Prices for inputs to construction fell 0.5% in August but are 8.1% higher than at the same time one year ago, according to an Associated Builders and Contractors analysis of Bureau of Labor Statistics data released today. Nonresidential construction input prices fell 0.4% in August but are up 8.3% year-over-year. Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

“Stakeholders will be tempted to look upon this month’s inputs to the construction Producer Price Index report as evidence that the cycle of rapidly rising prices is nearing an end,” said ABC Chief Economist Anirban Basu. “Prices of key inputs have been high for quite some time, which would tend to induce a larger supply of these items and, in turn, moderate prices.

“Some may also conclude that ongoing progress in trade negotiations with nations including Mexico and Canada has helped to moderate input prices. Still others might point to growing economic turmoil in nations like Turkey and Argentina. Economists would also note the likely impact of a strong U.S. dollar on import and commodity prices. While all of these are potential explanations, another possibility is that the August data are largely statistical aberrations. Metal prices continue to move higher on a monthly basis, with recently enacted tariffs representing a likely explanation.

“Softwood lumber, the subject of an ongoing trade dispute with the Canadians, experienced a significant dip in price on a monthly basis,” said Basu. “The price of softwood may have fallen in response to a weakening single-family residential construction market, as home builders have been wrestling with a combination of labor shortages, higher land prices and weakening demand due to higher mortgage rates.

“In the final analysis, the falling input prices trend likely won’t continue,” said Basu. “The economy is still strong, and ABC’s Construction Backlog Indicator remains elevated in both public and private construction segments. Inflation expectations have shifted, with purchasers of construction services now anticipating price increases and therefore more willing to accommodate them. Moreover, issues related to tariffs and trade wars persist. Accordingly, estimators and construction companies continue to consider the likelihood of additional input price increases for the balance of 2018 and into 2019.”

Related Stories

Market Data | May 18, 2020

5 must reads for the AEC industry today: May 18, 2020

California's grid can support all-electric buildings and you'll miss your office when it's gone.

Market Data | May 15, 2020

6 must reads for the AEC industry today: May 15, 2020

Nonresidential construction employment sees record loss and Twitter will keep all of its office space.

Market Data | May 15, 2020

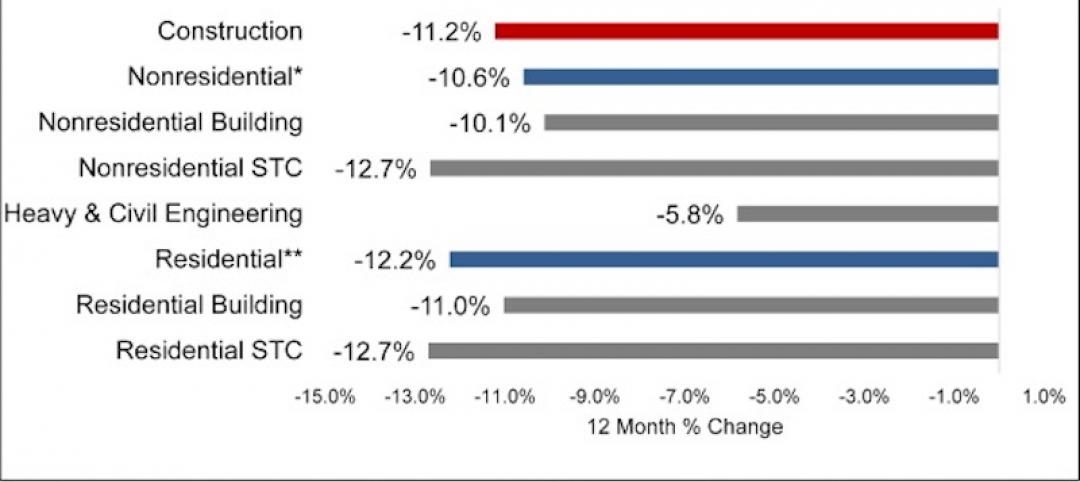

Nonresidential construction employment sees record loss in April

The construction unemployment rate was 16.6% in April, up 11.9 percentage points from the same time last year.

Market Data | May 14, 2020

5 must reads for the AEC industry today: May 14, 2020

The good news about rent might not be so good and some hotel developers consider whether to abandon projects.

Market Data | May 13, 2020

House democrats' coronavirus measure provides some relief for contractors, but lacks other steps needed to help construction

Construction official says new highway funding, employee retention credits and pension relief will help, but lack of safe harbor measure, Eextension of unemployment bonus will undermine recovery.

Market Data | May 13, 2020

5 must reads for the AEC industry today: May 13, 2020

How to design resilient libraries in a post-covid world and vacation real-estate markets are 'toast.'

Market Data | May 12, 2020

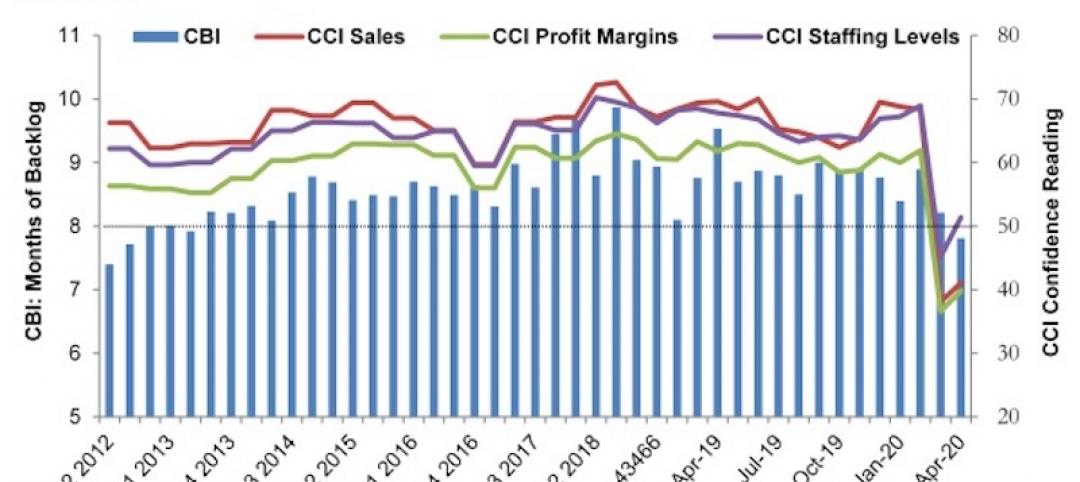

ABC’s Construction Backlog Indicator falls in April; Contractor Confidence rebounds from historic lows

Nonresidential construction backlog is down 0.4 months compared to the March 2020 ABC survey and 1.7 months from April 2019.

Market Data | May 12, 2020

6 must reads for the AEC industry today: May 12, 2020

A 13-point plan to reduce coronavirus deaths in nursing homes and Bjarke Ingels discusses building on Mars.

Market Data | May 11, 2020

Interest in eSports is booming amid COVID-19

The industry has proved largely immune to the COVID-19 pandemic due to its prompt transition into online formats and sudden spike in interest from traditional sports organizations.

Market Data | May 11, 2020

6 must reads for the AEC industry today: May 11, 2020

Nashville residential tower will rise 416 feet and the construction industry loses 975,000 jobs.