This article first appeared in BD+C's 2023 Multifamily Annual Report—our first-ever “state of the state” special report on the multifamily housing construction sector. To download the full 76-page report, click here.

Today, one in six people in the U.S. is 65 or older—an age group that has grown almost five times faster than the total population over the past century. Baby boomers, who began turning 65 in 2011, all will be at least that age by 2030. And despite recent declines in life expectancy, Americans for decades have been living increasingly longer.

The housing needs of this diverse and burgeoning population came into clear view during the pandemic. About half of senior housing properties experienced Covid deaths in 2020. Occupancy rates at senior living facilities have yet to reach pre-pandemic levels.

“The pandemic highlighted how our global healthcare, financial, and housing infrastructure is failing to serve a rapidly growing older population,” says Tama Duffy Day, FACHE, FASID, FIIDA, LEED BD+C, Global Leader of Gensler’s senior living practice. “As we look to the future, we need to build communities and neighborhoods that use momentous and creative solutions to empower people to thrive throughout their entire lifespan.”

Architecture, engineering, and construction firms shared their own creative solutions for senior living facilities that enable older people to thrive. Here are the top 10 trends in senior living facilities:

1. Senior housing design needs to foster connections with the community

Senior living facilities can no longer simply be places where Americans go after retirement to live in isolation. These facilities must be places where seniors not only can socialize with each other but also can interact with their surrounding communities. “Facility providers will be under increasing pressure to supply accommodations for older adults that are more accessible to food amenities, transit, green spaces, learning centers, entertainment, and health services,” Day says.

Check out our other multifamily housing sector trends reports:

Top 10 trends in multifamily rental housing

Top 10 trends in affordable housing (this PDF download requires a short registration)

Top 10 trends in student housing (this PDF download requires a short registration)

Many facilities are fostering connections with the neighborhoods around them. A mixed-used senior building could include a ground-floor coffee shop or other retail open to the general public. An intergenerational senior facility could have a child daycare center staffed with seniors. Or the facility might be embedded within a larger development that offers restaurants and other retail. “We’re seeing more mixed-use developments that include senior and independent living,” says Alejandro Giraldo, Assoc. AIA, NCARB, LEED AP, Principal, Perkins Eastman.

One senior living development, by Moseley Architects, is located in a suburban shopping center, providing residents with direct access to dining and retail. “A newer trend within our industry is to enable connections to the greater community,” says Mark Heckman, Vice President, Moseley Architects.

Such connections also provide a benefit to facility owners, Day notes: “The wider the network of services in the neighborhood, the less providers need to offer in the building complex.”

2. Senior living facilities should plan for aging in place

Nationwide, there are now more than 1,900 continuing care retirement communities (CCRCs), also called life-plan communities. These long-term care facilities offer multiple types of housing options—such as independent living, skilled nursing homes, assisted living, memory care, and short-term rehabilitation—to allow older people to move through the stages of aging, all within the same development. Such facilities are becoming increasingly popular, according to industry experts.

“We are witnessing the integration of independent living, assisted living, and memory care units within the same development,” says John Finn, Chief Operating Officer, W.E. O’Neil Construction.

3. The rise of university-based senior living communities

Within the larger trend of cultivating connections between senior living facilities and their communities, an offshoot trend has emerged: university-based communities. There are now more than 100 CCRCs operating on or near college and university campuses in 30 states. Recent projects include The Spires at Berry College in Georgia; Legacy Pointe at the University of Central Florida; and Broadview Senior Living at Purchase College in New York.

At these developments, seniors, many of whom are alumni, can take classes, teach, and mentor students. And with dwindling student populations, colleges and universities can gain revenue by leasing or owning the senior living buildings.

Developer McNair Living’s recently launched Varcity brand plans to build and operate on-campus senior living developments that eliminate generational separation while also changing campus life. McNair has projects breaking ground on six college campuses, with another half dozen planned by 2026. For one project, McNair Living and Gensler are bringing a mix of independent living cottages, apartments, and assisted living and memory care units to the edge of Purdue University in West Lafayette, Ind.

“University-based retirement communities attract and support faculty and alumni and act as a bridge to the surrounding community,” Giraldo says.

4. Provide amenities for the active adult demographic

For many, growing older doesn’t mean growing feeble—so senior living facilities shouldn’t just treat residents as patients. Facilities are serving the active adult demographic by providing gyms, swimming pools, walking and biking paths, and other fitness options. “These residents are ready to downsize but do not need to move into a licensed or life-plan community,” says Dora Kay, AIA, LEED AP, Vice President, Moseley Architects.

“Active adult communities are bridging the gap for homebuyers who want more community engagement, less property maintenance, and a more active atmosphere with similarly aged residents,” Kay adds. For instance, Moseley is designing a senior living community situated in a mountain location with trails.

“Active adult projects are experiencing a surge in development, predominantly led by for-profit developers seeking market diversification,” Giraldo says.

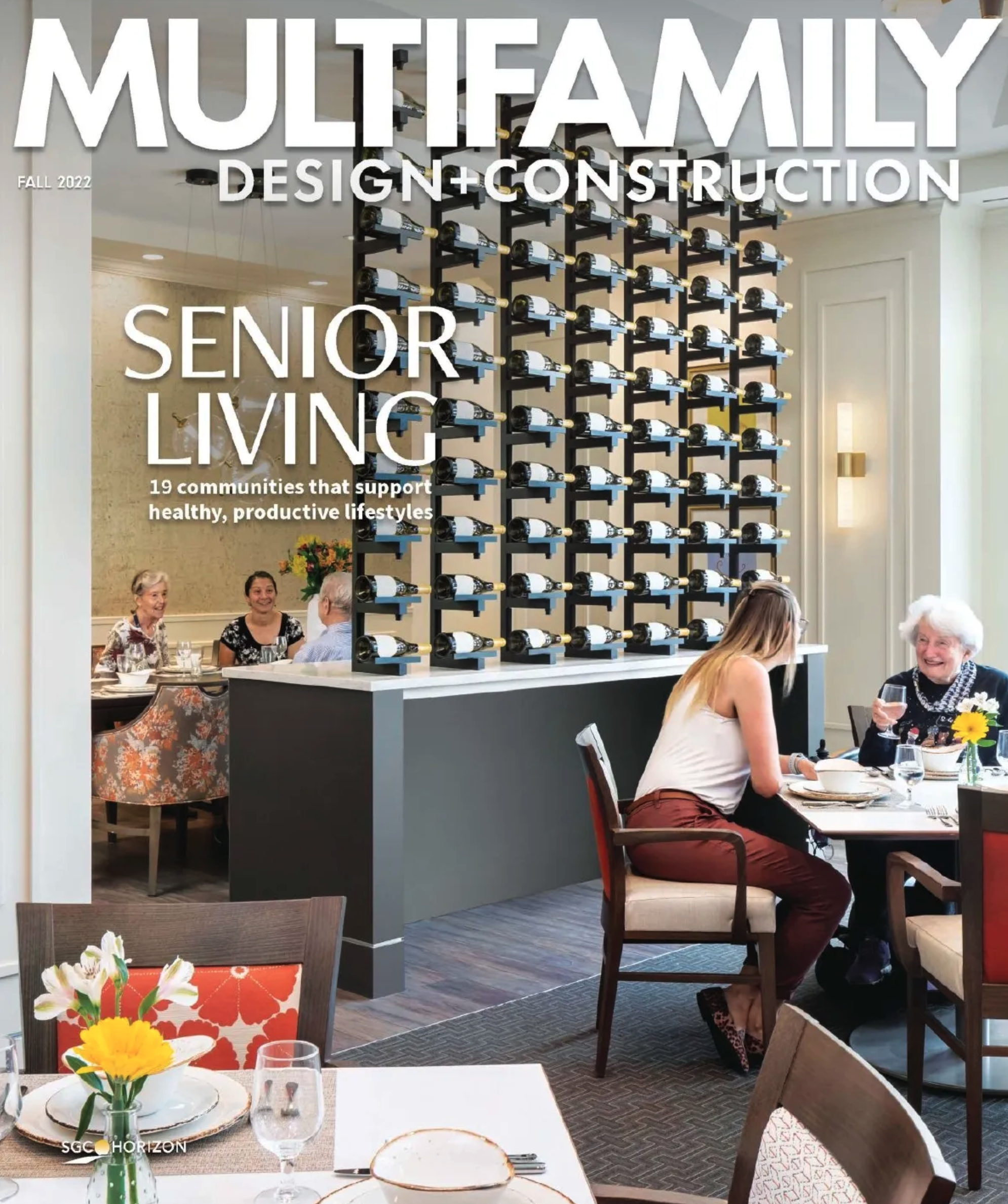

5. When it comes to senior housing amenities, aim for the quality of a high-end resort

As the active adult trend indicates, senior living facilities are finding they need to up their game when it comes to the amenities they offer. Increasingly, they’re offering more luxe amenities. These can include casual and formal dining, indoor fitness centers, outdoor fitness activities, day spas, and medical clinics.

For its renovation of Medford Leas in New Jersey, Bala Consulting Engineers transformed the building’s library, café, and fitness center into exercise spaces and a swimming pool along with locker rooms, patios, lounge, bistro, and display cooking venue.

“The biggest game-changer is designing senior living facilities that have the amenities of a high-end resort,” says Andy Heinen, Vice President, Kimley-Horn.

Finn agrees: “There is a growing emphasis on luxury in senior living, with an increased focus on amenity spaces.” For The Variel in California, W.E. O’Neil included a variety of activity-oriented amenities such as an indoor swimming pool, spa, physical therapy room, library, art studio, and lounge and massage rooms.

6. Health and wellness options are a must in senior living facilities

It’s not just more dining options that seniors want—it’s more healthy dining. Facilities are prioritizing more nutritious food options among many other health and wellness features and amenities. These can include healthy indoor air quality, robust fitness options, outdoor gardens, and walking and biking paths.

Outdoor spaces, such as healing gardens or memory gardens for assisted living and memory care facilities, can relieve stress by connecting residents with nature while also providing spaces for both solitude and togetherness.

“Improving connection to the outside for activity and wellness will open more doors to these facilities,” says Walter Ploskon, AIA, Principal and Managing Director, Niles Bolton Associates.

“The desire for health and wellness features within the design of our communities isn’t necessarily a new trend but it is maturing, and it’s now an integral part of every senior living building or community we design,” Heckman says.

7. Avoid institutional-looking designs

Facilities are looking less like institutions, and more like communities—inside and out. Developers are placing more emphasis on the facility’s frontage, “so they can increase the property’s exterior appeal and give residents a more peaceful home,” Heinen says.

“We believe in connecting common areas and resident areas to create more of a village feel. We want residents to walk out of their units and be part of a community,” Ploskon says, adding that common areas with sightlines that reveal connections to other spaces help residents feel less isolated.

More pleasing designs are also being facilitated by a shift in some municipalities’ parking mandates. The traditional requirement of two parking spaces per unit puts a burden on senior living facilities to have more parking than they actually need—which is only about 1.1 to 1.6 parking spaces per unit, according to Heinen.

More municipalities are realizing this and decreasing their parking requirements, he adds. “With lower parking mandates, the campus hardscape decreases and the inviting landscaping increases.”

8. Adopt modern technologies to keep senior housing residents connected

Today’s seniors want to stay connected to their communities not just physically but digitally, too.

As baby boomers move into senior living, they’re bringing all their devices with them. They’re also bringing an expectation that their new housing facilities will support their tech needs.

In response, senior care organizations are upgrading their network infrastructure and broadband—and even hiring tech concierges to answer residents’ tech questions.

“Demand has increased for technology design services to meet the needs of connected residents,” says Chuck Kensky, PE, LEED AP BD+C, Certified Energy Auditor, Executive Vice President, Bala Consulting Engineers.

Bala’s technology group focuses on connecting residents throughout the facility by utilizing the latest tech in wayfinding, AV systems, message boards, and activity rooms.

9. Mitigate financing struggles with front-end planning and efficient design and construction

Industry experts agree: These are tough financial times for senior living developments—with high construction costs, high interest rates, and lending uncertainty. “Beyond the costs for sites in desirable locations and the current financing environment, many developers are becoming increasingly frustrated with the time and costs associated with getting a senior living project approved by local jurisdictions, which in many cases now stretch to three or more years,” Heckman says.

Heckman points to a related burden: “Proposed senior living projects seem to garner a higher level of scrutiny than a typical multifamily proposal,” he says. This may be because many municipalities consider senior living as institutional facilities rather than what they really are: “another form of residential use that should be part of any healthy community,” Heckman says.

In response to these challenges, facility owners and developers are working hard to secure approvals and financing during the early planning stages. “Our customers are spending more time on the front end of projects getting sites entitled and approved with finance partners,” says Kyle Darnell, Vice President, ARCO Construction Company.

With greater financial stressors, developers are leaning into more efficient design and construction, including modular builds. For The Variel, W.E. O’Neil expedited construction by using prefabricated wall panels. ARCO achieves greater efficiency with repeatable building and operational layouts, Darnell says. “This allows AHJ [authorities having jurisdiction] approvals for state licensure to be a much smoother process.”

KTGY finds that fewer but more flexible common spaces provide both financial and residential advantages. “Not only does this save on construction costs, but it also puts more people into these spaces, so the community feels vibrant and active,” says Ben Seager, AIA, LEED AP, Principal, KTGY.

10. Explore adaptive reuse opportunities that may lower development and construction costs

Faced with high costs of land and construction and high interest rates amid ongoing inflationary pressures, facility owners and developers are embracing the trend of adaptive reuse.

Empty or underused office buildings, for instance, can offer potential opportunities for senior living conversion. In Chicago, Town Hall Apartments, a senior housing facility designed by Gensler, includes the adaptive reuse of a decommissioned police station.

“With the current economic conditions, we’re seeing an increase in creative solutions through adaptive reuse of existing buildings,” Giraldo says. Adaptive reuse projects can lower development and construction costs while at the same time providing carbon savings compared to building entirely new communities, Giraldo adds.

More recent senior living trends content from BD+C and Multifamily Pro+:

Related Stories

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Industry Research | Apr 4, 2024

Expenses per multifamily unit reach $8,950 nationally

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

Student Housing | Mar 27, 2024

March student housing preleasing in line with last year

Preleasing is still increasing at a historically fast pace, surpassing 61% in February 2024 and marking a 4.5% increase year-over-year.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

MFPRO+ News | Mar 12, 2024

Multifamily housing starts and permitting activity drop 10% year-over-year

The past year saw over 1.4 million new homes added to the national housing inventory. Despite the 4% growth in units, both the number of new homes under construction and the number of permits dropped year-over-year.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 1, 2024

Housing affordability, speed of construction are top of mind for multifamily architecture and construction firms

The 2023 Multifamily Giants get creative to solve the affordability crisis, while helping their developer clients build faster and more economically.

MFPRO+ Research | Feb 28, 2024

New download: BD+C's 2023 Multifamily Amenities report

New research from Building Design+Construction and Multifamily Pro+ highlights the 127 top amenities that developers, property owners, architects, contractors, and builders are providing in today’s apartment, condominium, student housing, and senior living communities.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.