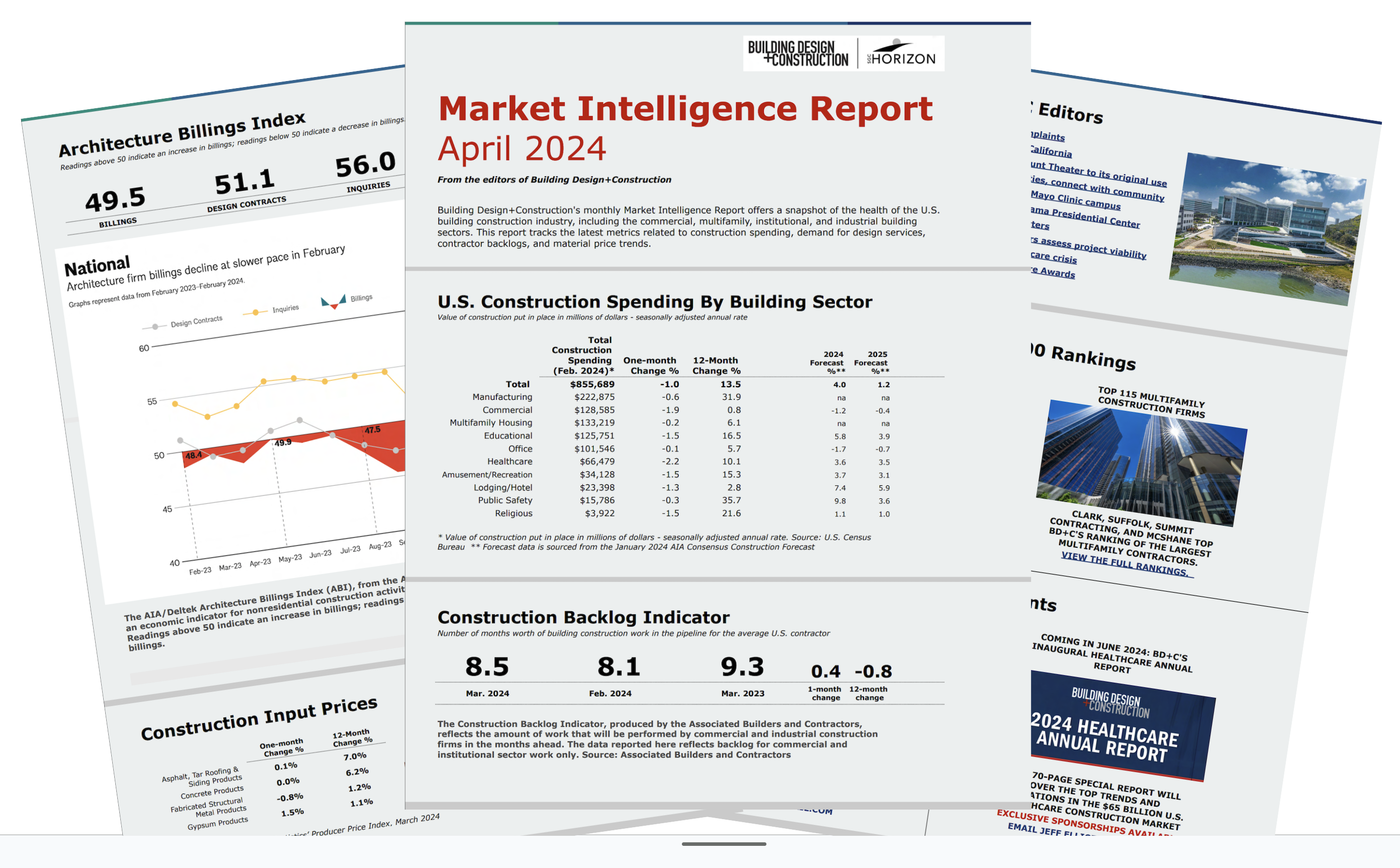

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Data for the Market Intelligence Report is gleaned from reputable economic sources, including the American Institute of Architects, Associated Builders and Contractors, and the U.S. Census Bureau.

Here are some of the highlights from the April 2024 report:

- U.S. construction spending for commercial, institutional, industrial, and multifamily buildings was down 1.0% in February 2024 vs. the previous month, but 13.5% higher than February 2023.

- Public safety, manufacturing, religious, educational, amusement/recreation, and healthcare all saw double-digit year-over-year growth in construction spending.

- The Architectural Billings Index had its best showing since July 2023. While still below 50 (at 49.5), the ABI climbed more than three points in February. The index scores for design contracts and inquiries also jumped in February. Both were above 50, which indicates that, among the firms surveyed by AIA, more firms than not saw increases in design contracts and inquiries for design work.

- Commentary on the latest ABI report from Kermit Baker, PhD, AIA Chief Economist: “There are indicators this month that business conditions at firms may finally begin to pick up in the coming months. Inquiries into new projects grew at their fastest pace since November, and the value of newly signed design contracts increased at their fastest pace since last summer. Given the moderation of inflation for construction costs and prospects for lower interest rates in the coming months, there are positive signs for future growth.”

- Construction backlogs expand: The average U.S. contractor had 8.5 months worth of building construction work in the pipeline as of March 2024, up 0.4 months from February 2024, but down 0.8 months from the same time last year.

- Construction material prices rose 0.4% in March 2024 vs. the previous month, and were 1.7% higher than a year ago. This marks the third straight month of rising prices, after a streak of three consecutive monthly declines.

- Commentary on the latest construction materials price report from Anirban Basu, ABC Chief Economist: “There has been growing evidence of resurfacing inflationary pressures in the nation’s nonresidential construction segment during the past two months. Were it not for declines in energy prices, the headline figure for construction input price dynamics would have been meaningfully higher. A new set of supply chain issues is emerging, including the cost of insuring ships and bottlenecks in the Red Sea, the Panama Canal and Baltimore."

Related Stories

Construction Costs | Nov 15, 2023

Construction input prices decrease 1.2% in October, driven by lower energy, lumber, and steel prices

Construction input prices declined 1.2% in October on a monthly basis, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 1.1% for the month.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Building Owners | Aug 23, 2023

Charles Pankow Foundation releases free project delivery selection tool for building owners, developers, and project teams

Building owners and project teams can use the new Building Owner Assessment Tool (BOAT) to better understand how an owner's decision-making profile impacts outcomes for different project delivery methods.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

| Sep 8, 2022

U.S. construction costs expected to rise 14% year over year by close of 2022

Coldwell Banker Richard Ellis (CBRE) is forecasting a 14.1% year-on-year increase in U.S. construction costs by the close of 2022.