Driven by steady growth in the economy, domestic merger and acquisition (M&A) activity in the architecture and engineering industry hit record levels in 2015, according to Morrissey Goodale LLC, a leading business management consulting and training firm to the A/E industry. Growing uncertainty about foreign markets, however, contributed to a drop in the number

of international deals last year.

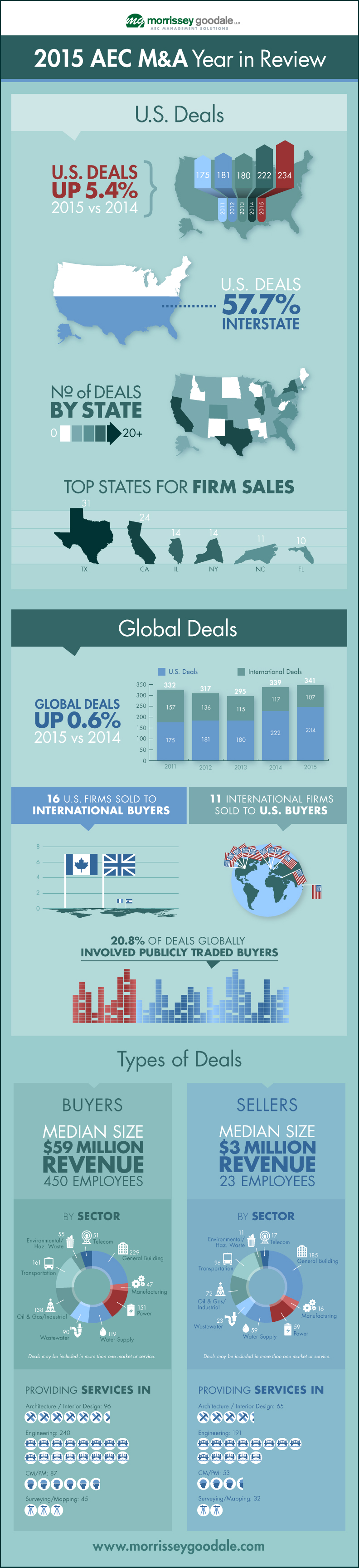

In 2015, Morrissey Goodale tracked a record 234 sales of U.S.-based A/E firms, representing a 5.4% increase over the 222 domestic deals recorded in 2014. Sales of international firms, however, dropped 8.5% from 117 in 2014 to 107 last year. When domestic and international sales are combined, overall global dealmaking in the A/E industry increased by 0.6% in 2015.

Other findings from Morrissey Goodale’s 2015 AEC M&A Year in Review include:

• Texas remained the hottest spot for M&A activity in the United States with 31 firm sales in 2015. California was a close second with 24 firm sales. Other states that saw 10 or more deals last year included Illinois, New York, North Carolina, and Florida.

• More than half (57.7%) of U.S. deals in 2015 involved a buyer and seller from different states, up from 56.2% in 2014.

• More than a fifth (20.8%) of global deals in 2015 involved publicly traded buyers, down from 28.4% in 2014.

• Mega-deals tapered somewhat last year as the median revenue of buyers decreased from $77 million in 2014 to $59 million in 2015, while the median revenue of sellers declined from $4 million to $3 million.

Morrissey Goodale Principal Consultant Neil Churman expects M&A activity in the United States will remain strong in 2016. “Continued confidence among AEC industry leaders will likely drive another busy year for domestic mergers and acquisitions,” he says. “Unease about the price of oil may give some buyers pause in pursuing energy deals, but a new transportation bill and strength in other building and infrastructure markets should lead to continued deal activity among growth-minded firms.”

Morrissey Goodale’s complete 2015 AEC M&A Year in Review and an interactive map of M&A activity in the United States can be found at www.morrisseygoodale.com.

Related Stories

| Aug 11, 2010

Stimulus funding helps get NOAA project off the ground

The award-winning design for the National Oceanic and Atmospheric Administration’s (NOAA) new Southwest Fisheries Science Center (SWFSC) replacement laboratory saw its first sign of movement on Sept 15 with a groundbreaking ceremony held in La Jolla, Calif. The $102 million project is funded primarily by the American Recovery and Reinvestment Act (ARRA), resulting in a rapidly advanced construction plan for the facility.

| Aug 11, 2010

New book on ‘Green Workplace’ by HOK’s Leigh Stringer, a BD+C 40 under 40 winner

The new book The Green Workplace is a comprehensive guide that demonstrates how green businesses can reduce costs, improve recruitment and retention, increase shareholder value, and contribute to a healthier natural environment.

| Aug 11, 2010

BIM adoption rate exceeds 80% among nation’s largest AEC firms

The nation’s largest architecture, engineering, and construction companies are on the BIM bandwagon in a big way, according to Building Design+Construction’s premier Top 170 BIM Adopters ranking, published as part of the 2009 Giants 300 survey. Of the 320 AEC firms that participated in Giants survey, 83% report having at least one BIM seat license in house, and nearly a quarter (23%) have 100-plus seats.

| Aug 11, 2010

PCA partners with MIT on concrete research center

MIT today announced the creation of the Concrete Sustainability Hub, a research center established at MIT in collaboration with the Portland Cement Association (PCA) and Ready Mixed Concrete (RMC) Research & Education Foundation.

| Aug 11, 2010

Study explains the financial value of green commercial buildings

Green building may be booming, especially in the Northwest, but the claims made for high-performance buildings have been slow to gain traction in the financial community. Appraisers, lenders, investors and brokers have found it difficult to confirm the value of high-performance green features and related savings. A new study of office buildings identifies how high-performance green features and systems can increase the value of commercial buildings.

| Aug 11, 2010

Architecture Billings Index flat in May, according to AIA

After a slight decline in April, the Architecture Billings Index was up a tenth of a point to 42.9 in May. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. Any score above 50 indicates an increase in billings.

| Aug 11, 2010

Architecture Billings Index drops to lowest level since June

Another stall in the recovery for the construction industry as the Architecture Billings Index (ABI) dropped to its lowest level since June. The American Institute of Architects (AIA) reported the August ABI rating was 41.7, down slightly from 43.1 in July. This score indicates a decline in demand for design services (any score above 50 indicates an increase in billings).

| Aug 11, 2010

RTKL names Lance Josal president and CEO

Lance K. Josal FAIA has been named President and CEO of RTKL Associates Inc., the international planning, design and engineering firm. Josal succeeds RTKL’s current President and CEO, David C. Hudson AIA, who is retiring from the firm. The changes will take effect on 1 September 2009.

| Aug 11, 2010

Balfour Beatty agrees to acquire Parsons Brinckerhoff for $626 million

Balfour Beatty, the international engineering, construction, investment and services group, has agreed to acquire Parsons Brinckerhoff for $626 million. Balfour Beatty executives believe the merger will be a major step forward in accomplishing a number of Balfour Beatty’s objectives, including establishing a global professional services business of scale, creating a leading position in U.S. civil infrastructure, particularly in the transportation sector, and enhancing its global reach.

![2015 was a record year for mergers and acquisitions in the AE industry [infographic] 2015 was a record year for mergers and acquisitions in the AE industry [infographic]](/sites/default/files/Screen%20Shot%202016-01-28%20at%209.38.08%20AM.png)