Building revenue and demand for new commercial construction may be rising fast—but so are costs. Profitability for new commercial building projects will be tricky in 2015, as soaring demand may not lead to soaring profits.

“Leasing momentum is boosting construction demand across multiple commercial property sectors—but raw material and labor costs are making it more expensive to get out of the ground than ever before,” said Todd Burns, President, JLL Project and Development Services, Americas. “Demand is exploding, but demand isn’t everything. You have to consider the bottom line of every project to make sure it makes economic sense short- and long-term.”

Affirming rising demand, the American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year. Likewise, the Construction Backlog Indicator, which tracks non-residential construction, hit a post-downturn high of 8.8 months in the third quarter of 2014.

A new JLL report on U.S. non-residential construction activity highlights several trends to watch in 2015:

- The construction industry remains 22% below peak (2007) levels. According to Gilbane, it may take seven to eight more years to retain previous levels.

- Recovery Continues, Backlog Builds. The overall value of buildings constructed has continued to grow since bottoming-out in 2010. The Construction Backlog Index has grown in all but the Southeast Region, indicating that 2015 will be a big year for construction. Office vacancy rates across the country have declined from 14.1% in 2012 to 10.9% in the fourth quarter of 2014, further strengthening demand. That said, cities with high labor costs and limited land, like New York and New Jersey, may see construction activity slow.

- Costs Climbing Higher. Although raw material costs are expected to stabilize in 2015, rising labor costs will force construction costs continue to grow. Cities such as New York and Chicago will feel the pain of cost hikes and so will Minneapolis where a massive downtown refurbishment is underway. Even Atlanta, one of the lowest-cost markets, saw a bump up in overall prices for the first time since 2008. This could be troublesome for the education sector, which reported the highest level of spending on construction in 2014 at $78.7 billion.

- The Construction Unemployment Paradox. Construction unemployment rates remain high, indicating a large potential employment pool for new construction. However, overall unemployment will drop quickly as building continues to grow. Though unemployment will drop, costs will continue to rise due to productivity issues; there is a lack of construction workers with the right skills and training, frustrating employers and driving up overall labor costs. Costs are also growing more quickly in union-centric markets. According to the U.S. Bureau of Labor Statistics, the lack of available workers with the right training will worsen even as 1.1 million construction jobs are added to the market by 2020. The construction industry has grown every month of 2014, gaining 48,000 jobs in December to reach 290,000 total in 2014. However, overall construction employment is still 1.5 million lower than its peak in 2007.

- Cheaper to Build Than to Lease. With more demand for new construction in some markets like Chicago, West L.A. and Seattle, replacement costs have become lower than purchase prices so constructing new space is more cost-effective than leasing existing space.

While the overall market is recovering, it’s not an even recovery. Construction of distribution facilities supporting e-commerce and retail supply chains will continue to expand, particularly in markets like Dallas and Miami, where new facilities are needed to support sophisticated logistics strategies. Conversely, due to a high volume of office projects started in 2014, more than 16 million sf of new office development is under construction in Houston; 44% of that space remains unleased, which may cause vacancy issues for the city down the road, especially if oil prices remain low.

“Vacancy rates for industrial properties have dropped in the last two years, and competition for big distribution centers has increased dramatically,” said Dana Westgren, research analyst with JLL. “Particularly in locations near ports and other key supply chain locations, new construction can replace older, now-obsolete facilities.”

Download a copy of the JLL U.S. Construction Perspective for Q4 2014 report here.

Related Stories

Multifamily Housing | Mar 18, 2015

Prefabricated skycubes proposed with 'elastic' living apartments inside

The interiors for each unit are designed using an elastic living concept, where different spaces are created by sliding on tracks.

Sponsored | | Mar 17, 2015

Are face-to-face meetings still important?

One CEO looks pass convenience and advocates for old school, in-person meetings.

Resort Design | Mar 16, 2015

Giancarlo Zema Design Group unveils plans for semi-submerged resort in Qatar

The resort will have four semi-submerged hotels that look similar to super-yachts, each including 75 luxury suites with private terraces.

Mixed-Use | Mar 13, 2015

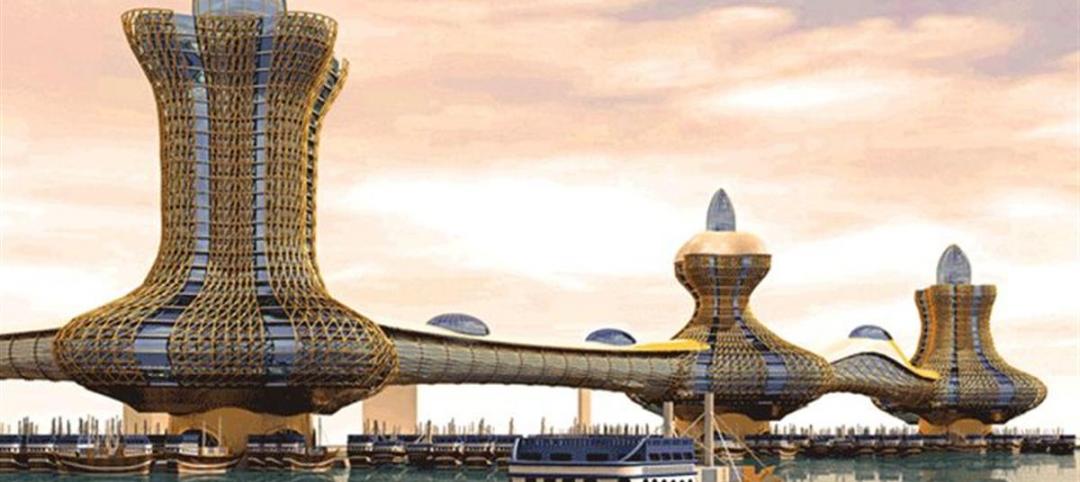

Dubai announces mega waterfront development Aladdin City

Planned on 4,000 acres in the Dubai Creek area, the towers will be covered in gold lattice and connected via air-conditioned bridges.

Contractors | Mar 13, 2015

Construction materials prices rise for first time in six months

The largest monthly gain in petroleum prices in over three years caused construction materials prices to expand 0.4% in February, ending a six-month streak when prices failed to rise, according to the Bureau of Labor Statistics.

High-rise Construction | Mar 12, 2015

Foster and Partners designs 'The One' in Toronto

Developer Sam Mizrahi worked with Foster and Partners and Core Architects to design Toronto's tallest skyscraper aside from the CN Tower, The One, which will house a luxury shopping mall and condos.

Modular Building | Mar 10, 2015

Must see: 57-story modular skyscraper was completed in 19 days

After erecting the mega prefab tower in Changsha, China, modular builder BSB stated, “three floors in a day is China’s new normal.”

Sponsored | Metals | Mar 10, 2015

Metal Building Systems: A Rising Star in the Market

A new report by the Metal Building Manufacturer's Association explains the entity's efforts in refining and extending metal building systems as a construction choice.

Retail Centers | Mar 10, 2015

Retrofit projects give dying malls new purpose

Approximately one-third of the country’s 1,200 enclosed malls are dead or dying. The good news is that a sizable portion of that building stock is being repurposed.

Retail Centers | Mar 10, 2015

Orlando's Skyscraper to be world's tallest roller coaster

The Skyscraper is expected to begin construction later this year, and open in 2016. It will stand at 570 feet.