Video may have killed the radio star, but has e-commerce done the same to your local retail establishment? Will the rise of everything from Amazon to Zappos take down the bookstore up the street, your local shoe store? Don’t bet on it.

While the much-touted demise of good old fashioned, bricks-and-mortar stores makes for good headlines, it’s not actually based in fact.

According to JLL’s Cross Sector Outlook released this spring, despite e-commerce’s leaps and bounds over the last few years, it still represents a relatively small percentage of total retail sales—6.0% to be exact. Your shoe store is safe for now, and probably well into the future.

“Remember catalogs? Flipping through the pages, dialing up a call center and placing an order? Web sales are really just replacing that,” said Kris Cooper, Managing Director, JLL Capital Markets. “People still need to see and touch things; the instant gratification of an in-store purchase can’t be discounted. Retailers who want to thrive will need to incorporate it all—hands-on goods, e-commerce and mobile-commerce.”

Despite these emerging structural challenges and newly-announced store closings, such as those of Radio Shack, Office Depot, and Coldwater Creek, the U.S. retail sector has continued on its solid recovery and is exhibiting tightening market conditions.

Cap rates compressed by approximately 20 basis points in 2013 as rent growth is expected to increase to 2.7% in 2014. Vacancy rates are also expected to compress another 20 basis points by the end of this year.

Right now, power centers, in particular, are punching above their weight class, experiencing the tightest overall market conditions with a total vacancy rate of just 5.1%.

A FEEDING FRENZY

What does this mean for the health of the retail investment sales and financing market? Investors have wasted no time hopping back on the retail bandwagon, particularly in core markets where new product often produces a “feeding frenzy.”

In February, Savanna purchased 10 Madison Square West in New York for more than $2,900 per square foot ($60 million). Price appreciation for retail product was outstanding in 2013; the Moody’s/RCA CPPI for retail is expected to post a 23% increase for the year—and reach similar numbers by the end of 2014.

“Right now, it’s all about high-quality, grocery-anchored centers and trophy malls," said Margaret Caldwell, Managing Director, JLL’s Capital Markets. "Demand for those asset types is incredible right now—if only we could convince all the owners to bring those to market. Investment in the gateway cities is strong, as always—but watch for a few dark horses to emerge in the coming months. Markets like Phoenix and Indianapolis could make some real headway by the end of the year.”

In the financing arena, debt is plentiful as balance sheet lenders such as life insurance companies are increasing their allocations in 2014 and remain competitive, while domestic banks continue to report stronger demand for commercial property loans. CMBS money is also plentiful, with retail collateralizing 20 percent of all CMBS deals in the first quarter of 2014.

“Watch for equity to make some significant strides in the retail space in the coming year, as well,” said Mark Brandenburg, Executive Vice President, JLL’s Capital Markets. “For a long time, equity sponsors were holding back, waiting to see if retail would survive the e-commerce invasion. Now that things have settled down a bit, many of those JV equity players are under allocated in the retail space and they’ll need to make some big plays to balance things out.”

Brandenburg also advises investors to keep their eyes on secondary markets as the borrowing rates for primary versus secondary markets don’t vary much.

“Leveraged yields into secondary and tertiary markets will be higher for the same quality real estate due to positive leverage between borrowing rates and cap rates,” he concluded.

About JLL's Retail Group

JLL’s Retail Group serves as the industry’s leader in retail real estate services. The firm’s more than 850 dedicated retail experts in the Americas partner with investors and occupiers around the globe to support and shape investment and site selection strategies.

Its retail specialists provide independent and expert advice to clients, backed by industry-leading research that delivers maximum value throughout the entire lifecycle of an asset or lease. The firm has more than 80 retail brokerage experts spanning 20 major markets, representing more than 100 retail clients. As the largest third party retail property manager in the United States, JLL’s retail portfolio has 305 centers, totaling 65.7 million square feet under management in regional malls, lifestyle centers, grocery-anchored centers, power centers, central business districts, transportation facilities and mixed-use projects.

For more, visit www.jllretail.com.

Related Stories

| Nov 18, 2014

Architecture Billings Index dips in October, still shows positive outlook design services

Headed by the continued strength in the multifamily residential market and the emerging growth for institutional projects, demand for design services continues to be healthy, as exhibited in the latest Architecture Billings Index.

| Nov 18, 2014

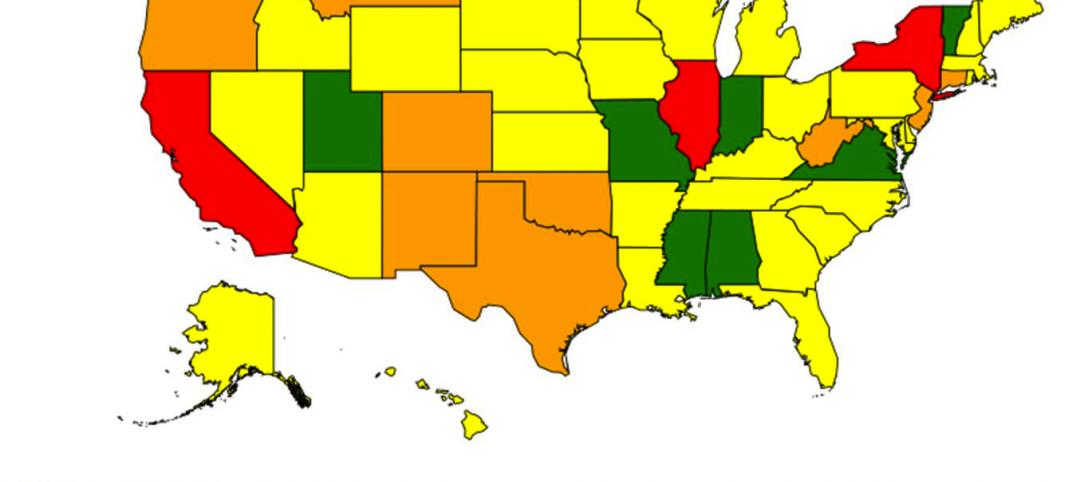

New tool helps developers, contractors identify geographic risk for construction

The new interactive tool from Aon Risk Solutions provides real-time updates pertaining to the risk climate of municipalities across the U.S.

| Nov 18, 2014

5 big trends changing the world of academic medicine

Things are changing in healthcare. Within academic medicine alone, there is a global shortage of healthcare professionals, a changing policy landscape within the U..S., and new view and techniques in both pedagogy and practice, writes Perkins+Will’s Pat Bosch.

| Nov 18, 2014

Grimshaw releases newest designs for world’s largest airport

The airport is expected to serve 90 million passengers a year on the opening of the first phase, and more than 150 million annually after project completion in 2018.

| Nov 17, 2014

Nearly two years after Sandy Hook, the bloodshed continues

It’s been almost two years since 20 first-graders were shot and killed at Sandy Hook Elementary School in Newtown, Conn., but these incidents, both planned and random, keep occurring, writes BD+C's Robert Cassidy.

| Nov 17, 2014

Hospitality at the workplace: 5 ways hotels are transforming the office

During the past five years, the worlds of hospitality and corporate real estate have undergone an incredible transformation. The traditional approach toward real estate asset management has shifted to a focus on offerings that accommodate mobility, changing demographics, and technology, writes HOK's Eva Garza.

| Nov 17, 2014

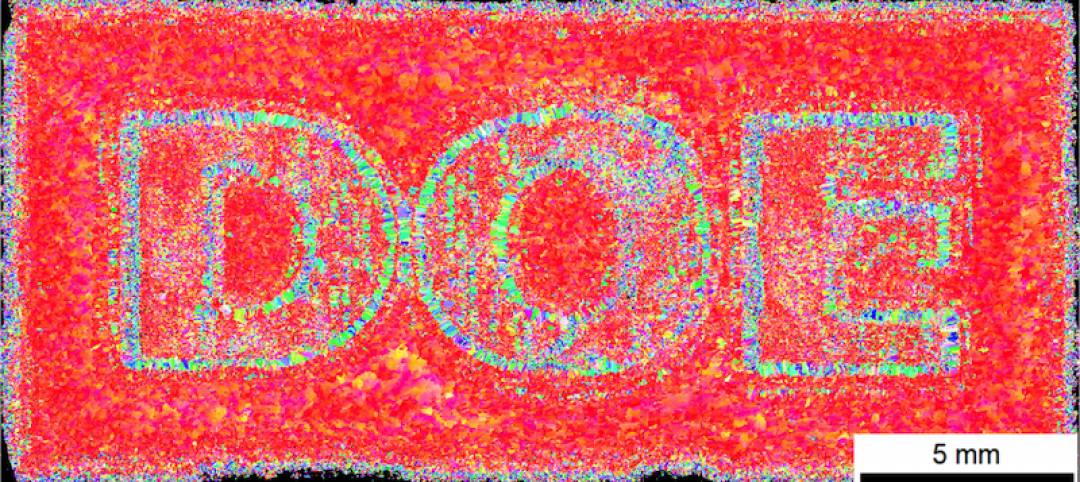

Developments in 3D printing can assist architecture in the smallest details

Researchers at the Department of Energy’s Oak Ridge National Laboratory (ORNL) have developed a way for 3D printed metals to be produced with an unprecedented degree of precision.

| Nov 17, 2014

A new BSL-3 public-safety lab debuts in Vermont

The laboratory will be used to perform a wide range of analyses to detect biological, toxicological, chemical, and radiological threats to the health of the population, from testing for rabies, West Nile, pertussis and salmonella to water and food contaminants.

| Nov 17, 2014

'Folded facade' proposal wins cultural arts center competition in South Korea

The winning scheme by Seoul-based Designcamp Moonpark features a dramatic folded facade that takes visual cues from the landscape.