The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

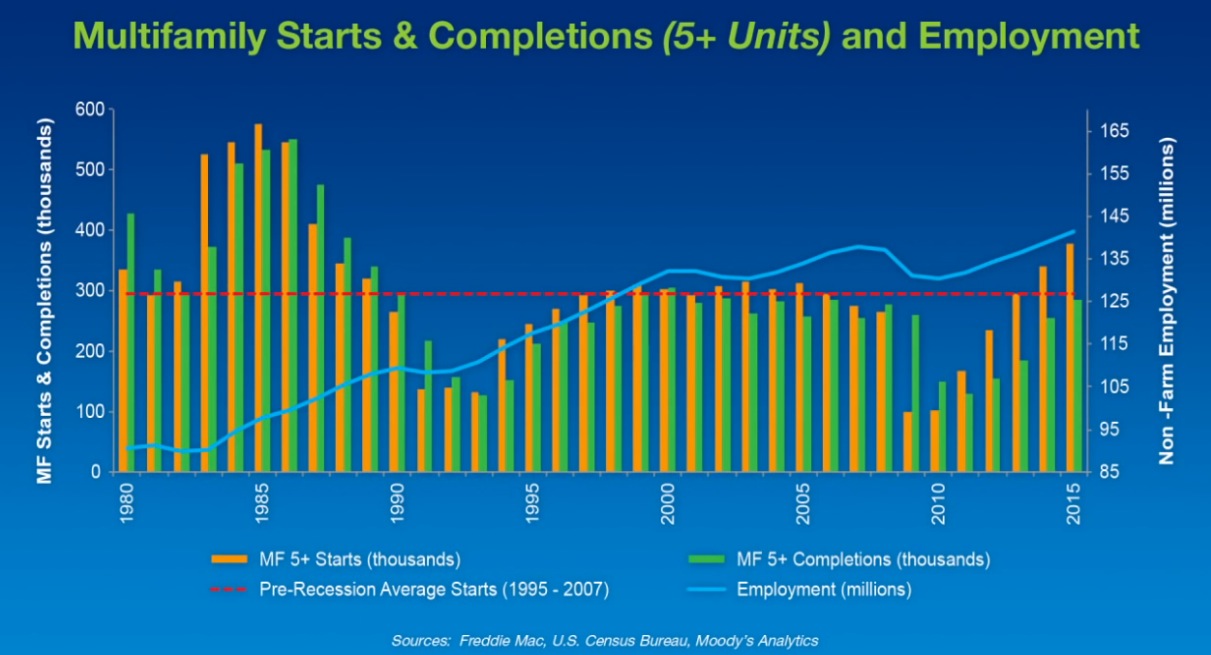

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Multifamily Housing | Apr 28, 2015

Mace and Make work on London's 40-story residential tower

The tower is one of six residential high-rises planned near London’s City Road, which is undergoing a mini construction boom.

Multifamily Housing | Apr 27, 2015

The empire strikes back: George Lucas proposes new affordable housing complex he'll finance alone

The latest plans are seen by some as payback for community opposition to his past real estate ventures.

Wood | Apr 26, 2015

Building wood towers: How high is up for timber structures?

The recent push for larger and taller wood structures may seem like an architectural fad. But Building Teams around the world are starting to use more large-scale structural wood systems.

Multifamily Housing | Apr 22, 2015

Condo developers covet churches for conversions

Former churches, many of which are sitting on prime urban real estate, are being converted into libraries, restaurants, and with greater frequency condominiums.

Green | Apr 22, 2015

AIA Committee on the Environment recognizes Top 10 Green Projects

Seattle's Bullitt Center and the University Center at The New School are among AIA's top 10 green buildings for 2015.

Multifamily Housing | Apr 16, 2015

3 award-winning affordable multifamily developments

San Francisco's Bayview Hill Gardens and the Broadway Affordable Housing complex in Santa Monica, Calif., are among the multifamily developments to be honored in AIA's 2015 Housing Awards.

Multifamily Housing | Apr 16, 2015

Seattle’s size restriction on micro apartments blamed for rise in rents

Seattle’s city planner recently said that the council’s new rules have made small apartments more expensive to build and charged the board with “overreaching” and not giving micro-housing “a fair shake.”

High-rise Construction | Apr 16, 2015

Construction begins on Seattle's Tibet-inspired Potala Tower

Construction on the 41-story Potala Tower in Seattle finally kicked off following a ground-breaking ceremony seven months ago.

Hotel Facilities | Apr 13, 2015

Figure-eight shaped hotel to open around PyeongChang 2018 Winter Olympics Facility

Just three miles away from the Olympic stadiums, the hotel will be a hub of its own.

Multifamily Housing | Apr 9, 2015

Multifamily development and transactions haven’t taken a breather yet

Despite predictions about an impending softening in multifamily construction, builders and developers continue to expand their market reach and portfolios.