Commercial real estate brokers are optimistic about their industry’s growth prospects for 2019, according to a poll of brokers that Transwestern released last month. They are buoyed by strong consumer and business confidence, steady employment growth, and the anticipation of available debt and equity liquidity.

The survey explored the sentiments of brokerage professionals about three sectors: offices, medical offices, and industrial.

Over half of the 107 respondents, 52%, believe that leasing velocity, tenant walk throughs, and asking rents in the U.S. office market will be slightly to significantly higher in 2019. These factors will be driven primarily by continued economic expansion, lease expirations coming due, and rising interest rates.

Amenities continue to spur tenant interest, with access to transportation/parking and reliable WiFi service leading the “very important” list.

More than three quarters of respondents expect development levels to be flat or slightly higher in 2019, with select markets showing concern of oversupply and rising construction costs.

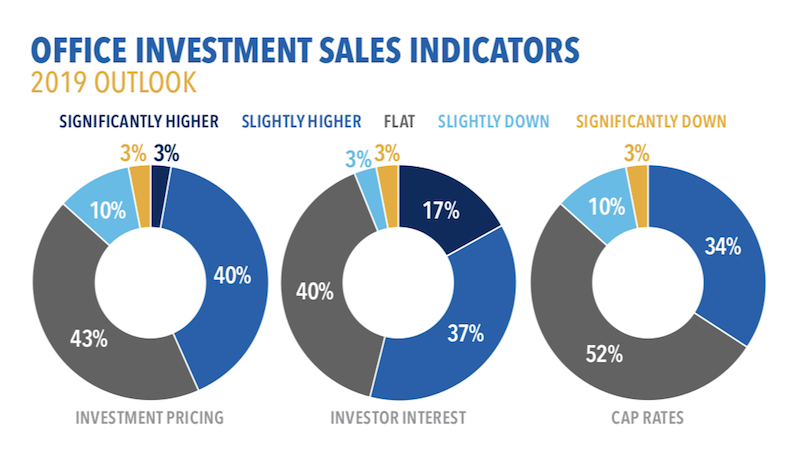

Most brokers foresee flat to modest growth for office pricing, investor interest and cap rates. Image: Transwestern

Nine of 10 respondents expect asking rents for medical offices to be slightly higher in 2019, driven by leasing activity. Demand is being driven by a growing and aging population. Cap rates in the medical office sector will be flat compared to 2018, predict 80% of respondents, with most also expecting investor interest to rise over the year.

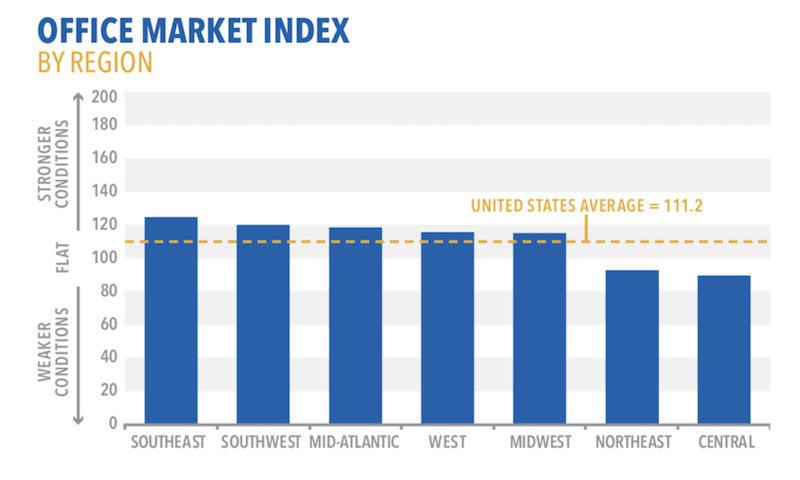

While the average index of 122.1 for the industrial sector’s prospects next year was down from 130.9 for last year’s outlook, respondents still expect tenant walk throughs, asking rents, and development to be higher for this sector, driven by ecommerce, a growing population demanding consumer goods, and better economic conditions.

Seventy-two percent of respondents expect higher investment interest in 2019, as the industrial market strengthens and select REITs shift focus away from office to industrial properties, especially in the Northeast and Mid-Atlantic regions.

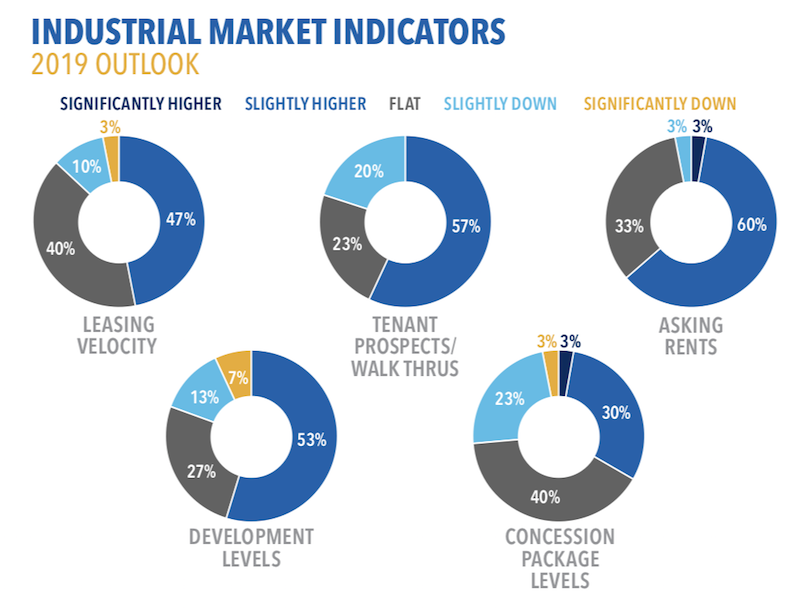

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Related Stories

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.

Market Data | Feb 2, 2022

Majority of metro areas added construction jobs in 2021

Soaring job openings indicate that labor shortages are only getting worse.

Market Data | Feb 2, 2022

Construction spending increased in December for the month and the year

Nonresidential and public construction lagged residential sector.

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.