The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

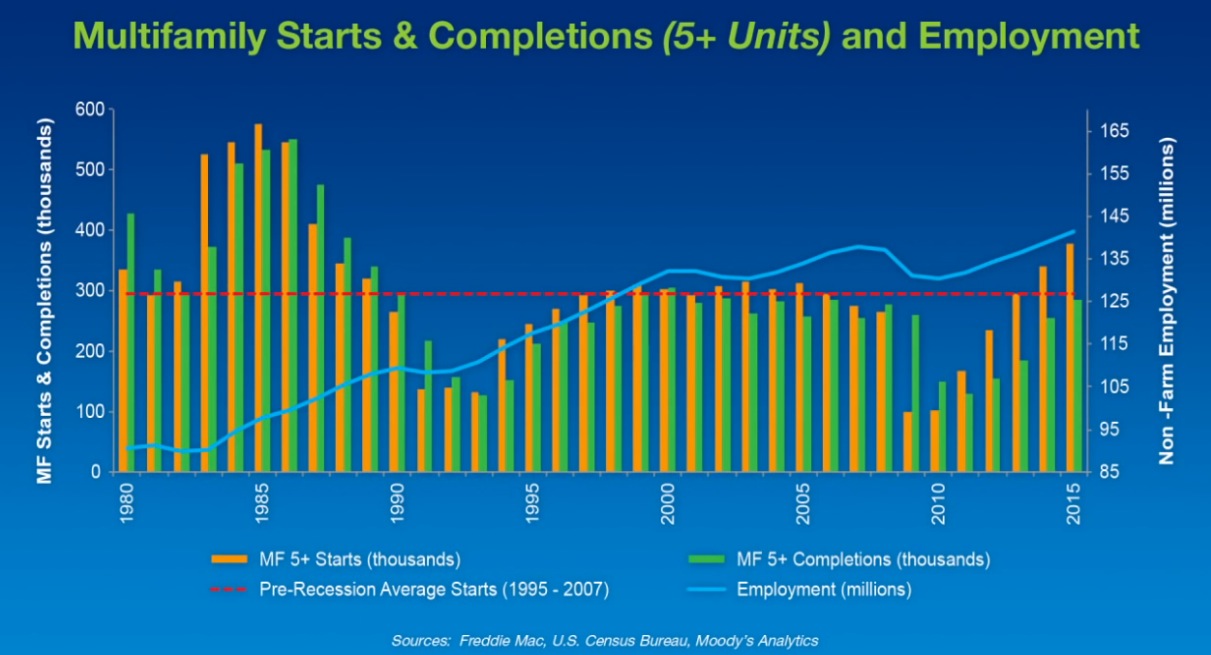

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Mixed-Use | Apr 22, 2022

San Francisco replaces a waterfront parking lot with a new neighborhood

A parking lot on San Francisco’s waterfront is transforming into Mission Rock—a new neighborhood featuring rental units, offices, parks, open spaces, retail, and parking.

Multifamily Housing | Apr 20, 2022

A Frankfurt tower gives residents greenery-framed views

In Frankfurt, Germany, the 27-floor EDEN tower boasts an exterior “living wall system”: 186,000 plants that cover about 20 percent of the building’s facade.

Multifamily Housing | Apr 20, 2022

Prism Capital Partners' Avenue & Green luxury/affordable rental complex is 96% leased

The 232-unit rental property, in Woodbridge, N.J., has surpassed the 96 percent mark in leases.

Senior Living Design | Apr 19, 2022

Affordable housing for L.A. veterans and low-income seniors built on former parking lot site

The Howard and Irene Levine Senior Community, designed by KFA Architecture for Mercy Housing of California, provides badly needed housing for Los Angeles veterans and low-income seniors

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Wood | Apr 13, 2022

Mass timber: Multifamily’s next big building system

Mass timber construction experts offer advice on how to use prefabricated wood systems to help you reach for the heights with your next apartment or condominium project.

Codes and Standards | Apr 13, 2022

LEED multifamily properties fetch higher rents and sales premiums

LEED-certified multifamily properties consistently receive higher rents than non-certified rental complexes, according to a Cushman & Wakefield study of two decades of data on Class A multifamily assets with 50 units or more.

Multifamily Housing | Apr 7, 2022

Ken Soble Tower becomes world’s largest residential Passive House retrofit

The project team for the 18-story high-rise for seniors slashed the building’s greenhouse gas emissions by 94 percent and its heating energy demand by 91 percent.

Multifamily Housing | Apr 5, 2022

New Covenant House New York contains multiple services for youth in crisis

The new Covenant House New York, a crisis shelter for homeless youth in the Hell’s Kitchen neighborhood, provides a temporary home and multiple services for young people.