Apartments outperform other commercial real estate property types, on both a risk-adjusted and unadjusted basis, regardless of holding period, geographic region, metro size, and growth rate according to new research from the National Multifamily Housing Council Research Foundation.

In the first work of research funded by NMHC’s Research Foundation since it was launched in late 2016, Professors Dr. Mark J. Eppli (Marquette University) and Dr. Charles C. Tu (University of San Diego) examine a wide range of property and financial market characteristics to try to determine if apartment market over-performance stands up to the test of time.

“Over the last three decades, apartments have become a desired asset class among both domestic and foreign real estate investors because of their strong returns coupled with relatively low risk,” said Mark Obrinsky, NMHC’s Chief Economist. “Despite the different characteristics of apartment, office, retail, and industrial properties, one might expect competitive markets to reduce, even eliminate, the higher risk-adjusted returns on apartments. This research finds that not to be the case, however.”

According to the authors, part of the reason that apartment returns outperform other asset classes is because investors tend to underestimate capital expenditures for both office and industrial properties.

Drs. Eppli and Tu examined a wide range of property and financial market characteristics to try to find insights into expected investment returns. One result they documented is that acquiring properties immediately after a downturn boosts returns.

“We are delighted to publish this first research report from the NMHC Research Foundation,” said NMHC President and CEO Doug Bibby. “As the multifamily industry grows in sophistication, so must the quality and breadth of our analysis. Filling that need was our goal in creating the Foundation and this paper is one of many forthcoming works that will provide leading, actionable information for the apartment market.”

Related Stories

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

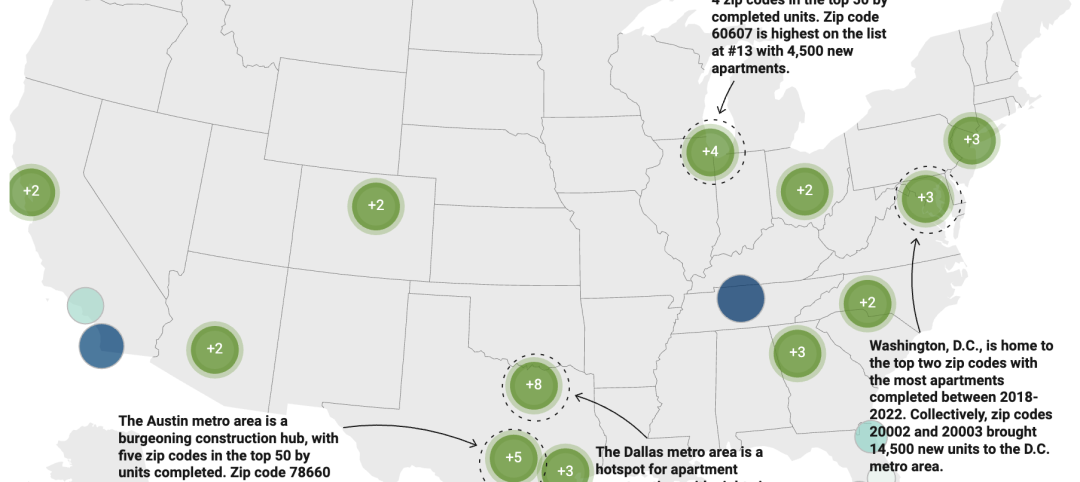

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.