Video may have killed the radio star, but has e-commerce done the same to your local retail establishment? Will the rise of everything from Amazon to Zappos take down the bookstore up the street, your local shoe store? Don’t bet on it.

While the much-touted demise of good old fashioned, bricks-and-mortar stores makes for good headlines, it’s not actually based in fact.

According to JLL’s Cross Sector Outlook released this spring, despite e-commerce’s leaps and bounds over the last few years, it still represents a relatively small percentage of total retail sales—6.0% to be exact. Your shoe store is safe for now, and probably well into the future.

“Remember catalogs? Flipping through the pages, dialing up a call center and placing an order? Web sales are really just replacing that,” said Kris Cooper, Managing Director, JLL Capital Markets. “People still need to see and touch things; the instant gratification of an in-store purchase can’t be discounted. Retailers who want to thrive will need to incorporate it all—hands-on goods, e-commerce and mobile-commerce.”

Despite these emerging structural challenges and newly-announced store closings, such as those of Radio Shack, Office Depot, and Coldwater Creek, the U.S. retail sector has continued on its solid recovery and is exhibiting tightening market conditions.

Cap rates compressed by approximately 20 basis points in 2013 as rent growth is expected to increase to 2.7% in 2014. Vacancy rates are also expected to compress another 20 basis points by the end of this year.

Right now, power centers, in particular, are punching above their weight class, experiencing the tightest overall market conditions with a total vacancy rate of just 5.1%.

A FEEDING FRENZY

What does this mean for the health of the retail investment sales and financing market? Investors have wasted no time hopping back on the retail bandwagon, particularly in core markets where new product often produces a “feeding frenzy.”

In February, Savanna purchased 10 Madison Square West in New York for more than $2,900 per square foot ($60 million). Price appreciation for retail product was outstanding in 2013; the Moody’s/RCA CPPI for retail is expected to post a 23% increase for the year—and reach similar numbers by the end of 2014.

“Right now, it’s all about high-quality, grocery-anchored centers and trophy malls," said Margaret Caldwell, Managing Director, JLL’s Capital Markets. "Demand for those asset types is incredible right now—if only we could convince all the owners to bring those to market. Investment in the gateway cities is strong, as always—but watch for a few dark horses to emerge in the coming months. Markets like Phoenix and Indianapolis could make some real headway by the end of the year.”

In the financing arena, debt is plentiful as balance sheet lenders such as life insurance companies are increasing their allocations in 2014 and remain competitive, while domestic banks continue to report stronger demand for commercial property loans. CMBS money is also plentiful, with retail collateralizing 20 percent of all CMBS deals in the first quarter of 2014.

“Watch for equity to make some significant strides in the retail space in the coming year, as well,” said Mark Brandenburg, Executive Vice President, JLL’s Capital Markets. “For a long time, equity sponsors were holding back, waiting to see if retail would survive the e-commerce invasion. Now that things have settled down a bit, many of those JV equity players are under allocated in the retail space and they’ll need to make some big plays to balance things out.”

Brandenburg also advises investors to keep their eyes on secondary markets as the borrowing rates for primary versus secondary markets don’t vary much.

“Leveraged yields into secondary and tertiary markets will be higher for the same quality real estate due to positive leverage between borrowing rates and cap rates,” he concluded.

About JLL's Retail Group

JLL’s Retail Group serves as the industry’s leader in retail real estate services. The firm’s more than 850 dedicated retail experts in the Americas partner with investors and occupiers around the globe to support and shape investment and site selection strategies.

Its retail specialists provide independent and expert advice to clients, backed by industry-leading research that delivers maximum value throughout the entire lifecycle of an asset or lease. The firm has more than 80 retail brokerage experts spanning 20 major markets, representing more than 100 retail clients. As the largest third party retail property manager in the United States, JLL’s retail portfolio has 305 centers, totaling 65.7 million square feet under management in regional malls, lifestyle centers, grocery-anchored centers, power centers, central business districts, transportation facilities and mixed-use projects.

For more, visit www.jllretail.com.

Related Stories

| Jan 16, 2014

ASHRAE revised climatic data for building design standards

ASHRAE Standard 169, Climatic Data for Building Design Standards, now includes climatic data for 5,564 locations throughout the world.

| Jan 15, 2014

6 social media skills every leader needs

The social media revolution—which is less than a decade old—has created a dilemma for senior executives. While its potential seems immense, the inherent risks create uncertainty and unease.

| Jan 15, 2014

Report: 32 U.S. buildings have been verified as net-zero energy performers

The New Buildings Institute's 2014 Getting to Zero Status report includes an interactive map detailing the net-zero energy buildings that have been verified by NBI.

| Jan 14, 2014

Sherwin-Williams unveils colormix 2014

Drawing influence from fashion, science, nature, pop culture and global traditions, Sherwin-Williams introduces colormix™ 2014, which captures colors that inspire creativity and design in today’s world. The four-palette collection provides design professionals with a guide to help them define the moods they want to create and select colors for their projects.

| Jan 13, 2014

Custom exterior fabricator A. Zahner unveils free façade design software for architects

The web-based tool uses the company's factory floor like "a massive rapid prototype machine,” allowing designers to manipulate designs on the fly based on cost and other factors, according to CEO/President Bill Zahner.

| Jan 13, 2014

AEC professionals weigh in on school security

An exclusive survey reveals that Building Teams are doing their part to make the nation’s schools safer in the aftermath of the Sandy Hook tragedy.

| Jan 13, 2014

6 legislative actions to ignite the construction economy

The American Institute of Architects announced its “punch list” for Congress that, if completed, will ignite the construction economy by spurring much needed improvements in energy efficiency, infrastructure, and resiliency, and create jobs for small business.

| Jan 12, 2014

CES showcases innovations: Can any of these help you do your job better?

The Consumer Electronics Show took place this past week in Las Vegas. Known for launching new products and technologies, many of the products showcased there set the bar for future innovators. The show also signals trends to watch in technology applicable to the design and building industry.

| Jan 12, 2014

The ‘fuzz factor’ in engineering: when continuous improvement is neither

The biggest threat to human life in a building isn’t the potential of natural disasters, but the threat of human error. I believe it’s a reality that increases in probability every time a code or standard change is proposed.

| Jan 12, 2014

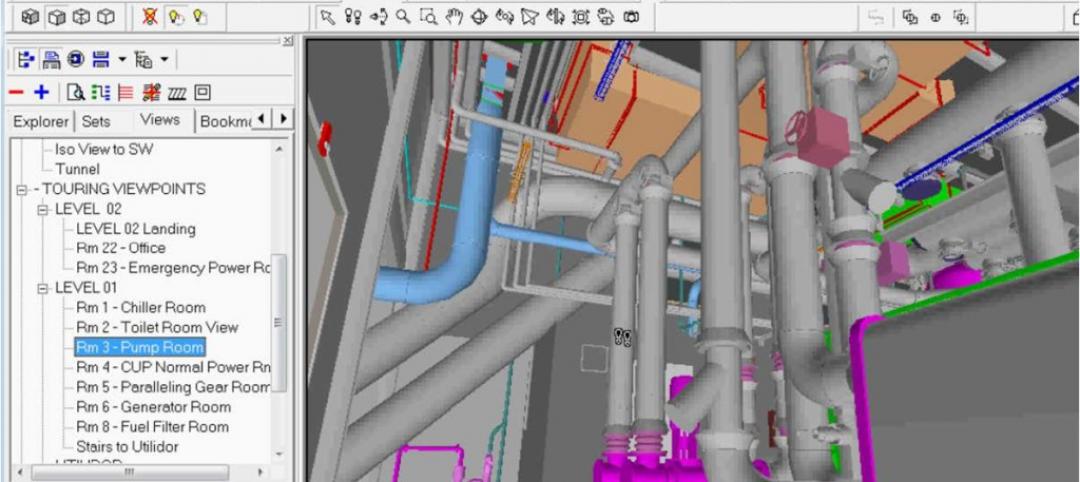

5 ways virtual modeling can improve facilities management

Improved space management, streamlined maintenance, and economical retrofits are among the ways building owners and facility managers can benefit from building information modeling.