The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

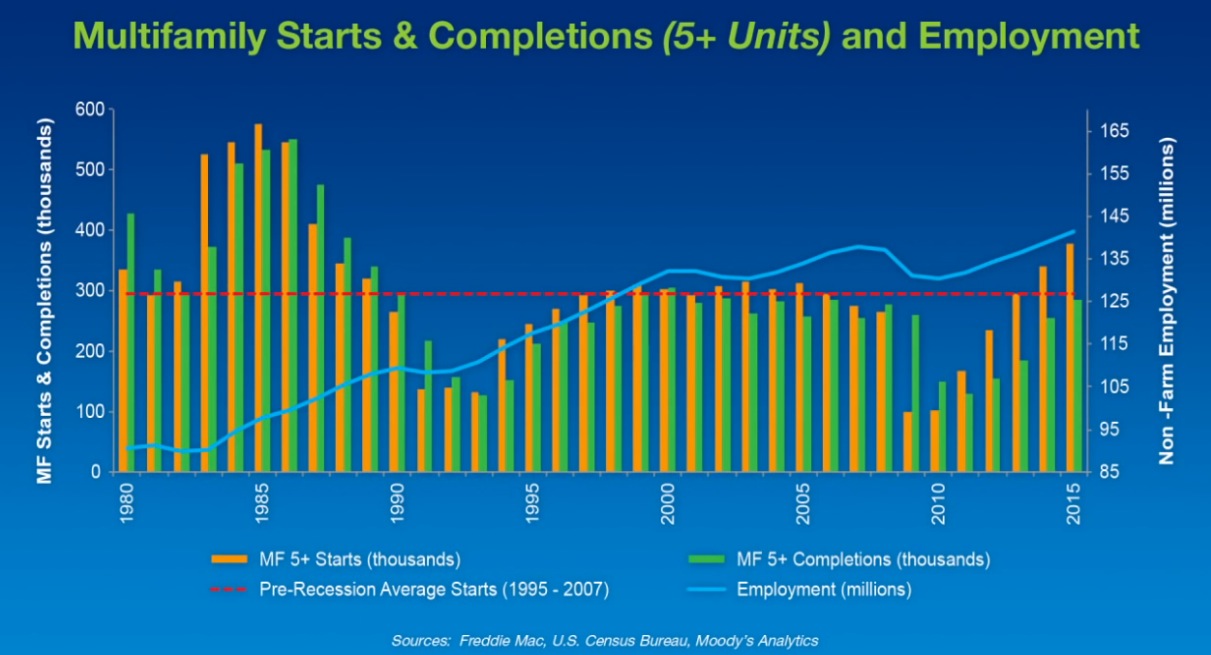

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Multifamily Housing | Mar 18, 2015

Prefabricated skycubes proposed with 'elastic' living apartments inside

The interiors for each unit are designed using an elastic living concept, where different spaces are created by sliding on tracks.

Multifamily Housing | Mar 16, 2015

New Jersey Supreme Court puts control of affordable housing agency in the courts

The court said the state’s affordable housing agency had failed to do its job, and effectively transferred the agency's regulatory authority to lower courts.

High-rise Construction | Mar 16, 2015

Mexican Museum tower caught in turmoil to break ground this summer in San Francisco

Millennium Partners said it will break ground on the 53-story residential and museum tower while the lawsuits go through the appeals process.

Mixed-Use | Mar 13, 2015

Dubai announces mega waterfront development Aladdin City

Planned on 4,000 acres in the Dubai Creek area, the towers will be covered in gold lattice and connected via air-conditioned bridges.

High-rise Construction | Mar 12, 2015

Developers confirm Renzo Piano’s contribution in Sydney harbor overhaul

If the entire development is approved, One Sydney Harbour will be Piano’s second project in Australia.

Multifamily Housing | Mar 12, 2015

Multifamily construction has been a boon to L.A.’s economy

A new study finds that nearly one-quarter of Los Angeles’ population lived in rental homes and apartments in 2013, a number that undoubtedly has increased since.

Modular Building | Mar 10, 2015

Must see: 57-story modular skyscraper was completed in 19 days

After erecting the mega prefab tower in Changsha, China, modular builder BSB stated, “three floors in a day is China’s new normal.”

Multifamily Housing | Mar 10, 2015

Developers bullish about multifamily market for third consecutive quarter

After increasing steadily over the past several years, multifamily production has now reached a healthy, sustainable level, according to NAHB Chief Economist David Crowe.

Multifamily Housing | Mar 10, 2015

A loft project in Dallas evolves into a high rise for both affluent and artistic customers

Atelier | Flora Lofts will be built on one of this city’s last choice undeveloped lots.

Multifamily Housing | Mar 10, 2015

KTGY homes in on seniors with new studio

Its director, Doug Ahlstrom, says designs will emphasize socialization and community.