The news this week that the regional First Republic Bank lost $102 billion in bank deposits in the first quarter of 2023—more than half of the $176 billion the bank was holding at the end of last year—was further evidence that investors and depositors are more than a little jittery about the financial condition of the banking industry.

While First Republic stated that its deposit-and-withdrawal activities had stabilized in late March and mid April, the bank is also in the process of reducing its workforce by one quarter and slashing its executive compensation.

First Republic’s travails, coupled with the recent takeover of Silicon Valley Bank and Signature Bank by federal regulators, has industry observers wondering whether these bank failures are signs of something more ominous. This is particularly true among real estate developers that rely heavily on bank lenders to capitalize their purchases and projects.

To sort out the latest banking turmoil and where the Commercial Real Estate (CRE) sector fits in, Cushman & Wakefield on April 19 posted a list of 14 frequently asked questions and weighed in on each. The topics touched on:

•What happened?

•How is this different from other banking failures?

•Why is commercial real estate in the limelight?

•What key metrics bear watching?

“Don’t panic,” C&W advises. But developers should also be aware that recent banking failures have toughened the lending environment; the percentage of banks that say they have tightened their lending standards for CRE loans and other business loans is the highest it’s been in 13 years.

“There are reasons to be both optimistic and concerned,” says C&W. “The sky isn’t falling; at this stage, it’s more overcast than anything else.”

This doesn't look like mid-2000s déjà vu

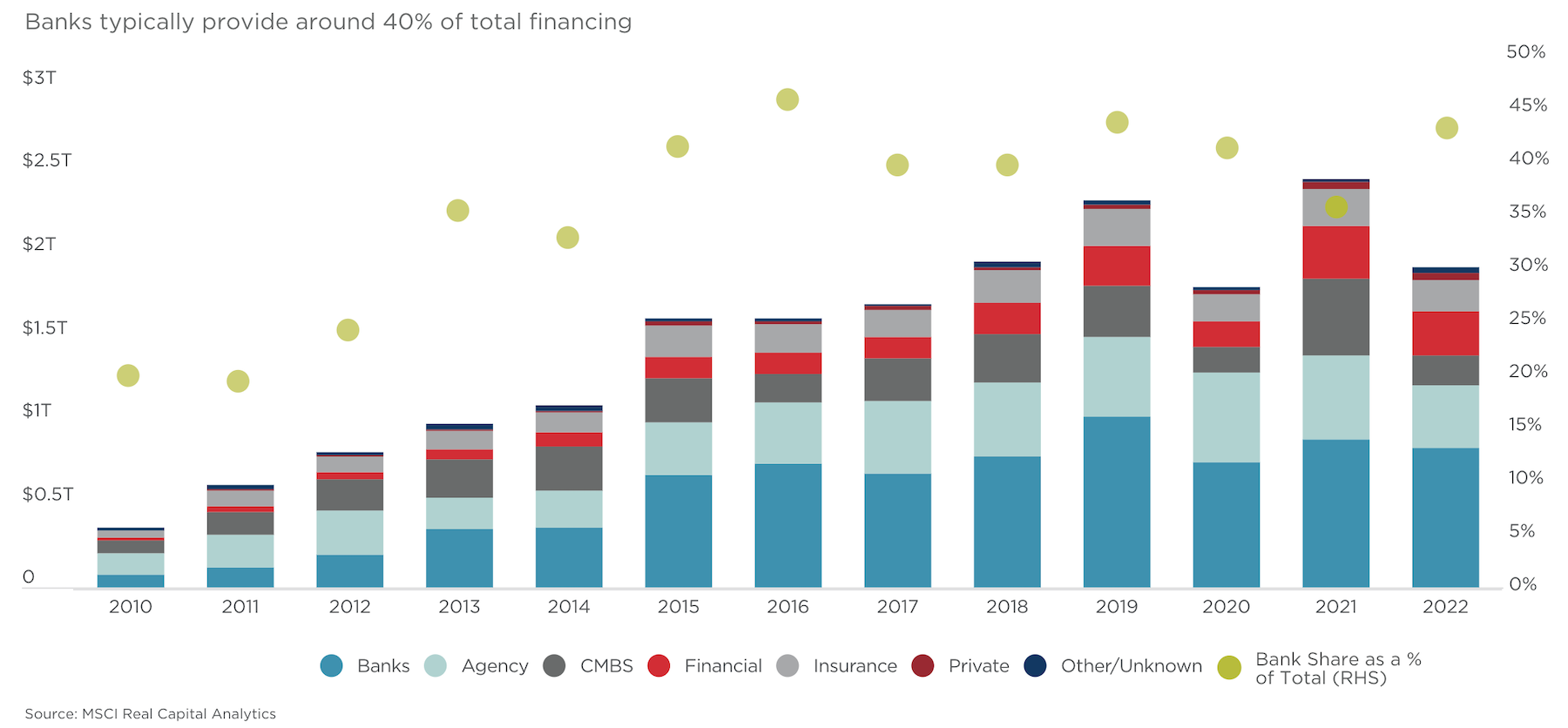

Of all the sources the CRE sector turns to for money, banks provide between 40 and 45 percent of the sector’s financing. Community and regional banks “are the lifeblood of the CRE lending landscape,” says Cushman & Wakefield. And smaller banks are responsible for the majority of multifamily, nonfarm residential, and acquisition/development/construction loan lending.

The failures of a handful of banks, out of a total of more than 5,000, don’t qualify as a crisis. And the banks that have failed in recent months had idiosyncratic factors that contributed to their unraveling. For example, C&W observes that, in the failures of Signature Bank and Silvergate Bank (the latter of which started liquidation proceedings in March), “underlying losses in the value of cryptocurrency served to act as a deposit outflow prior to outright withdrawals happening.”

C&W states that while no bank can survive a run on its deposits, and that a few more failures wouldn’t be a surprise, the U.S. banking system as a whole remains “well capitalized,” with most bank deposits spread across an array of sectors and individuals. The key in the future, C&W says, will be sustaining confidence in the solvency of that system.

It's worth noting that lenders had been pulling back on their CRE lending since last summer, homing in on high-quality assets like industrial and multifamily. C&W is keeping an eye on how the debt market perceives risk for CRE borrowers. On a broader scale, C&W is watching deposit flows, lending patterns to see how banks are navigating incoming maturities, liquidity based on the Federal Reserve’s provision of credit to banks, and jobless claims and inflation, which could be signs of recession.

Recent banking failures haven’t altered Cushman & Wakefield’s prediction of a mild recession in 2023 that will abate as tighter credit and slower economic growth stem inflation.

What C&W doesn’t predict is a repeat of the Great Financial Crisis of the mid-2000s. The financial system is “much stronger” now, and policymakers are responding to problems much quicker and aggressively. The size of the banking failures (so far, at least) is much smaller, and those failures relate not so much to credit but to the ramifications of a rising-rate environment and its impact on bond and securities values.

Most development is an attractive risk

Any weaknesses in the CRE sector will pose challenges to lenders. C&W doesn’t expect those weaknesses to pose a systemic banking sector failure. But, it cautions, there could be isolated instances of loan or credit stress for the banking sector, stemming from any combination of factors that might include oncoming loan maturity, a diminishing of underlying asset value, or deteriorating cash flows.

What does this mean for companies that are leasing space? C&W predicts that most property types will shift toward a tenant-friendlier environment. But landlords will also favor higher-quality tenants “to ensure the viability of the lease agreement.” For companies leasing space in ongoing construction, “the good news is that most development is considered to be attractive on a risk-adjusted basis.” So even if banks pull back, other lending groups are likely to step into that breech.

For signposts about what might happen next, C&W recommends following commercial mortgage-backed securities loan performance data across the CRE industry, and measuring that data against CRE debt financing. It might also be insightful to track prevailing underwriting standards and banks’ forward-looking expectations for the credit market.

What C&W doesn’t recommend is overreacting to the recent failure of Credit Suisse, and its takeover by rival UBS, as indicators of a European domino effect to what’s happening in the U.S.

Related Stories

Healthcare Facilities | Jul 11, 2024

New download: BD+C's 2024 Healthcare Annual Report

Welcome to Building Design+Construction’s 2024 Healthcare Annual Report. This free 66-page special report is our first-ever “state of the state” update on the $65 billion healthcare construction sector.

Healthcare Facilities | Jun 25, 2024

Register today! BD+C live webinar: Key Trends in the Healthcare Facilities Market for 2024-2025

Join the Building Design+Construction editorial team for this live webinar on key trends, innovations, and opportunities in the $65 billion U.S. healthcare buildings market. This free live webinar, hosted by BD+C editors, will take place Thursday, July 11 at Noon ET / 11 AM Central.

Apartments | Jun 25, 2024

10 hardest places to find an apartment in 2024

The challenge of finding an available rental continues to increase for Americans nation-wide. On average, there are eight prospective tenants vying for the same vacant apartment.

MFPRO+ News | Jun 20, 2024

National multifamily outlook: Summer 2024

The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

MFPRO+ News | Jun 11, 2024

Rents rise in multifamily housing for May 2024

Multifamily rents rose for the fourth month in a row, according to the May 2024 National Multifamily Report. Up 0.6% year-over-year, the average U.S. asking rent increased by $6 in May, up to $1,733.

Apartments | Jun 4, 2024

Apartment sizes on the rise after decade-long shrinking trend

The average size of new apartments in the U.S. saw substantial growth in 2023, bouncing back to 916 sf after a steep decline the previous year. That is according to a recent RentCafe market insight report released this month.

HVAC | May 28, 2024

Department of Energy unveils resources for deploying heat pumps in commercial buildings

To accelerate adoption of heat pump technology in commercial buildings, the U.S. Department of Energy is offering resources and guidance for stakeholders. DOE aims to help commercial building owners and operators reduce greenhouse gas emissions and operating costs by increasing the adoption of existing and emerging heat pump technologies.

Student Housing | May 28, 2024

Student housing remains strong in May 2024

Although the pace has slowed down this year, student housing preleasing for the 2024–2025 season reached 73.5% in April, 50 basis points year-over-year (YOY).

Mixed-Use | May 22, 2024

Multifamily properties above ground-floor grocers continue to see positive rental premiums

Optimizing land usage is becoming an even bigger priority for developers. In some city centers, many large grocery stores sprawl across valuable land.

Office Buildings | May 20, 2024

10 spaces that are no longer optional to create a great workplace

Amenities are no longer optional. The new role of the office is not only a place to get work done, but to provide a mix of work experiences for employees.