Gilbane has released its Spring 2014 edition of the periodic report "Construction Economics: Market Conditions in Construction" (download the full report).

Among the findings from the Executive Summary:

CONSTRUCTION GROWTH IS LOOKING UP

- Construction Spending for 2014 will finish the year 6.6% higher than 2013. Nonresidential buildings will contribute substantially to the growth.

- The Architecture Billings Index (ABI) in 2013 dropped below 50 in April, November and December briefly, indicating declining workload. Overall the ABI portrays a good leading indicator for future new construction work.

- Selling price data for 2013 shows contractors adding to their margins.

- Construction jobs grew by 156,000 in 2013, less than anticipated. However, hours worked also grew by 3%, the equivalent of another 150,000+ jobs.

SOME ECONOMIC FACTORS ARE STILL NEGATIVE

- We are experiencing a slight slowdown in construction spending that could last through May, influenced by a slight dip in nonresidential buildings and a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending. The monthly rate of spending for nonbuilding infrastructure may decline by 10% through Q3 2014.

- The construction workforce and hours worked is still 22% below the 2006 peak. At peak average growth rates, it will take a minimum of five more years to return to previous peak levels.

- Construction volume is 23% below peak inflation adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it will take eight more years to regain previous peak volume levels.

- As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity and the ability to readily increase construction volume.

THE EFFECTS OF GROWTH

- Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices increased on average about 2% to 2.5% year over year. However, selling price indices increased 4% on average. The difference between these indices is increased margins.

IMPACT OF RECENT EVENTS

- There are several reasons why spending is not rapidly increasing: public sector construction remains depressed as sequestration continues; the government is spending less on schools and infrastructure; lenders are just beginning to loosen lending criteria; consumers are still cautious about increasing debt load, including the consumers’ share of public debt and we may be constrained by a skilled labor shortage.

- Supported by overall positive growth trends for year 2014, Gilbane expects margins and overall escalation to climb more rapidly than we have seen in six years.

- Growth in nonresidential buildings and residential construction in 2014 will lead to more significant labor demand, resulting in labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here to download the complete report and a list of data sources.

ABOUT THIS REPORT

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Related Stories

| May 1, 2013

New AISC competition aims to shape the future of steel

Do you have the next great idea for a groundbreaking technology, model shop or building that could potentially revolutionize the future of the steel design and construction industry? Enter AISC's first-ever Future of Steel competition.

| May 1, 2013

Data center construction remains healthy, but oversupply a concern

Facebook, Amazon, Microsoft, and Google are among the major tech companies investing heavily to build state-of-the-art data centers.

| May 1, 2013

Groups urge Congress: Keep energy conservation requirements for government buildings

More than 350 companies urge rejection of special interest efforts to gut key parts of Energy Independence and Security Act

| May 1, 2013

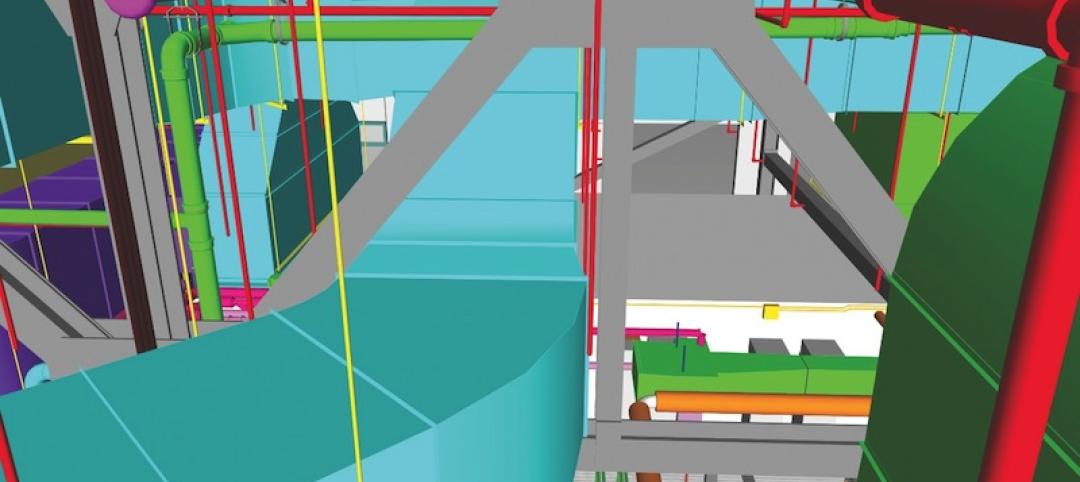

World’s tallest children’s hospital pushes BIM to the extreme

The Building Team for the 23-story Lurie Children’s Hospital in Chicago implements an integrated BIM/VDC workflow to execute a complex vertical program.

| Apr 30, 2013

Healthcare lighting innovation: Overhead fixture uses UV to kill airborne pathogens

Designed specifically for hospitals, nursing homes, child care centers, and other healthcare facilities where infection control is a concern, the Arcalux Health Risk Management System (HRMS) is an energy-efficient lighting fixture that doubles as a germ-killing machine.

| Apr 30, 2013

First look: North America's tallest wooden building

The Wood Innovation Design Center (WIDC), Prince George, British Columbia, will exhibit wood as a sustainable building material widely availablearound the globe, and aims to improve the local lumber economy while standing as a testament to new construction possibilities.

| Apr 26, 2013

Apple scales back Campus 2 plans to reduce price tag

Apple will delay the construction of a secondary research and development building on its "spaceship" campus in an attempt to drive down the cost of developing its new headquarters.

| Apr 26, 2013

Documentary shows 'starchitects' competing for museum project

"The Competition," a new documentary produced by Angel Borrego Cuberto of Madrid, focuses on the efforts of five 'starchitects' to capture the design contract for the new National Museum of Art of Andorra: a small country in the Pyrenees between Spain and France.

| Apr 26, 2013

Solving the parking dilemma in U.S. cities

ArchDaily's Rory Stott yesterday posted an interesting exploration of progressive parking strategies being employed by cities and designers. The lack of curbside and lot parking exacerbates traffic congestion, discourages visitors, and leads to increased vehicles emissions.

| Apr 26, 2013

Decaying city: Exhibit demonstrates the fragility of the man-made world

Theater set designer Johanna Mårtensson built a model cityscape out of bread only to watch it decay.