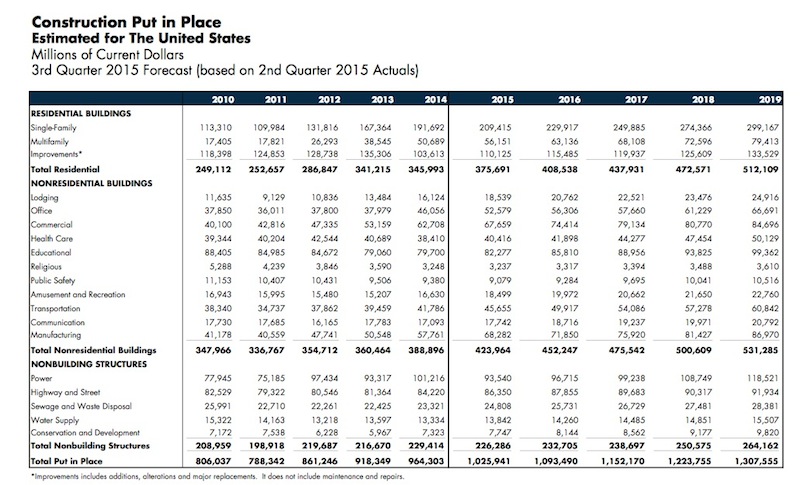

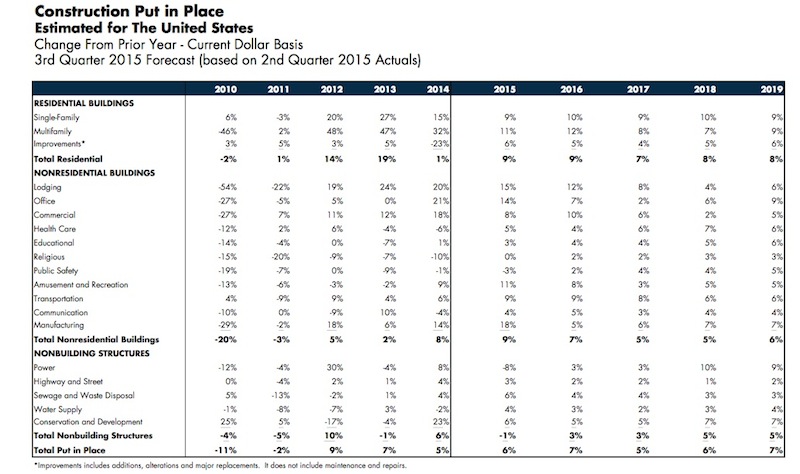

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

Airports | Aug 31, 2015

Experts discuss how airports can manage growth

In February 2015, engineering giant Arup conducted a “salon” in San Francisco on the future of aviation. This report provides an insight into their key findings.

Healthcare Facilities | Aug 28, 2015

Hospital construction/renovation guidelines promote sound control

The newly revised guidelines from the Facilities Guidelines Institute touch on six factors that affect a hospital’s soundscape.

Healthcare Facilities | Aug 28, 2015

7 (more) steps toward a quieter hospital

Every hospital has its own “culture” of loudness and quiet. Jacobs’ Chris Kay offers steps to a therapeutic auditory environment.

Healthcare Facilities | Aug 28, 2015

Shhh!!! 6 ways to keep the noise down in new and existing hospitals

There’s a ‘decibel war’ going on in the nation’s hospitals. Progressive Building Teams are leading the charge to give patients quieter healing environments.

Mixed-Use | Aug 26, 2015

Innovation districts + tech clusters: How the ‘open innovation’ era is revitalizing urban cores

In the race for highly coveted tech companies and startups, cities, institutions, and developers are teaming to form innovation hot pockets.

Contractors | Aug 19, 2015

FMI's Nonresidential Construction Index Report: Recovery continues despite slow down

The Q3 NRCI dropped to 63.6 from the previous reading of 64.9 in Q2, painting a mixed picture of the state of the nonresidential construction sector.

Giants 400 | Aug 7, 2015

GOVERNMENT SECTOR GIANTS: Public sector spending even more cautiously on buildings

AEC firms that do government work say their public-sector clients have been going smaller to save money on construction projects, according to BD+C's 2015 Giants 300 report.

Giants 400 | Aug 7, 2015

K-12 SCHOOL SECTOR GIANTS: To succeed, school design must replicate real-world environments

Whether new or reconstructed, schools must meet new demands that emanate from the real world and rapidly adapt to different instructional and learning modes, according to BD+C's 2015 Giants 300 report.

Giants 400 | Aug 7, 2015

MULTIFAMILY AEC GIANTS: Slowdown prompts developers to ask: Will the luxury rentals boom hold?

For the last three years, rental apartments have occupied the hot corner in residential construction, as younger people gravitated toward renting to be closer to urban centers and jobs. But at around 360,000 annual starts, multifamily might be peaking, according to BD+C's 2015 Giants 300 report.

Giants 400 | Aug 7, 2015

UNIVERSITY SECTOR GIANTS: Collaboration, creativity, technology—hallmarks of today’s campus facilities

At a time when competition for the cream of the student/faculty crop is intensifying, colleges and universities must recognize that students and parents are coming to expect an education environment that foments collaboration, according to BD+C's 2015 Giants 300 report.