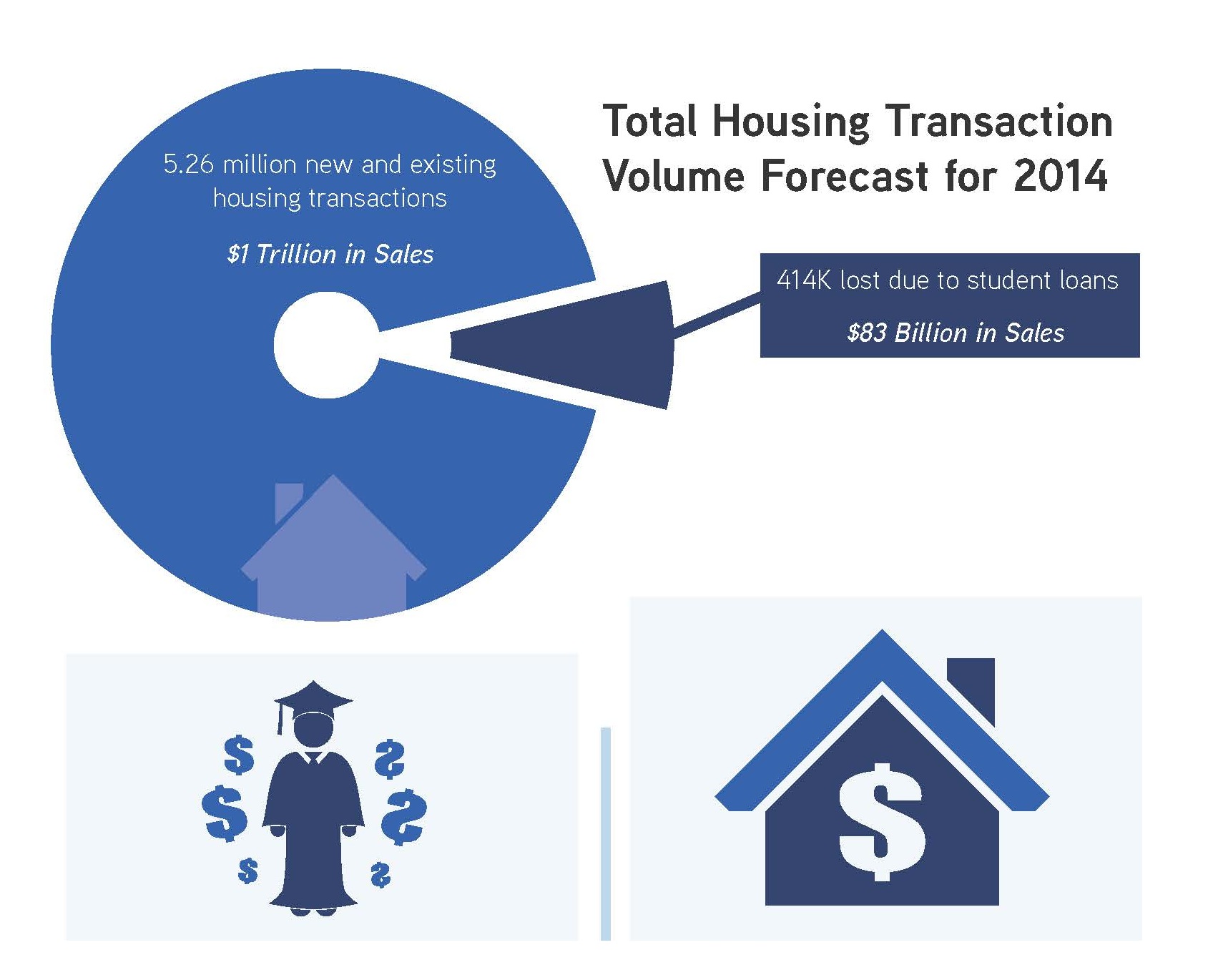

Eight percent fewer homes will transact in 2014 than normal, purely due to student loan debt, according to analysis by Rick Palacios, Jr., and Ali Wolf of John Burns Real Estate Consulting.

In a new 30-page paper, the firm assesses the impact of student loans on home buying for households under the age of 40. Its conclusion: 414,000 transactions will be lost in 2014 due to student debt. At a typical price of $200,000, that equals $83 billion in lost volume.

Palacios and Wolf explain their methodology and findings:

The analysis was quite complicated and involved a few assumptions, but we believe it is conservative, primarily because we looked only at those under the age of 40 with student debt.

At a high level, the math is as follows:

• Student debt has ballooned from $241 billion to $1.1 trillion in just 11 years.

• 29 million of the 86 million people aged 20-39 have some student debt.

• Those 29 million individuals translate to 16.8 million households.

• Of the 16.8 million households, 5.9 million (or 35%) pay more than $250 per month in student loans, which inhibits at least $44,000 per year in mortgage capability for each of them.

• About 8% of the 20-39 age cohort usually buys a home each year, which would be 1.35 million transactions per year.

• Using previous academic literature as a benchmark for our own complicated calculation, we then estimated that today's purchase rate is reduced from the normal 8% depending on the level of student debt--ranging from 6.9% for those paying less than $100 per month in student loans to less than 1% for those paying over $1,300 per month. Other factors contribute to even less entry-level buying today.

While we applaud the increasing education, we need to realize that it comes with a cost known as student debt. We raised the red flag on student debt back in 2011 and continue to believe that this debt will delay homeownership for many, or at least require that they buy a less expensive home.

Related Stories

Modular Building | Mar 31, 2022

Rick Murdock’s dream multifamily housing factory

Modular housing leader Rick Murdock had a vision: Why not use robotic systems to automate the production of affordable modular housing? Now that vision is a reality.

Multifamily Housing | Mar 29, 2022

Here’s why the U.S. needs more ‘TOD’ housing

Transit-oriented developments help address the housing affordability issue that many cities and suburbs are facing.

Contractors | Mar 28, 2022

Amid supply chain woes, building teams employ extreme procurement measures

Project teams are looking to eliminate much of the guesswork around product availability and price inflation by employing early bulk-purchasing measures for entire building projects.

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Legislation | Mar 28, 2022

LEED Platinum office tower faces millions in fines due to New York’s Local Law 97

One Bryant Park, also known as the Bank of America Tower, in Manhattan faces an estimated $2.4 million in annual fines when New York City’s York’s Local Law 97 goes into effect.

Healthcare Facilities | Mar 25, 2022

Health group converts bank building to drive-thru clinic

Edward-Elmhurst Health and JTS Architects had to get creative when turning an American Chartered Bank into a drive-thru clinic for outpatient testing and vaccinations.

Higher Education | Mar 24, 2022

Higher education sector sees 19 percent reduction in facilities investments

Colleges and universities face a growing backlog of capital needs and funding shortfalls, according to Gordian’s 2022 State of Facilities in Higher Education report.

Architects | Mar 16, 2022

James Hoban: Designer and builder of the White House

Stewart D. McLaurin, President of the White House Historical Association, chats with BD+C Executive Editor Robert Cassidy about James Hoban, the Irish draftsman and builder who convinced George Washington to let him design and build the White House.

Architects | Mar 16, 2022

Diébédo Francis Kéré named 2022 Pritzker Architecture Prize recipient

Diébédo Francis Kéré, architect, educator and social activist, has been selected as the 2022 Laureate of the Pritzker Architecture Prize, announced Tom Pritzker, Chairman of The Hyatt Foundation, which sponsors the award that is regarded internationally as architecture’s highest honor.

Architects | Mar 10, 2022

Gyo Obata, FAIA, HOK Founding Partner, passes away at 99

Obata's career spanned six decades and included iconic projects like the National Air and Space Museum in Washington, D.C., and Community of Christ Temple in Independence, Mo.