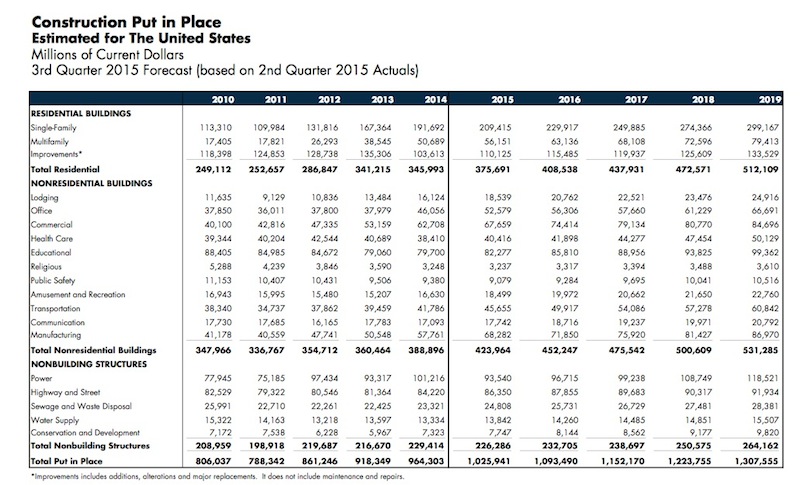

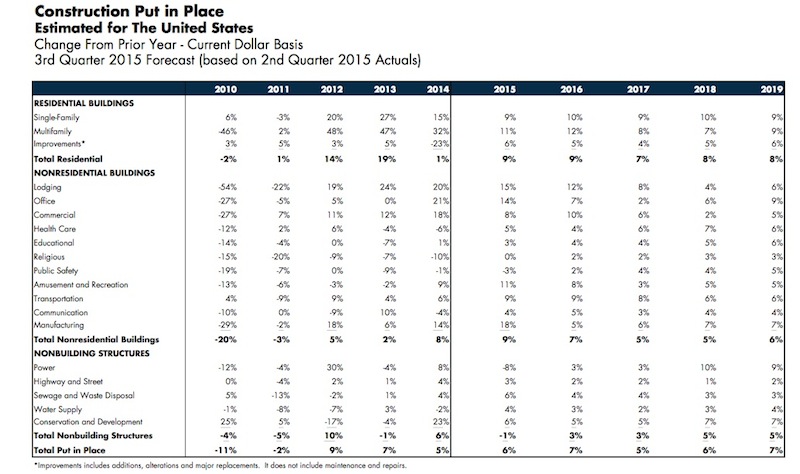

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

Coronavirus | May 29, 2020

Black & Veatch, DPR, Haskell, McCarthy launch COVID-19 construction safety coalition

The NEXT Coalition will challenge engineering and construction firms to enhance health and safety amid the Coronavirus pandemic.

Coronavirus | May 26, 2020

9 tips for mastering virtual public meetings during the COVID-19 pandemic

Mike Aziz, AIA, presents 9 tips for mastering virtual public meetings during the COVID-19 pandemic.

Coronavirus | May 18, 2020

Infection control in office buildings: Preparing for re-occupancy amid the coronavirus

Making workplaces safer will require behavioral resolve nudged by design.

Data Centers | May 8, 2020

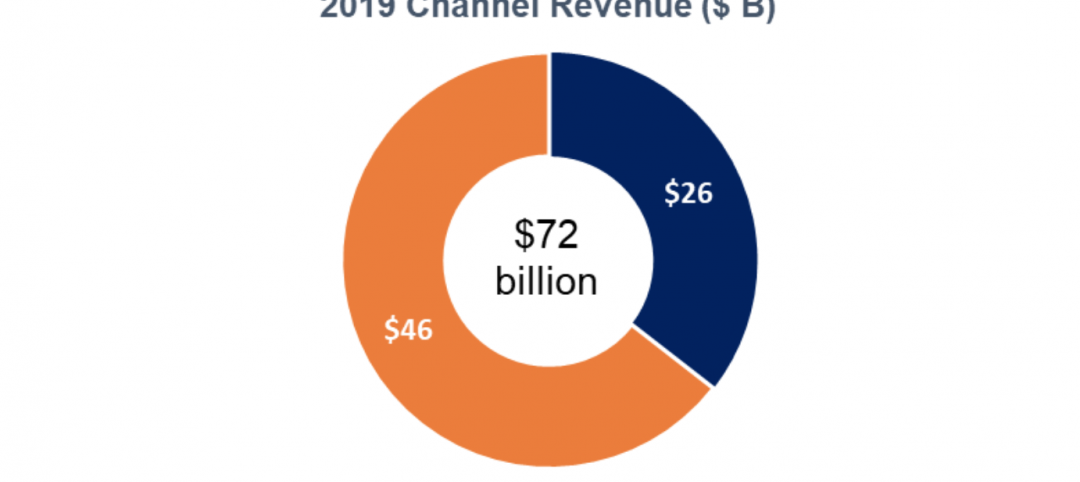

Data centers as a service: The next big opportunity for design teams

As data centers compete to process more data with lower latency, the AEC industry is ideally positioned to develop design standards that ensure long-term flexibility.

Coronavirus | Apr 30, 2020

Gilbane shares supply-chain status of products affected by coronavirus

Imported products seem more susceptible to delays

Coronavirus | Apr 14, 2020

COVID-19 alert: Missouri’s first Alternate Care Facility ready for coronavirus patients

Missouri’s first Alternate Care Facility ready for coronavirus patients

AEC Tech | Apr 13, 2020

A robotic dog becomes part of Swinerton’s construction technology arsenal

Boston Dynamics, the robot’s creator, has about 100 machines in the field currently.

Coronavirus | Apr 8, 2020

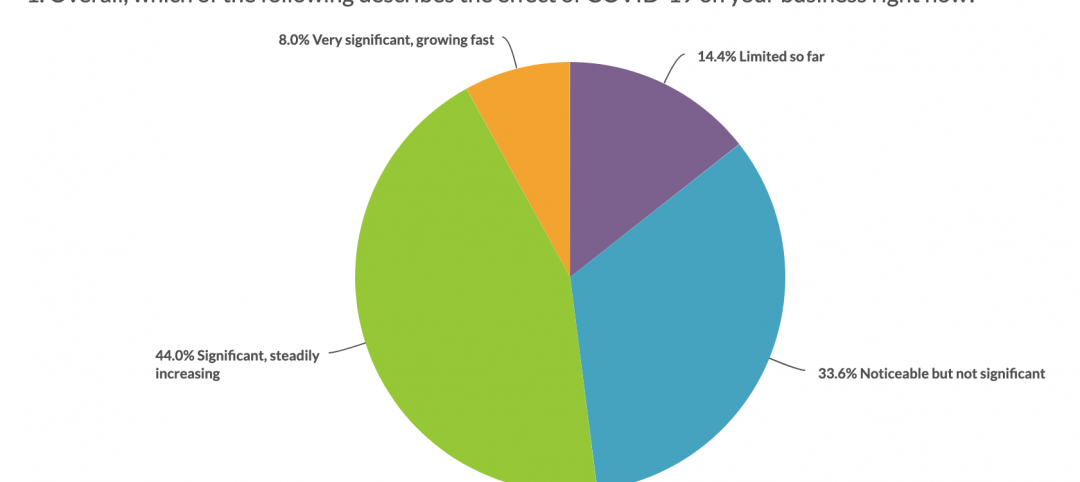

COVID-19 alert: Most U.S. roofing contractors hit by coronavirus, says NRCA

NRCA survey shows 52% of roofing contractor said COVID-19 pandemic was having a significant or very significant impact on their businesses.

Coronavirus | Apr 5, 2020

COVID-19: Most multifamily contractors experiencing delays in projects due to coronavirus pandemic

The NMHC Construction Survey is intended to gauge the magnitude of the disruption caused by the COVID-19 outbreak on multifamily construction.