According to expert forecasters, multifamily projects, the Panama Canal expansion, and the petroleum industry’s “shale gale” could be saving graces for commercial AEC firms seeking growth opportunities in an economy that’s provided its share of recent disappointments.

In a spring industry roundtable hosted by Reed Construction Data, economists from the American Institute of Architects, the Associated General Contractors of America, and RCD discussed the mixed signals in commercial design and construction, and the seemingly perennial predictions of a breakthrough.

The overall conclusion, according to Bernard Markstein, U.S. Chief Economist for RCD? The economy’s improving and employment is growing, but both ought to be better by now.

Nevertheless, Markstein identifies several positives in the overall picture. “The Federal Reserve has started to taper its activity, without too much impact on interest rates; these remain historically low,” he says. “Lenders are slowly loosening lending standards. We’ve already seen most of the impact of sharp cuts in federal spending, and those should be done for now.”

Multifamily continues to be a particularly bright spot, according to Markstein. Other sectors remain more problematic, with a brutal winter limiting overall activity in many regions.

TOP ARCHITECTURE FIRMS

2013 Architecture Revenue ($)1 Gensler $883,221,1892 Perkins+will 356,360,0003 NBBJ 196,784,0004 Kohn Pedersen Fox Associates 177,715,0005 Callison 160,912,3986 Perkins Eastman 155,000,0007 ZGF Architects 128,101,1368 Populous 111,754,0009 Corgan 95,097,37210 MulvannyG2 Architecture 73,200,000TOP ARCHITECTURE/ENGINEERING FIRMS

2013 A/E Revenue ($)1 Stantec $450,836,5752 HOK 400,000,0003 Skidmore, Owings & Merrill 334,525,3464 HDR 303,000,0005 HKS 255,063,6246 CannonDesign 213,000,0007 RTKL Associates 205,373,0008 SmithGroupJJR 162,973,0009 Hammel, Green and Abrahamson 119,100,00010 DLR Group 110,000,000

Kermit Baker, Chief Economist for the AIA, admits that “nonresidential construction has had a hard time building momentum behind the recovery,” and that the AIA Architecture Billings Index keeps hitting soft spots. Reconstruction, rather than new builds, currently represents a larger-than-usual share of the business, at about 25% of nonresidential construction activity.

Baker predicts that firms doing lodging, office, retail, and manufacturing projects should see decent results this year, with hotel construction especially hot (tracking at 37% growth from February 2013 to February 2014, according to the U.S. Census Bureau). Communication-related construction is another booming area, with growth at more than 50% year over year.

Giants 300 coverage of Architecture Firms brought to you by Sage www.sageglass.com

However, some sectors that represent bread-and-butter business for many top architecture firms are looking grimmer, especially healthcare (off about 4% from February to February) and education (down about 7%). Baker says project financing remains “a chronic problem.”

He believes the long-range outlook is better, however. “New design contracts have been growing, and those stats lead construction. Our member firms are building up more work.”

Ken Simonson, Chief Economist for the AGC of America, reported that his group’s members think the manufacturing, retail/lodging/warehouse, private office, and healthcare sectors should grow this year compared with 2013. Most members are feeling positive overall, he says. “For the first time, two-thirds of our respondents expect the market to upturn either this year or next year,” Simonson says. “In previous years I have been more optimistic than our members. Not this year.”

Tighter government spending on education and infrastructure, consumers’ interest in online buying, and companies’ drive to shrink office space per employee have all restrained commercial AEC growth, according to Simonson. But there are positive trends, as well. In addition to acknowledging the continued strength of the multifamily sector, he says big infrastructure projects provide ample opportunities for AEC firms positioned to take advantage of them.

In particular, Simonson points to massive development related to the so-called “shale gale”: exploitation of America’s petroleum reserves through advanced extraction technologies (notably, fracking). The employment is drawing large numbers of workers to areas that have previously been sparsely populated. Primary “shale gale” zones, or “plays,” include the Bakken (North Dakota/Montana/Saskatchewan), the Niobrara (Kansas/

Wyoming), the Permian (Texas/New Mexico), the Eagle Ford (Texas), the Haynesville (Texas/Louisiana), and the Marcellus (West Virginia/Pennsylvania/New York).

Firms that do large infrastructure projects related to roads, site prep, piping, rail lines, and drilling obviously will benefit, but there’s also an urgent need for housing (typically, modular dorms and extended-stay hotels), recreational facilities, and food service. Nearby existing towns also benefit, not only in terms of hotel, apartment, and restaurant construction but also retail, healthcare, education, and government projects. The burgeoning industry entails environmental controversy, turbulent politics, and an uncertain future, but for now, building is proceeding at a rapid clip.

Simonson also points to upcoming development in U.S. port cities on both coasts and the Gulf of Mexico linked to expansion of the Panama Canal, which is set to be completed next year. Again, in addition to big infrastructure, related facilities will be needed: warehouses, terminals, equipment garages, and even data centers. Incoming workers may also need new housing and services facilities. Commercial AEC firms with the right capabilities could reap big gains.

Read BD+C's full 2014 Giants 300 Report

Related Stories

| Jul 18, 2014

2014 Giants 300 Report

Building Design+Construction magazine's annual ranking the nation's largest architecture, engineering, and construction firms in the U.S.

| Jul 7, 2014

7 emerging design trends in brick buildings

From wild architectural shapes to unique color blends and pattern arrangements, these projects demonstrate the design possibilities of brick.

| Jul 2, 2014

Emerging trends in commercial flooring

Rectangular tiles, digital graphic applications, the resurgence of terrazzo, and product transparency headline today’s commercial flooring trends.

| Jun 30, 2014

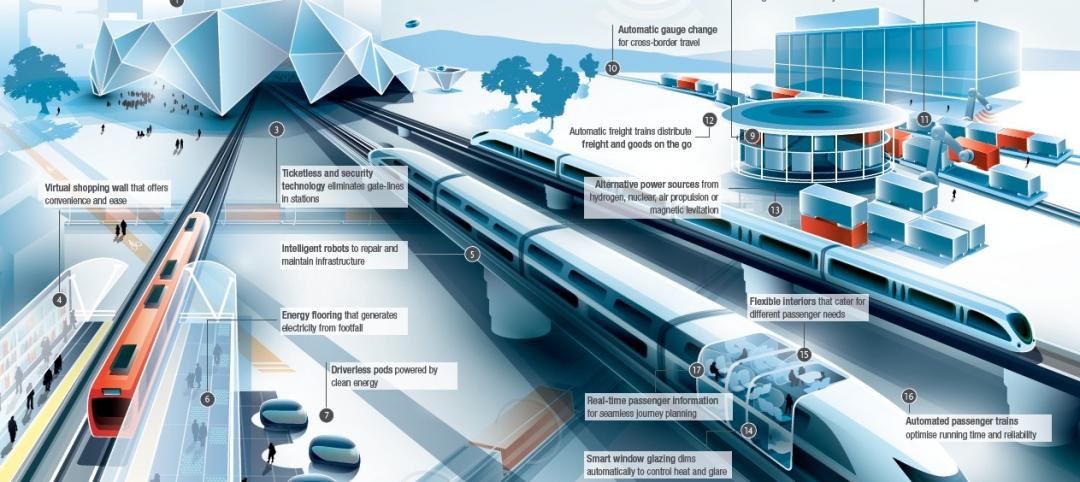

Arup's vision of the future of rail: driverless trains, maintenance drones, and automatic freight delivery

In its Future of Rail 2050 report, Arup reveals a vision of the future of rail travel in light of trends such as urban population growth, climate change, and emerging technologies.

| Jun 18, 2014

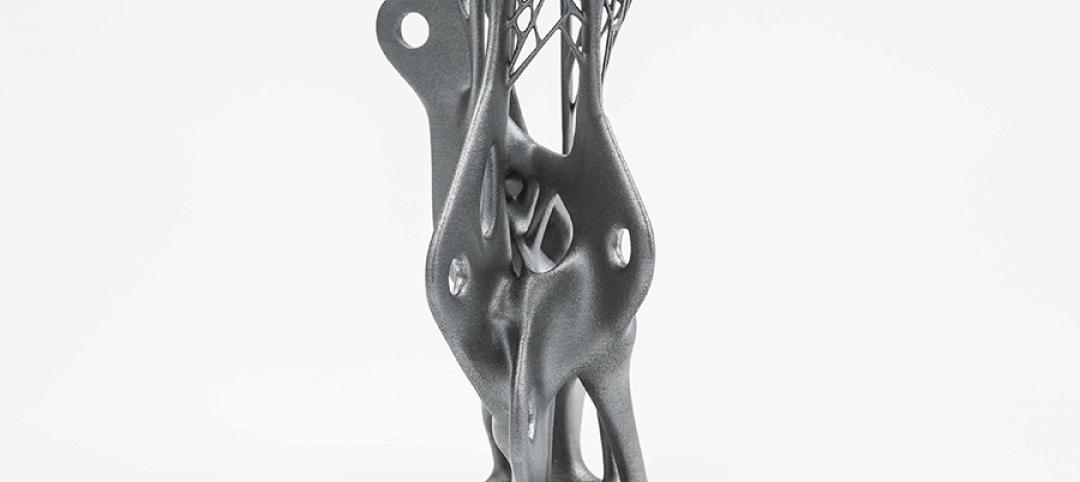

Arup uses 3D printing to fabricate one-of-a-kind structural steel components

The firm's research shows that 3D printing has the potential to reduce costs, cut waste, and slash the carbon footprint of the construction sector.

| Jun 12, 2014

Austrian university develops 'inflatable' concrete dome method

Constructing a concrete dome is a costly process, but this may change soon. A team from the Vienna University of Technology has developed a method that allows concrete domes to form with the use of air and steel cables instead of expensive, timber supporting structures.

| Jun 2, 2014

Parking structures group launches LEED-type program for parking garages

The Green Parking Council, an affiliate of the International Parking Institute, has launched the Green Garage Certification program, the parking industry equivalent of LEED certification.

| May 29, 2014

7 cost-effective ways to make U.S. infrastructure more resilient

Moving critical elements to higher ground and designing for longer lifespans are just some of the ways cities and governments can make infrastructure more resilient to natural disasters and climate change, writes Richard Cavallaro, President of Skanska USA Civil.

| May 23, 2014

Top interior design trends: Gensler, HOK, FXFOWLE, Mancini Duffy weigh in

Tech-friendly furniture, “live walls,” sit-stand desks, and circadian lighting are among the emerging trends identified by leading interior designers.

| May 20, 2014

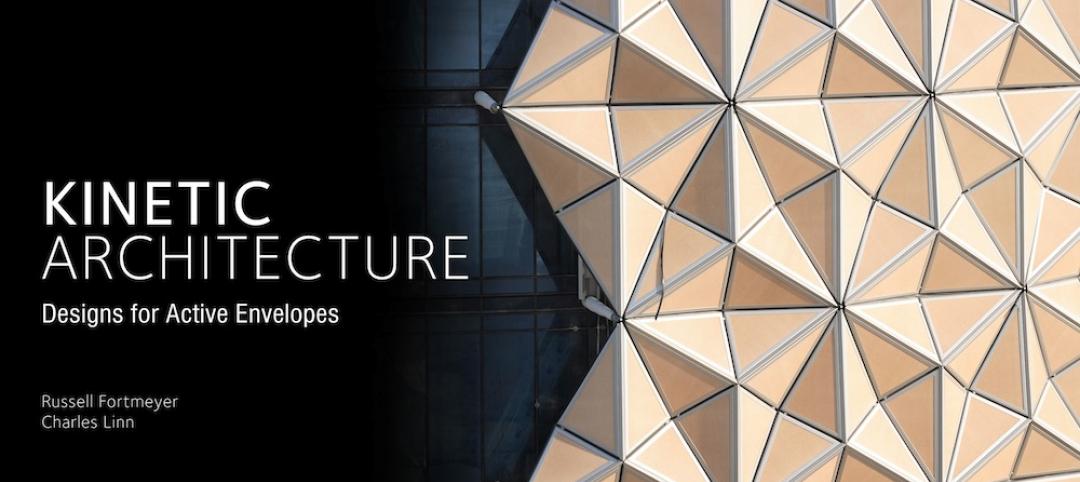

Kinetic Architecture: New book explores innovations in active façades

The book, co-authored by Arup's Russell Fortmeyer, illustrates the various ways architects, consultants, and engineers approach energy and comfort by manipulating air, water, and light through the layers of passive and active building envelope systems.