 2022

Multifamily rents climbed 15.4 percent in one year

Multifamily asking rents picked up another $10 in February to reach a national average $1,628, and year-over-year growth recorded a 15.4 percent bump, according to the new Yardi Matrix Multifamily National Report.

Multifamily Housing | Mar 15, 2022

A 42-story tower envelops residents in Vancouver’s natural beauty

The city of Vancouver is world-renowned for the stunning nature that surrounds it: water, beaches, mountains. A 42-story tower, Fifteen Fifteen, will envelop residents in that natural beauty.

Multifamily Housing | Mar 15, 2022

Hermosa Village earns 2021 NAHB Best in American Living Award

Cadence McShane Construction Company received first place in this year's NAHB Best in American Living Award for its Hermosa Village project.

Projects | Mar 11, 2022

Suffolk completes construction of luxury condominium 2000 Ocean

The 38-story glass-encased tower along the beach on 1.3 acres is owned by KAR Properties and designed by TEN Arquitectos.

Projects | Mar 9, 2022

New 243-unit luxury apartment community opens in St. Paul, Minn.

Waterford Bay, a four-story, 243-unit luxury multifamily development recently opened in St. Paul, Minn.

Mass Timber | Mar 8, 2022

Heavy timber office and boutique residential building breaks ground in Austin

T3 Eastside, a heavy timber office and boutique residential building, recently broke ground in Austin, Texas.

Multifamily Housing | Mar 4, 2022

221,000 renters identify what they want in multifamily housing, post-Covid-19

Fresh data from the 2022 NMHC/Grace Hill Renter Preferences Survey shows how remote work is impacting renters' wants and needs in apartment developments.

Projects | Mar 2, 2022

Manufacturing plant gets second life as a mixed-use development

Wire Park, a mixed-use development being built near Athens, Ga., will feature 130 residential units plus 225,000 square feet of commercial, office, and retail space. About an hour east of downtown Atlanta, the 66-acre development also will boast expansive public greenspace.

Multifamily Housing | Feb 25, 2022

First set of multifamily properties achieve BREEAM certification in the U.S.

WashREIT says it has achieved certification on eight multifamily assets under BREEAM’s In-Use certification standard.